By Del Chatterson

Special to the Financial Independence Hub

Your financial advisor is probably not recommending it and you may be naturally averse to more borrowing, but it is hard to ignore the basic principles of financial leverage from Finance 101. (The principles have not changed, since I first taught the course in 1972!)

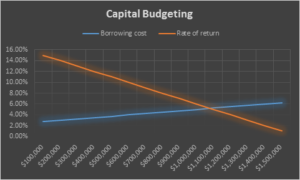

As explained in a chapter on Capital Budgeting, companies and investors should continue to invest in projects until the marginal cost of capital equals the marginal rate of return: assuming you select projects in order from the highest return to the lowest return and that the cost of borrowing increases with the total amount of loans outstanding.

So in the example chart shown to the right, you would borrow and invest up to $1.0 million, which is the point where the expected rate of return declines to meet increasing cost of borrowing at about 5%.

So in the example chart shown to the right, you would borrow and invest up to $1.0 million, which is the point where the expected rate of return declines to meet increasing cost of borrowing at about 5%.

You may have confirmed the theory from your own experience. Your current portfolio has a few investments that are achieving better than 10% or 12% returns, most congregate around the long-term average of 7% to 8% and a few continuing disappointments are returning below 5%, or worse. Your lowest cost of borrowing is probably the mortgage you signed in 2015 at 2.5% or a car loan at 1.9%, but your subsequent borrowing for a personal line of credit is at 3.25%.

Applying the theory, you would never cash in investments to buy a car and you would borrow up to the maximum that your credit limits will allow for additions to your portfolio.

Two important risks to consider

It’s a simple theory but it may be dangerous in practice because it ignores two important risks. First, returns may not occur as expected; and second, costs of borrowing may suddenly increase. These uncertainties require a margin of safety. In the example above, investments with a reasonable expectation of earning 7% return may be justified as long as the highest cost of borrowing is below 4%. It’s your choice for the appropriate safety margin based on an informed estimate of the uncertainties, the liquidity of you investments and it’s your responsibility to monitor returns and costs and ensure that the gap is not closing.

The current volatile investment climate means short-term returns are very unpredictable while at the same time there is high probability that interest rates will be rising rapidly and soon. That view has been confirmed over the past year, most recently in Canada, the last to follow the lead of the US Federal Reserve Bank.

The Bank of Canada rate went up again early in September: two quarter-per-cent increases in a few months after two declines since 2015. A strong economy indicates the upward trend will continue. The Bank of Canada rate is essentially a benchmark rate for the banks that normally raise their rates immediately by the same amount.

So if your current Line of Credit or variable rate mortgage is at 3.25% it may soon be going to 3.75%. That’s still low and below your threshold rate, but it is a 15% increase in your monthly interest payments and may have a painful impact on cash flow. On a loan balance of $300,000, the 0.5% rate increase means an additional $125 in interest charges per month.

Time to review and rebalance, or pay down loans

Now is the time to review your investment performance and re-balance or sell to pay down your loans. Paying off 15% of the loan balance will bring your monthly payments back in line with your budget. Assess and compare your average portfolio returns and the current costs of borrowing. Decide what it will take to maintain an acceptable safety margin on any borrowing to invest.

Then walk away and check in after another quarter. Watching and worrying every day does not help. It probably only shortens your life expectancy and will give you less time to enjoy all that wealth you are accumulating.

Del Chatterson is your Uncle Ralph. He is a strategic business consultant, author, advisor, coach & cheerleader for entrepreneurs. Del is an experienced and successful entrepreneur, executive and consultant. As an entrepreneur, he grew his computer products distribution business from zero to $20 million per year in eight years. DirectTech Solutions provides strategic advice to business owners at all stages: from start-up through the challenges of managing growth and profitability to exit strategies for management transition and business succession. Del shares his experience and offers ideas, and inspiration for entrepreneurs under the persona of “Uncle Ralph.’ He has published two books for entrepreneurs: “Don’t Do It the Hard Way” and “The Complete Do-It-Yourself Guide to Business Plans.” Learn more at LearningEntrepreneurship.com.

Del Chatterson is your Uncle Ralph. He is a strategic business consultant, author, advisor, coach & cheerleader for entrepreneurs. Del is an experienced and successful entrepreneur, executive and consultant. As an entrepreneur, he grew his computer products distribution business from zero to $20 million per year in eight years. DirectTech Solutions provides strategic advice to business owners at all stages: from start-up through the challenges of managing growth and profitability to exit strategies for management transition and business succession. Del shares his experience and offers ideas, and inspiration for entrepreneurs under the persona of “Uncle Ralph.’ He has published two books for entrepreneurs: “Don’t Do It the Hard Way” and “The Complete Do-It-Yourself Guide to Business Plans.” Learn more at LearningEntrepreneurship.com.