Procrastinators: There is just a week to go until the March 1st deadline for making contributions to a Registered Retirement Savings Plan (RRSP). My column in the Financial Post in today’s paper (page FP10) can also be found online by clicking on the following highlighted text of the headline, As the RRSP deadline looms, here’s what all the procrastinators need to know.

Procrastinators: There is just a week to go until the March 1st deadline for making contributions to a Registered Retirement Savings Plan (RRSP). My column in the Financial Post in today’s paper (page FP10) can also be found online by clicking on the following highlighted text of the headline, As the RRSP deadline looms, here’s what all the procrastinators need to know.

One of the sources cited is CPA David Trahair, author of the book illustrated to the left: The Procrastinator’s Guide to Retirement. Here’s a link to the Hub’s review of that book.

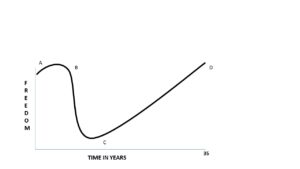

The FP piece notes that while making an RRSP contribution before the deadline is not technically a “use it or lose it” proposition, procrastination nevertheless provides opportunity losses: you end up paying more income tax than necessary for the 2016 tax year (reminder, THAT deadline is also looming: see Jamie Golombek’s reminder in his FP column: Tax season is upon us.) Procrastination also creates the opportunity loss of considerable tax-compounded investment growth.

While you can arrange an RRSP top-up loan or — for multiple years of under contributions — an RRSP “catch-up” loan, my conclusion is that the optimum course of action is to automate RRSP savings through a pre-authorized checking (PAC) arrangement with a financial institution. This approach also allows you to “dollar cost average” your way into financial markets: that way, you reduce the stress of coming up with a large lump sum to contribute, as well as the stress of fretting about the best time to invest.

Of course, as Trahair notes at the end of the article, and as Borrowell’s Eva Wong reminded us in her Hub blog on Monday, if you’re heavily in debt you may be better off eliminating that debt before getting too serious about RRSP contributions: See When you should NOT invest in an RRSP.