By Patrick McKeough, TSINetwork.ca

Special to the Financial Independence Hub

When you want to decide which Canadian bank is best to invest in, there are a few things to consider.

We’ve long recommended that all Canadian investors own two or more of the big five Canadian bank stocks. That’s mainly because of their importance to Canada’s economy. These are key safe investments for a portfolio. The big five Canadian bank stocks also have long histories of annual dividend increases.

If you’ve decided to start by investing in just one Canadian bank, the question remains: which Canadian bank is best to invest in today? How can you tell which bank will give you the best long-term performance? There are a few performance clues you can look out for.

When deciding which Canadian bank is best to invest in, you want to start with the same criteria you would use in any investment:

We believe Canada’s big banks are still well positioned to weather any downturn in the Canadian economy, contrary to pessimistic forecasts on the banks’ prospects from some in the business media. They trade at attractive multiples to earnings and continue to raise their dividends.

Bank of Nova Scotia remains one of our top picks among Canada’s big five banks due to its wide international exposure. Here’s why:

Bank of Nova Scotia remains our top choice Canadian bank

BANK OF NOVA SCOTIA (Toronto symbol BNS; Finance sector; TSINetwork Rating: Above Average; www.scotiabank.com) is Canada’s third-largest bank. It remains our top pick for anyone who asks which Canadian bank is best to invest in. That’s mainly because it continues to expand in regions like Latin America, South America and Asia.

Acquisitions have played a large role in Bank of Nova Scotia’s recent growth. One of its most prominent acquisitions has been ING Direct, the specialist in no-fee banking services. Early in 2014, Bank of Nova Scotia changed ING’s name to Tangerine, which let this business keep using the orange colour associated with ING Direct—and continues to give the bank’s customers access to a no-fee banking service.

There’s still room for the bank to expand throughout Latin America and Asia, especially as their growing middle classes look for stable deposit and consumer-lending services.

Bank of Nova Scotia is a buy in TSI and CWA.

Don’t limit your investing to bank stocks

Simply put, a well-constructed stock portfolio will make your life easier and maximize your gains.

Early in their investing careers, many investors have only a vague idea of the value of a planned portfolio when investing in the stock market.

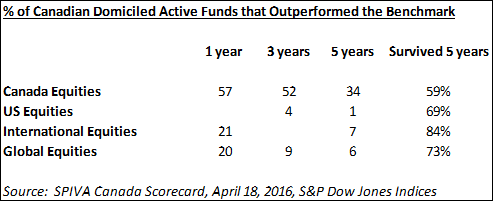

When you try to pick a handful of stocks that will all beat the market, you are asking a lot of yourself. No one, not even people that devote their entire lives to it, has ever been able to consistently pick stock-market winners over long periods.

On the other hand, it’s relatively easy to acquire a balanced, diversified portfolio of mainly high-quality dividend paying stocks, spread out across the five main economic sectors: Resources & Commodities, Finance, Manufacturing & Industry, Utilities and Consumer.

If you diversify, you improve your chances of making money over long periods, no matter what happens in the market.

For example, Manufacturing stocks may suffer if raw-material prices rise, but in that case your Resources stocks will gain. Rising wages can put pressure on manufacturers, but your Consumer stocks should do better as workers spend more.

If borrowers can’t pay back their loans, your Finance stocks will suffer. But high default rates usually lead to lower interest rates, which push up the value of your Utilities stocks.

Spreading your holdings out across the five sectors helps you avoid overloading yourself with stocks that are about to slump because of industry conditions or a change in investor fashion. By diversifying across the sectors, you increase your chances of stumbling upon a market superstar – a stock that does two to three or more times better than the market average.

These stocks come along every year. By nature, their appearance is unpredictable: if you could routinely spot them ahead of time, you’d quickly acquire a large proportion of all the money in the world, and nobody ever does that.

Pat McKeough has been one of Canada’s most respected investment advisors for over three decades. He is the founder and senior editor of TSI Network and the founder of Successful Investor Wealth Management. He is also the author of several acclaimed investment books.