By Noah Solomon

Special to Financial Independence Hub

Time is on my side, yes it is

Time is on my side, yes it is

Now you always say

That you want to be free

But you’ll come running back (said you would baby)

You’ll come running back (I said so many times before)

You’ll come running back to me

— The Rolling Stones

The Rolling Stones’ iconic hit, “Time Is On My Side,” is a testament to the power of patience. Its lyrics remind listeners that even though things can seem challenging, eventually everything will fall into place. Although this message may be conceptually appealing, it is increasingly ringing hollow with many investors.

Discipline is one of the most important principles of successful, long-term investing. Successful investors tend to stick to their knitting, even during times when this entails avoiding “hot” stocks and underperforming over the short or medium term.

However, even the most disciplined investors have their limits, which have been sorely tested over the past decade, courtesy of the blistering appreciation of mega-cap growth stocks. Such companies are largely represented by the aptly named Magnificent 7 (MAG7), which includes Apple, Microsoft, NVIDIA, Meta, Alphabet, and Tesla. The “pain trade” of prolonged, MAG7-related underperformance has been pervasive across investment styles, countries, and active management in general.

Value managers have been caught in the wrong place (or style) at the wrong time, to say the least. As the table below demonstrates, growth stocks have left their value counterparts in the dust over the decade ending in 2023.

S&P 500 Growth Index vs. S&P 500 Value Index: 2013-2023

This incredible dispersion has caused investment styles to dominate investment acumen to the point where even some of the best value managers have underperformed some of the worst growth managers. Alternately stated, there has been little, if anything that a value-based investor could have done to avoid getting outrun by the growth trade juggernaut that has dominated markets over the past 10 years.

The effect of the tremendous run of MAG7 companies has also had a profound effect on the relative performance of different countries and regions.

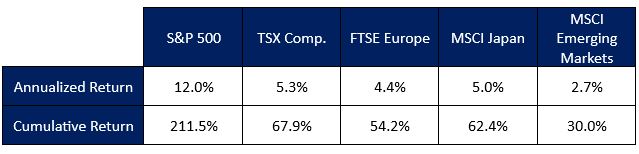

Comparative Returns: 2013-2023 (in USD)

To put it mildly, the S&P 500 Index, which its heavy exposure to MAG7 companies has turbocharged, has left non-U.S. indexes in the dust. The bottom line is that if you were underweight U.S. stocks, you were doomed to underperform.

Lastly, the MAG7 juggernaut has cast a dark shadow over active management (more on this later). According to Morningstar, during the decade ending in 2023, 90.2% of U.S. large cap managers underperformed their benchmarks. When it comes to active equity strategies, most clients’ experiences have been less than inspiring, if not disappointing.

From Big is Bad to Big is Beautiful

The dramatic outperformance of mega-cap companies over the past 10 years stands in sharp contrast to their longer-term historical pattern. Over the past several decades, underweighting the very largest stocks has been a winning bet. Since 1957, the 10 largest stocks in the S&P 500 have underperformed an equal-weighted portfolio of the other 490 stocks by an average of 2.4% per year. Continue Reading…