By Robb Engen, Boomer & Echo

Special to the Financial Independence Hub

Canadians have few reasons to save these days. Cheap borrowing coupled with feeble returns on your savings deposits makes it hardly seem worthwhile to park your cash in a savings account. Some banks have decided to punish savers even further by charging fees just for moving your money around.

Gaining Momentum Through Inertia

But one bank has turned to the carrot rather than the stick approach to help its customers save. Scotiabank, which already boasts the best suite of rewards credit cards, in addition to its Moneyback chequing account, has raised the stakes with a new high-interest savings product called the Momentum Savings Account. Here’s how it works:

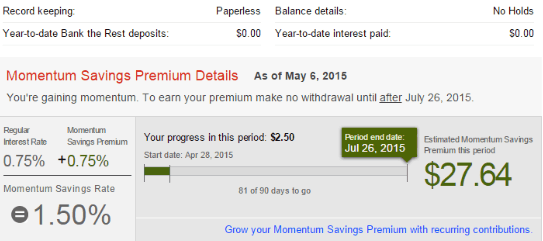

Using a unique incentive that rewards “inaction”, or our tendency to drift toward financial inertia, the Scotiabank Momentum Savings Account pays a bonus interest rate for customers who do not make a withdrawal in a 90-day period.

The account pays regular interest of 0.75 percent when you keep a balance of $5,000 or more. If you resist the temptation to withdraw from your account for 90-days, you’ll receive a 0.75 percent bonus, for a total interest rate of 1.5 percent.

Customers who open an account by June 15th, 2015 will get an additional 0.5 percent bonus, for a total of up to 2 percent until July 31st, 2015.

Momentum Savings also comes with an “Account Tracker” that customers can access online and through their mobile app. It provides a visual “countdown” to the extra interest payment, so you can see when you’ll receive the extra interest. With this tool, you can be strategic about when to withdraw from the account to ensure maximum savings.

How does Momentum Savings stack up against the competition? Here’s what the big banks and popular online banks offer for interest rates on balances of $5,000 or more:

| Bank / Product | Interest rate |

| Scotia Momentum Savings Account | 1.50% |

| BMO Savings Builder Account | 1.30%* |

| Tangerine Savings Account | 1.05% |

| PC Financial Interest Plus Savings | 1.05% |

| RBC High Interest e-Savings | 0.80% |

| CIBC e-Advantage Savings Account | 0.80% |

| TD High Interest Savings Account | 0.75% |

*Regular interest of 0.3% – plus 1% bonus when monthly balance increases by $200 each month

Final thoughts

It’s hard to get excited about high interest savings accounts in this low rate environment. But if you need cash within the next few years, whether for a house down payment, car fund, or tuition, unfortunately there aren’t many risk-free options available.

And instead of hopping around from bank-to-bank chasing the latest promotion, you’d like to find one place to stash your savings and earn a market-leading interest rate that’s attainable and doesn’t change.

With a Momentum Savings Account, you’ll get paid twice. Once for the initial deposit, and then again for simply keeping your money parked.

Isn’t that the ultimate point of a savings account anyway – a safe place to squirrel your money away for the future? It’s nice to be rewarded for the good habit of doing nothing.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on May 10th and is republished here with his permission.