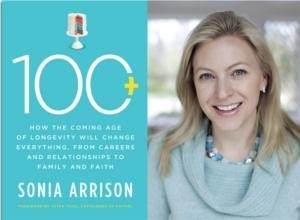

One of dozens of books I read for a talk I gave on how Longevity Changes Everything is entitled 100 Plus: How the Coming Age of Longevity will Change Everything, from Careers and Relationships to Family and Faith.

The author, Sonia Arrison, challenges the reader to at least open one’s mind to the possibility of human beings reaching the age of 150, which of course is a good 30 years longer than the age reached by modern centenarians, although still much less than the biblical Methusalah, Noah et al.

Certainly, as I was reading at the same time Moshe Milevsky’s new second edition of Pensionize Your Nest Egg, I was conscious of the financial implications of breakthroughs in human longevity. Milevsky’s preferred form of “Longevity Insurance” is life annuities and new hybrid variations of Variable Annuities that provide both stock market exposure and some guarantees and mortality credits provided by insurance companies.

Financial implications of Longevity

Arrison does devote one of her eight chapters to the Financial Implications of Longevity, starting with the evident proposition that “living longer means both making and spending money longer.” Health and Wealth are inextricably linked, which is why the author mentions a movement to urge the US congress to spend more on antiaging research: in order to create a “longevity dividend.”

Longevity gains have caused an increase in economic welfare around the world. She cites a 2006 University of Chicago study that for Americans, “gains in life expectancy over the century were worth over $1.2 million per person to the current population.”

Consider education. Living longer means more time for education: for advanced degrees or even multiple advanced degrees. “This is important,” Arrison writes, “because education increases the quality of human capital, which matters quite a bit when it comes to the financial well-being of both individuals and nations.”

Extreme Experience

As life expectancies rise, you can expect older and wiser business leaders along with it. The author cites a 2008 BusinessWeek article on 25 influential busies leaders who at the time were over the age of 75. They included Suzuki Motor’s Osamu Suzuki, then 78; PR maven Harold Burson, then 87, and 85 year old Sumner Redstone of CBS and Viacom.

Life Expectancy has grown linearly at an average rate of three months per year (2.5 years per decade) for women and 2.5 months per year (2 years per decade) for men, the book says.

Persistence of Work and Redefining Retirement

Clearly, assuming these trends come to pass, work will have to play a bigger role in what used to be called the “Retirement” years. Arrison suggests that many will use the additional life years to peruse secondary and tertiary life goals. In such cases:

‘Retirement’ might be redefined to mean the expensive chunk of time that someone takes out of regular working life in order to train extensively for a new career.

Longer lives may spur more part-time and flex-time work, Arrison suggests, “because older individuals will not want to leave the workforce but will not wish to put in full days either.” She cites one interesting finding in the United States that many people who have reached the age of 100 planned financially forth for their retirement but also continued to accumulate capital post retirement.

In this respect, it’s interesting that seniors in Canada will be free to contribute $5,500 a year into their Tax-Free Savings Accounts (TFSAs) for as long as they live, even well past 100 if they are so blessed. The other day, my 99-year-old friend Meta informed me she had just put the yearly maximum into her TFSA with some of the proceeds of her part-time job (she works two half days a week) and planned to add more soon, so she could build up a little nest egg to take care of any medical emergencies. (so far, touch wood, this has not yet occurred).

As Arrison writes, “Longer lives could tilt the scales in favour of increasing, not decreasing, personal savings .. Clearly, older people who started saving at a younger age will benefit the most from compound interest.”

This is why when I look at my 24-year old daughter, who started her TFSA at 18, I am optimistic about her long-term future. And i find a certain satisfaction that both she and near-centenarian Meta use such a vehicle.

More’s the pity the annual $10,000 limit in place during the last year of the Conservative administration has been pushed back to $5,500!