By Susan Hyatt

By Susan Hyatt

Special to the Financial Independence Hub

People plan for retirement to live how they want in their ‘silver years.’ But have you thought about including eldercare in those plans? Most have not and when reality sets in people are shocked at the cost.

Several years ago I was on a consulting assignment in the United Kingdom when both my elderly parents went into crisis at the same time. To make matters worse, they were divorced and lived in separate towns. Still, I figured I could work it out. I had consulted for governments and global technology companies all over the world with expertise in healthcare. In Canada I helped government bring the healthcare system into the electronic age. I figured I knew the system.

I returned to Canada only to find that, despite all my experience and contacts, it was a challenge to navigate my parents through the healthcare system into new living quarters, due to their dementia and inability to live on their own. I had 40 years of professional experience in the healthcare industry, and discovered that in all this time little had changed. The hospital system is well funded, but after discharge from hospital you are on your own and pay for out-of-pocket costs.

After six months wandering through the maze of eldercare options, I put my retirement plans on hold and started a professional services company that delivers crisis management and planning services for the elderly. We offer seniors and their families advice in estate planning and life planning.

Boomers slow to formalize eldercare plans

We always see people, including those of high net worth, who don’t include eldercare costs in their financial and estate planning. Too many Baby Boomers have not formalized plans for growing old or designated who should care for them. Indeed, people refuse to plan ahead or even talk about aging. Adult children don’t want to question their parents about plans involving money management, never mind health issues that may already be developing.

Today many seniors – especially those with health or mobility issues – talk about whether or not to stay at home. The ‘gold standard’ used to be that you stayed at home as long as possible. But for how long and at what cost?

Before, family members might have taken care of you. But now families are dispersed and most of your neighbours work. So you must pay for help yourself.

Bill Gates’ dementia campaign

Bill Gates just announced he is donating $50 million to Alzheimer’s research and discovery. He realizes there is a dementia epidemic and Alzheimer’s is a leading cause. As he says in his blog, almost 50% of people who live into their 80s will get Alzheimer’s. But health care costs are prohibitive. Current estimates in the U.S. indicate that health care costs and eldercare costs for those suffering from Alzheimers will be five times the costs for normal aging.

Seniors and their adult children must start thinking about a lot of factors if a parent becomes ill. What exactly is Dad’s prognosis? How long will he be able to walk? How long will it be before he’s in a wheelchair? If he stays in the house, what modifications are needed and how much will they cost? What about home care? All, this takes time and expertise, and people need a plan to cost out the options.

Where to start? It’s a good idea to create a family playbook with clear plans and expectations to help reduce the emotional and financial strain that may be ahead. At Silver Sherpa, we use a holistic assessment approach. We assign a Client Director to work with the senior and their family to navigate through key quality-of-life factors such as health issues, legal and financial preparedness, family dynamics, and the needs and wants for living accommodation. This is a proactive approach. It lets our clients recognize the warning signs of an impending crisis and respond in advance rather than slip into chaos.

Where to start? It’s a good idea to create a family playbook with clear plans and expectations to help reduce the emotional and financial strain that may be ahead. At Silver Sherpa, we use a holistic assessment approach. We assign a Client Director to work with the senior and their family to navigate through key quality-of-life factors such as health issues, legal and financial preparedness, family dynamics, and the needs and wants for living accommodation. This is a proactive approach. It lets our clients recognize the warning signs of an impending crisis and respond in advance rather than slip into chaos.

Canadians are beginning to understand that they must pay for out-of-pocket costs associated with aging, and as care needs increase, those costs could skyrocket. Earlier this year CIBC released a study called ‘Who Cares: The Economics of Caring For Aging Parents,’ and it’s an eye-opener. According to the study, in 2007 about 14% of Canadians were aged 65 and older, but now it’s 17%, and in ten years it will be 22%. Today, 30% of working Canadians with parents over the age of 65 have to take time off from work for eldercare duties.

40% are uncomfortable talking about eldercare/illness

The study also found that 40% of respondents were uncomfortable talking about eldercare and illness because they figured their parents would think they were after their money, and that only 23% of Canadians with a parent 65 or over have a financial plan for their senior years. What’s more, Continue Reading…

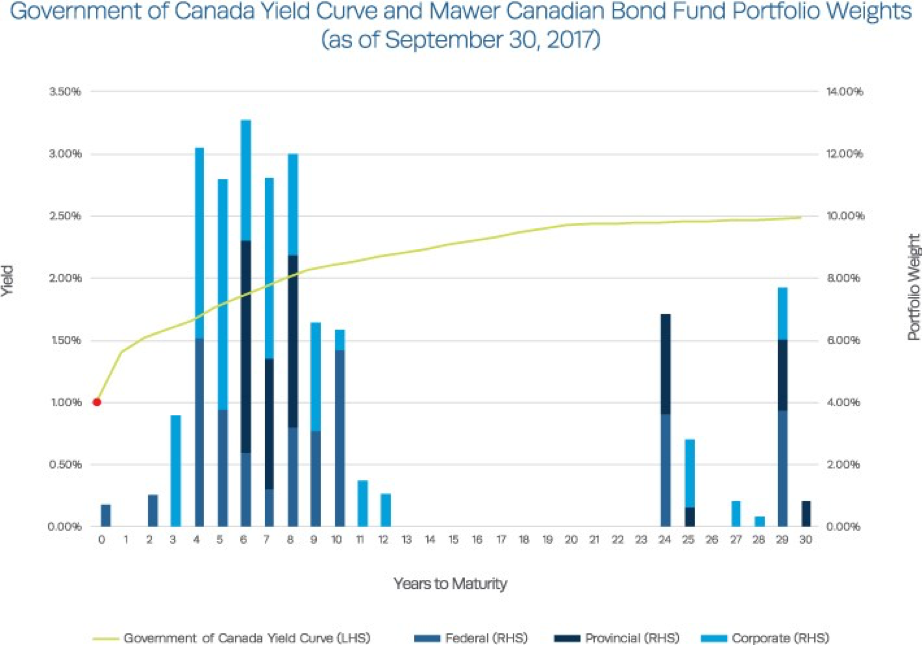

Sources: Bloomberg and FactSet

Sources: Bloomberg and FactSet