Special to the Financial Independence Hub

Planning the income for seniors often has the coolest opportunities to increase after-tax income.

The government pensions, CPP [Canada Pension Plan] and OAS [Old Age Security], are full of opportunities, because:

- Seniors often have flexibility in taking taxable and non-taxable income.

- OAS is subject to several “clawbacks” in addition to income tax.

To see these opportunities, you need to think creatively about pensions, tax and investments.

For example, in my recent article “Should I start my CPP early? – Real-Life Examples,” I found the single most important factor in whether to take CPP early before age 65 is how you invest.

Here you will see that the single most important factor in deciding whether to delay CPP after age 65 is: Will you withdraw more from your investments if you delay starting?

A quick review of the facts:

Delayed CPP Rules

- The maximum CPP benefit in 2016 at age 65 is $1,092.50 per month, or $13,110 per year.

- You can delay starting up to age 70 and you get 8.4% more for every year after age 65. If you start at age 70, you get 42% more for life, so the maximum is $18,616 per year.

- New rules in 2012 allow you to start CPP even if you are still working.

- If you are over 65 and still working, you can choose whether or not to pay into CPP.

- Your 8 lowest earning years since age 18 (plus years when you had kids under age 7) are “dropped out” in calculating how much CPP you get.

Delayed OAS Rules

- The maximum OAS benefit in 2016 at age 65 is $578.53 per month, or $6,942 per year.

- You can delay starting up to age 70 and you get 7.2% more for every year after age 65. If you start at age 70, you get 36% more for life, so the maximum is $9,442 per year.

Clawbacks on OAS and the Guaranteed Income Supplement [GIS]

- You can get up to $10,369 per year additional income from the Guaranteed Income Supplement [GIS] if you are single, collecting OAS and have a taxable income less than $17,544 per year (excluding OAS income).

- For married couples, GIS is up to $12,484 per year if your combined taxable income is under $23,184 (excluding OAS income).

- GIS is “clawed back” at 50% of your income (excluding OAS income). Low-income seniors are essentially in a 50% tax bracket!

- The OAS clawback is a tax of 15% of your taxable income between $73,756 and $119,615 per year.

The simple breakeven calculations miss many important factors. For example, John starts receiving $13,110 per year of CPP and $6,942 per year of OAS at age 65. Jane starts receiving $18,616 CPP and $9,442 OAS at age 70. It will take Jane 11 to 13 years to catch up. The simple breakeven is age 81 for CPP and 83 for OAS. John gets more before age 81 and 83, while Jane gets more after.

This implies that if you expect to live past 83 (and most people will), you should delay your CPP and OAS. But this is not the complete answer.

The complete answer depends on these six main factors:

- How long do you expect to live? Morbid question, but important for this decision. If you start CPP and OAS at age 70 instead of 65, you collect for five less years. If you start at age 70, you get more and eventually catch up. The longer you expect to live, the better it is to delay CPP and OAS. Today, a 65-year old of average health should expect to live until age 85. (Actually, it’s 84 for men and 87 for women.)

- Can you qualify for GIS? The GIS supplement is significant, being up to $12,500 per year tax-free. You can only get GIS if you are getting OAS. You may be able to qualify with some creative planning, such as deferring taxable income and living only on OAS, GIS and non-registered investments. See the story of Gloria below. The 50% clawback is a huge factor.

- How do you invest? Delaying your CPP and OAS might mean you will take more income from your RRSPs and investments. Then you will have less saved for later.

- What will inflation be? CPP and OAS benefits rise by inflation each year. Higher inflation means you get more up front by starting earlier. With 2% inflation, the simple breakeven rises from age 81 to age 84 for CPP and age 83 to age 87 for OAS.

- Are you still working? If you are still working, CPP and OAS income will be added to your work income and may be taxed at a higher rate.

- When do you need the money? Part of a retirement plan is figuring out how much income you want and when. If you plan to travel a lot for a few years, it might make sense to start CPP and OAS earlier.

I have read quite a few articles that say the OAS clawback is a factor. However, I found that in every example I looked at, the OAS clawback did not change my advice.

Best Advice

After my last article, a few people wrote me to point out that many people do not have any choice. I agree. If you are retired at 65 and have little income other than these two government pensions, you may have no option.

My advice here is — based on all the pension, tax and investment factors — which choice is most likely to give you the highest after-tax income throughout your life?

