The federal government kept the annual TFSA contribution limit at $6,000 for 2022: the same annual TFSA limit that we had since 2019. It’s still good news for Canadian savers and investors, who as of January 1, 2022, have a cumulative lifetime TFSA contribution limit of $81,500.

The Tax Free Savings Account (TFSA) was introduced in 2009 by the federal conservative government. The TFSA limit started at $5,000 that year: an amount that “will be indexed to inflation and rounded to the nearest $500.” The TFSA limit is expected to increase to $6,500 in 2023.

TFSA Contribution Limit since 2009

The table below shows the year-by-year historical TFSA contribution limits since 2009.

| Year | TFSA Contribution Limit |

|---|---|

| 2022 | $6,000 |

| 2021 | $6,000 |

| 2020 | $6,000 |

| 2019 | $6,000 |

| 2018 | $5,500 |

| 2017 | $5,500 |

| 2016 | $5,500 |

| 2015 | $10,000 |

| 2014 | $5,500 |

| 2013 | $5,500 |

| 2012 | $5,000 |

| 2011 | $5,000 |

| 2010 | $5,000 |

| 2009 | $5,000 |

| Total | $81,500 |

Note that the maximum lifetime TFSA limit of $81,500 applies only to those who were 18 or older as of December 31, 2009. If you were born after 1991 then your lifetime TFSA contribution limit begins the year you turned 18.

You can find your TFSA contribution room information online at CRA My Account, or by calling Tax Information Phone Service (TIPS) at 1-800-267-6999.

TFSA Overview

The Tax Free Savings Account is a flexible vehicle for Canadians to save for a variety of goals. You can contribute every year as long as you’re 18 or older and have a valid social insurance number.

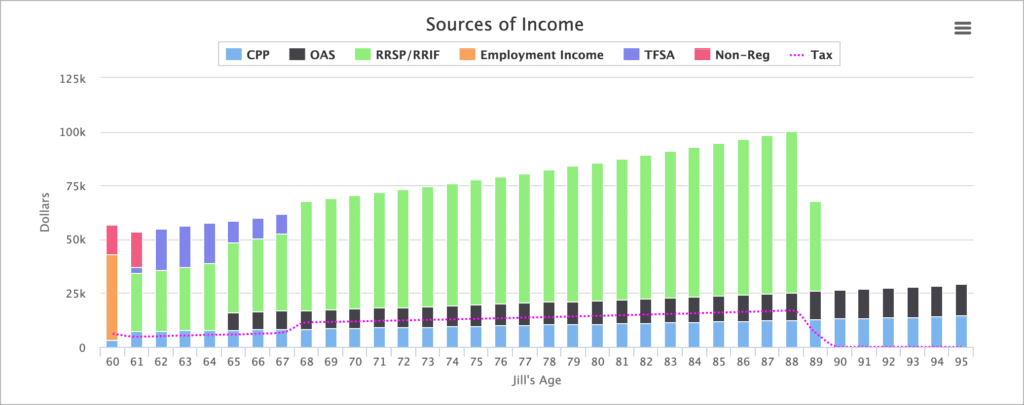

That means young savers can use their TFSA contribution room to establish an emergency fund or save for a down payment on a home. Long-term investors can use their TFSA to invest in ETFs, stocks, or mutual funds and save for the future. Retirees can continue to save inside their TFSA for future consumption or withdraw from their TFSA tax-free without impacting their Old Age Security or GIS.

Unlike an RRSP, any amount contributed to your TFSA is not tax deductible and so it does not reduce your net income for tax purposes.

- Your contribution room is capped at your TFSA limit. Excess contributions will be taxed at 1 per cent per month

- Any withdrawals will be added back to your TFSA contribution room at the start of the next calendar year

- You can replace the amount of your withdrawal in the same year only if you have available TFSA contribution room

- Any income earned in the account, such as interest, dividends, or capital gains is tax-free upon withdrawal

How to open a TFSA

Any Canadian 18 or older can open a TFSA. You are allowed to have more than one TFSA account open at any given time, but the total amount you contribute to all of your TFSA accounts cannot exceed your available TFSA contribution room.

To open a TFSA you can contact any bank, credit union, insurance company, trust company or robo-advisor and provide that issuer with your social insurance number and date of birth.

The most common type of TFSA offered is a deposit account such as a high-interest savings account or a GIC.

You can also open a self-directed TFSA account where you can build and manage your own savings and investments.

Qualified TFSA Investments

That’s right: you’re not just limited to savings accounts and GICs. Generally, you can put the same investments in your TFSA as you can inside your RRSP. These types of allowable investments include:

- Cash

- GICs

- Mutual funds

- Stocks

- Exchange-Traded Funds (ETFs)

- Bonds

You can contribute foreign currency such as USD to your TFSA. Note that your issuer will convert the funds to Canadian dollars. The total amount of your contribution, in Canadian dollars, cannot exceed your TFSA contribution room.

If you receive dividend income from a foreign country inside your TFSA, the dividend income could be subject to foreign withholding tax.

Gains inside your TFSA

Some investors may be tempted to put risky assets inside their TFSA account to try and earn tax-free capital gains. There are two advantages to this strategy: Continue Reading…