Not Perfect

There are various criticisms of the book, such as:

There are various criticisms of the book, such as:

- being an outsider: but being outside the traditional financial community gives Tony a different perspective

- contradicting advice: but that’s common in life. He interviews 50 money experts with varying views.

- over-simplified: but isn’t that better than over-complicating and confusing? Complexity can be added once the A-B-Cs (or 1-2-3s) are known.

- conflicts of interest: Tony recommends companies in which he might have financial interests (see dealing with biased financial advice). That doesn’t mean the choices are bad but they but warrant more investigation.

- too long: yes … I got the audiobook, which runs over 21 hours and sped up the playback by 30%

- US-centric: yes but the general ideas apply everywhere

Tony responded to some criticism in this interview for The Wall Street Journal.

At the other extreme, you’ll find gushing praise.

Tony’s Advantage

Do celebrities give better financial advice? Maybe not but Tony reaches the unreachable: people who get missed by conventional financial education. Even when Tony says things you’ve heard before, you might be more likely to believe them now. For instance, I’ve covered things like

- $1,000,000 after taxes on investment growth (2007)

- Your life expectancy exceeds 1 billion seconds (2009)

- Why is financial planning ignored? (2009)

- The Globe and Mail on Canada’s insurance loophole (2011)

- How to protect your money from Goliath (2013)

We often know the keys about money (e.g., spend less than you earn, disaster-proof your life, save for the future). That doesn’t mean we do. Tony helps people change. He might get you to change too. He has a knack for making financial education engaging. He explains his terms and uses many examples.

Differently

Instead of writing a book, Tony could have created videos and an app. That’s what I thought before getting the book. I don’t see videos, but he has a free app (if you’re willing to give your contact information).

Instead of using a conventional publisher, Tony could have self-published. He could have made the book cheaper. He could have narrated the full audiobook, rather than portions.

Overall, what he did is fine.

Free Meals

Tony is paying for 50 million free meals. Besides donating all his book royalties, he’s made an additional personal financial contribution. That’s rare. Chances are good that you’ll end up on his mailing list, though. That gives him the opportunity to sell you his other stuff with the money you’re saving.

Caution

Tony tackles tough topics such as the conflicts of interest rampant in the financial sector. He gives solutions too. Think before you leap.

The stories from successes like Richard Branson are interesting but may not provide much practical guidance (e.g., how Honest Ed turned $212 into $100 million). Look for patterns rather than a guaranteed formula to financial independence.

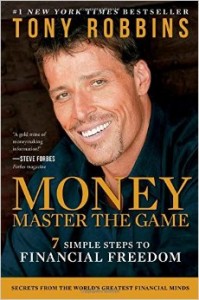

I wasn’t expecting much from Tony’s book but because he’s popular, I knew that I had an obligation to read it. Overall, I’m impressed and highly recommend Money: Master The Game. There’s lots of practical advice.

Money books get stale. Tony’s book is new, which means now is the best time to read it.

Links

- official website: MoneyMasterTheGame.com

- Tony Robbins doesn’t quite master the game of money (MarketWatch, Nov 2014)

- Tony Robbins responds to critics (WSJ Video, Nov 2014)

- Do celebrities give better financial advice?

- Do financial doctors make as many mistakes as medical doctors?

- Dealing with biases financial advice

- If you have/had/want money, read Pound Foolish

- Why billionaires by life insurance

- $1,000,000 after taxes on investment growth (2007)

- Your life expectancy exceeds 1 billion seconds (2009)

- How Honest Ed turned $212 into $100 million

- The Wealthy Barber returns with more wisdom

- The wealthy reveal how their financial advisors fail them

- Why do you care what your insurance advisor gets paid?

- Disaster-proof your life: the first rule for financial freedom from Preet Banerjee

- The A-B-Cs of 1-2-3

- How to protect your money from Goliath

PS Another must-read (or re-read) is Warren Buffett’s biography, The Snowball.