There are two crucial success factors that often elude investors: the ability to save consistently and the discipline to stick with a saving and investment plan over time.

There are two crucial success factors that often elude investors: the ability to save consistently and the discipline to stick with a saving and investment plan over time.Successful investing is a long-term proposition. In the short run, financial markets are very unpredictable, gyrating to a complex and increasingly-interconnected information flow that changes by the second. Sentiment and trendiness rule the short run, as markets oscillate around a more predictable long-term relationship between risk and reward. As the great investor Benjamin Graham once said:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Furthermore, we believe most investors are confused about what it is that is difficult and what it is that is straightforward about investing. Let’s start by looking at some essential yet straightforward steps for creating a sensible portfolio that should put you put you in a good position to achieve long-term investment success:

1.) Decide whether you’re going to do it yourself or use an advisor. While it may seem obvious: you want to ensure that if you do choose to work with an advisor that he or she will act in your best interest. In Canada, the vast majority of advisors are not required by law to work in your best interest – that doesn’t mean they won’t, but be aware – Robb Engen addressed this issue in a recent piece on Jonathan Chevreau’s Findependence Hub – Commission-based advice & suitability: a dangerous combination

2.) Decide how much risk to take. Risk is most effectively assumed by exposing your portfolio to broad asset classes with different risk characteristics. For example, stocks are riskier than bonds but that risk is usually rewarded with higher returns over the long run. Your portfolio should be allocated to different asset classes so that it’s appropriate for your risk profile. And we don’t just mean you take a questionnaire and allocate according to your score: your allocation really has to reflect your specific financial situation, taking into account both near and longer term goals.

3.) Pick what type of securities or funds in which to invest. A sensible portfolio should be diversified effectively across geographies, industries and other dimensions of risk.

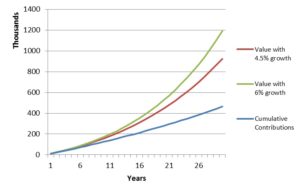

4.) Pick investment products that keep costs low. Compound interest is a modern miracle: costs work in the same way but against you, and the other side of that miracle is a curse. For example, mutual fund fees in Canada are among the highest in the world, which can take a huge dent out of your nest egg over the long run.

5.) Trade only when necessary. Trading should be kept to a minimum and is really only necessary when a portfolio strays too far from its target allocation, you have new savings to invest / you need to withdraw funds, or your situation has changed by a magnitude that requires a new allocation.

So go create a low-cost diversified portfolio that suits your risk profile and trade when necessary to rebalance back to target: it’s actually very straight forward. There are wonderful products on the market for both do-it-yourselfers and those who want to work with advisors. The merits of such an approach are evidenced in volumes of peer-reviewed academic literature, in the publicly available records of investment fund performance and anecdotally from scores of investors.

It all starts with saving

Unfortunately it’s easier said than done.

While the investing side as described above may, on the surface, seem fairly formulaic and mechanical, it doesn’t properly address two extremely important elements that are essential to long-term investing success.

The first may seem obvious but is not easy: saving. Without money to invest in the first place it’s hard to benefit from a long-term investment plan! But saving is really hard. It forces you to ask yourself some tough questions:

- What do I need versus what do I want?

- Can I live within my means?

- Can I ignore what other people think is important and focus only on what is important for me and my family?

- Am I comfortable with delaying gratification in order to save?

- How much do I need to save to accomplish what I desire in life? What do I desire in life?

- What is worth sacrificing today so I can benefit later in life?

The second is not so obvious and is really difficult: discipline. Successful investing means that at times you’ll be fighting some very difficult impulses and emotions. Again, you need to answer some difficult questions:

- Am I prepared to buy an investment that has decreased in value dramatically?

- Am I prepared to sell an investment that is skyrocketing, that everyone is talking about at cocktail parties and “getting rich” from?

- Can I ignore the pundits and market commentators?

- Can I stick with the plan even though my emotions tell me to do the exact opposite?

Now you might be saying sure, I won’t let my emotions get the better of me. Believe us when we say it’s much more difficult in the heat of the moment to stick with the discipline that’s required. Most investors, both amateur and professional, fall victim to psychological pitfalls and stray from their discipline precisely at the moment they need it most, usually around market peaks and troughs.

By all means, engage in an investment process to deliver long-term success. Do your research and take your time to set it up correctly but don’t forget about the really hard part: saving enough to allow you to benefit from investing and maintaining the discipline to reap the rewards over the long run. If you feel you can’t avoid the psychological pitfalls alone, get some help!

Graham Bodel is the founder and director of a new fee-only financial planning and portfolio management firm based in Vancouver, BC., Chalten Fee-Only Advisors Ltd. This blog is republished with permission: the original ran on December 14th, here.

Graham Bodel is the founder and director of a new fee-only financial planning and portfolio management firm based in Vancouver, BC., Chalten Fee-Only Advisors Ltd. This blog is republished with permission: the original ran on December 14th, here.