“Books are the bees which carry the quickening pollen from one to another mind.” — James Russell Lowell, poet and author

“Books are the bees which carry the quickening pollen from one to another mind.” — James Russell Lowell, poet and author

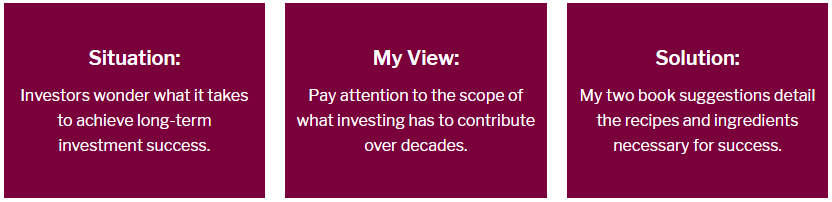

Last week I highlighted two books that help manage your family’s retirement aspirations. This week I turn my sights onto two books that shape investment success over the long run: all about taking charge of investing in your self-education through quality reading.

I’ve selected two books that provide great insights into stewarding your long-term wealth. The authors are well known in the wealth management profession.

The books emphasise simple, yet fundamental recipes of investing: something for everyone’s investment toolbox when the bulls and bears make their presence known.

My initial pick is a gem written by two leading, seasoned authors of many books. Both have contributed heavily to the profession of managing wealth. The investing process is condensed into five short chapters, all in layman’s language.

The authors make the point that everything starts with savings. It is their position that each of us can make sound investing decisions. The process does not have to be complicated.

Rather, it is a highly disciplined approach to investing. All the rules you need to know and implement are explained. I visualise the book as a clear, concise and practical guide for the long road ahead.

The easygoing writing style emphasises keeping the approach to investing as simple as possible. My perspective concurs with the view that the book is a prudent, logical road map.