My best advice is:

- OAS – If you are retired, take it at age 65. If you can qualify to receive GIS (even with creative planning), definitely start at age 65.

- CPP – If you are retired and will withdraw the same amount from your investments either way, delay starting until age 70. If delaying means you will need more income from your investments, start at age 65.

- GIC investor – If you are still working and are in a 20% higher tax bracket than when you retire, delay CPP and OAS until you retire.

- Balanced investor – If you are still working and are in a 30% higher tax bracket than when you retire, delay CPP and OAS until you retire.

- Equity investor – Always start CPP at 65. Always start OAS at 65 unless you could qualify for GIS. If you are still working, invest them if you can.

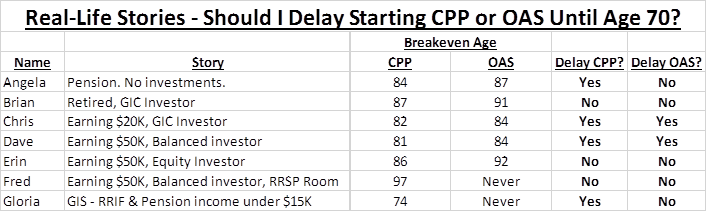

Let’s look at some real-life stories from my clients. Should they delay CPP and OAS to age 70?

- Angela is 65 and retired. She has no investments and only a fixed pension (not integrated with CPP). Her breakeven age is 84 for CPP and 87 for OAS. She is of average health. Should she delay CPP and OAS until age 70? Yes for CPP. No for OAS.

- Brian is 65 and retired. He has significant retirement investments and plans for a steady retirement income. If he delays CPP or OAS, he would withdraw from investments instead. His breakeven age is 87 for CPP and 91 for OAS. Should he delay CPP and OAS until age 70? No.

- Chris is 65 and still working part time earning $20,000 per year. She has small RRSPs and TFSAs. She is conservative and invests only in GICs at 2% per year. Her breakeven age is 82 for CPP and 84 for OAS. Should she delay CPP and OAS until age 70? Yes.

- Dave is 65 and still working earning $50,000 per year. He is a moderate, balanced fund investor. A reasonable expected return is 5% per year. His breakeven age is 81 for CPP and 84 for OAS. Should he delay CPP and OAS until age 70? Yes.

- Erin is 65 and still working earning $50,000 per year. She is a confident equity fund investor. A reasonable expected return is 8% per year long term. Her breakeven age is 86 for CPP and 92 for OAS. Should she delay CPP and OAS until age 70? No.

- Fred is the same as Dave, 65 and still working earning $50,000 per year. He is a moderate, balanced fund investor. A reasonable expected return is 5% per year. His CPP and OAS will be taxed on top of his salary in a 30% tax bracket. The answer would normally be “Yes” (same as Dave), but Fred has lots of RRSP room. He plans to collect CPP and OAS and invest the full amounts into his RRSP. His breakeven age is 97 for CPP and never for OAS. Should he delay CPP and OAS until age 70? No.

- Gloria is 65 and retired. She has significant investments in RRSP, TFSA and non-registered. She can qualify for $10,369 GIS income if she avoids any taxable income other than OAS. She plans to delay CPP and withdraw only from her TFSA and non-registered investments. Her breakeven age is 74 for CPP and never for OAS. Should she delay CPP and OAS until age 70? Yes for CPP. No for OAS.

The answer is complex and these government pensions are only one piece of your retirement income. There are often creative opportunities to get a higher after-tax income throughout your life. Fred and Gloria are two examples.

The best advice is to look at this as part of a professional retirement income plan.

Ed Rempel, CPA, CMA, CFP is a popular financial blogger, fee-for-service financial planner, and an expert in many advanced tax & investment strategies. He is a certified financial planner with a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans. He has been an active blogger for more than 10 years. He loves sharing his insights on his blog “Unconventional Wisdom” at https://edrempel.com/

Ed Rempel, CPA, CMA, CFP is a popular financial blogger, fee-for-service financial planner, and an expert in many advanced tax & investment strategies. He is a certified financial planner with a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans. He has been an active blogger for more than 10 years. He loves sharing his insights on his blog “Unconventional Wisdom” at https://edrempel.com/

By my calculations, inflation should shorten rather than lengthen the breakeven age. Can you explain this a bit more?