While it’s well known that the longer you wait to start receiving CPP benefits, the higher the payout, a series of papers debuting today from the National Institute on Ageing (NIA) highlights the fact that:

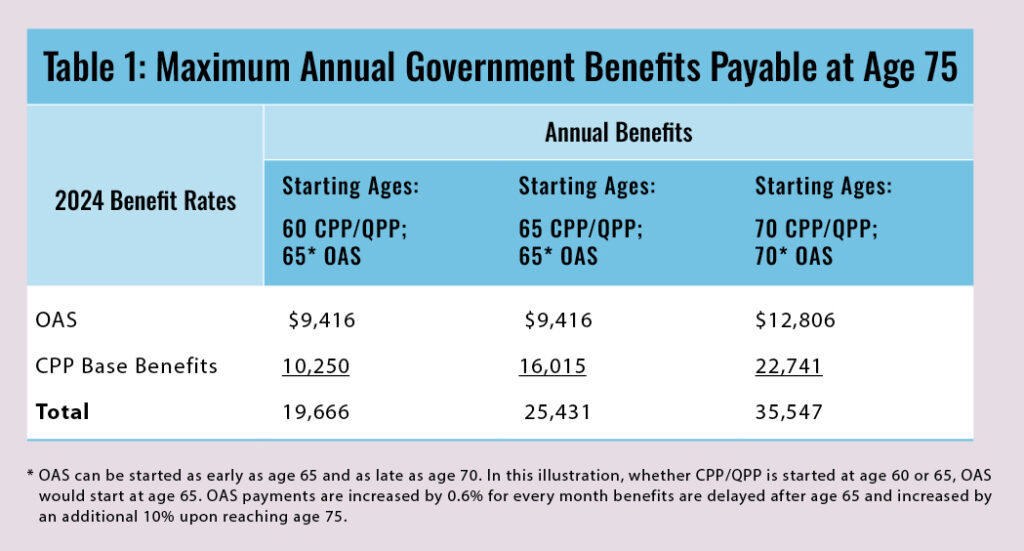

a) Many Canadians don’t realize that CPP benefits taken at age 70 are a whopping 2.2 times what they are if taken at the earliest possible age of 60. Indeed, a 2018 Government of Canada poll found an amazing two thirds of us didn’t understand that the longer you wait, the higher the CPP payout will be.

b) Despite this fact and despite being often mentioned in media personal finance articles, most Canadians nevertheless take CPP long before age 70.

You can see at a glance in the chart shown at the top the dramatic rise in free government money that can be obtained by waiting till 70.

The paper’s lead author is Bonnie-Jeanne MacDonald, PhD, FCIA, FSA, Director of Financial Security Research for the National Institute on Ageing at Toronto Metropolitan University.

Addressed chiefly to Canadian baby boomers, MacDonald and three contributors say upfront that deciding when to start taking CPP (or the Quebec Pension Plan) is “one of the most important retirement financial decisions they will make.”

Not only are benefits begun at age 70 2.2 times higher than they would be if taken at age 60, but “these higher payments last for life and are also indexed to inflation.”

So it’s a baffling that 90% choose to start CPP at the traditional mid-way point between these extremes: age 65.

Starting with the paper being released today, the NIA will publish seven papers in total aimed at educating consumers about these decisions.

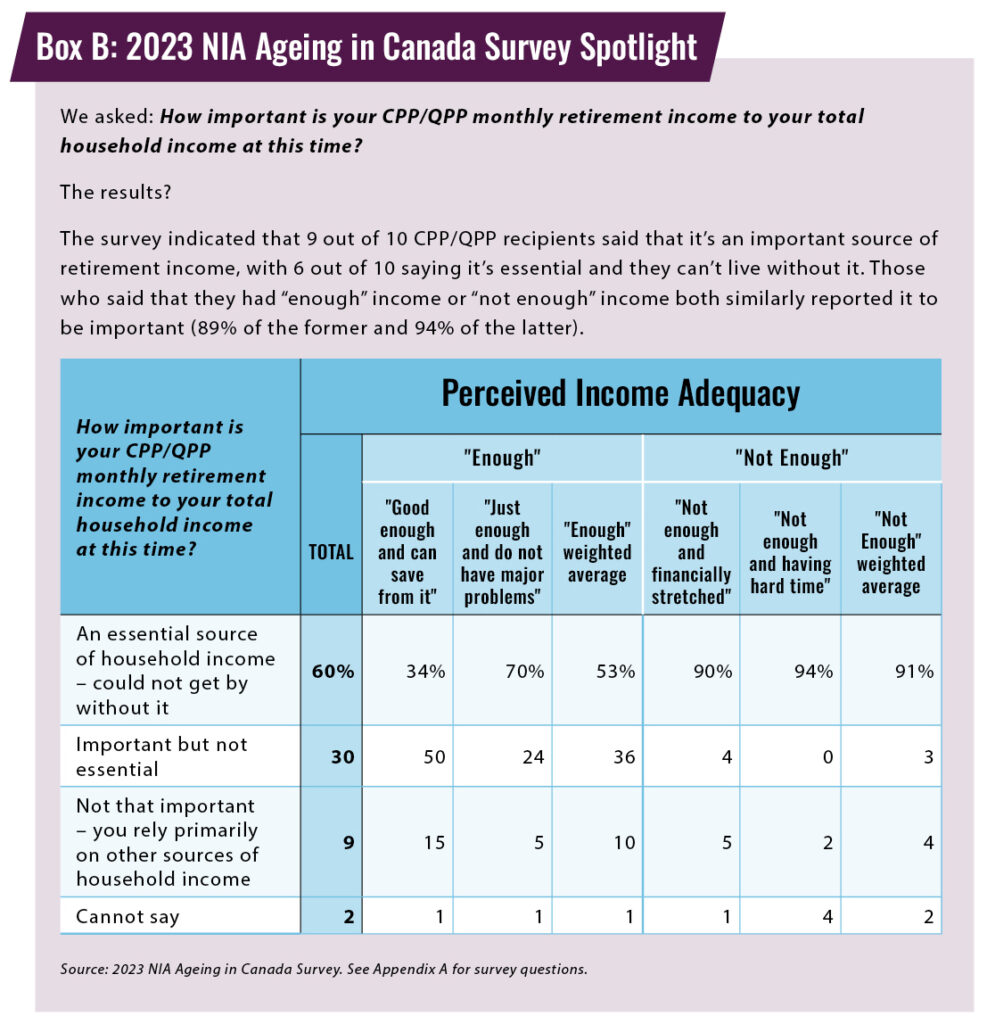

It’s not as if most Canadians don’t already realize how important CPP will be to their income. Indeed, with traditional Employer-Sponsored Defined Benefit pension plans becoming increasingly rare outside the public sector, for many the CPP, together with Old Age Security, will be the closest many retirees will come to having a guaranteed-for-life inflation-indexed pension. According to a 2023 NIA survey on Ageing in Canada, 9 out of 10 recipients say their CPP/QPP pension is an important source of their retirement income, with 6 out of 10 saying it’s essential and they can’t live without it.

The chart below illustrates this:

The initial paper being released today observes that similar dynamics are at work in the United States with its Social Security system. Academic literature there finds that “delaying claiming is almost always the optimal decision from an economic perspective.”

CPP offsets the 2 big bogeymen of Inflation and Running out of Money

A larger CPP income obtained by waiting till 70, or at least past 65, helps new retirees address two of their biggest fears, the NIA says: Inflation and running out of money before you run out of life. It finds that 37% fret about inflation and 22% worry about running out of money in old age. Continue Reading…