Sources: Bloomberg and FactSet

Sources: Bloomberg and FactSet

By James Redpath and Curtis Elkington

Special to the Financial Independence Hub

Conversations about increasing interest rates and their impact on bond investments have recently spiked in Canada. Since bonds are traditionally viewed as an investment that provides a steady stream of income while acting as a safety net within an overall balanced portfolio, an environment of rising interest rates understandably causes unease: it can decrease the price of bonds and therefore can negatively impact performance.

While we share the same concern, we also think some of the prevailing discussions oversimplify the relationship between interest rates and bonds and require a bit more context. We may want to think twice about knee-jerk shunning of the asset class.

Right off the bat, what should be kept in mind is that the interest rate most commonly referred to in media articles is the overnight interest rate, which we will refer to here as simply ‘interest rate’. For anything longer than the overnight rate, we will use ‘yield’ and/or ‘yield curve’.

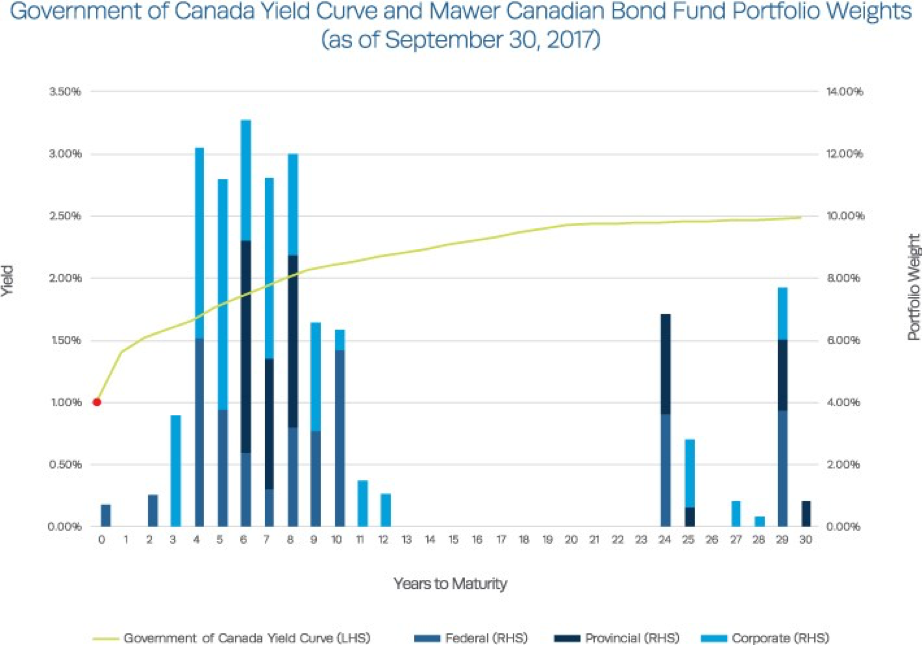

While the Bank of Canada controls the overnight interest rate (represented by the red dot in the graph above) and has some influence on the short end of the yield curve, medium to long-term yields are a different story. Medium and long-term yields tend to be driven by long-term factors outside the Bank of Canada’s direct control, such as potential economic growth and inflation dynamics, supply and demand, and global influences.

Thus, pinning too much importance and conversation onto that red dot doesn’t provide a holistic picture since the Fund has a diverse maturity structure and exposure to multiple sectors: all of which can have different influences on performance. While shifts higher in the yield curve over the short-run will likely negatively impact a bond portfolio, over a longer time horizon, the effects might be surprisingly positive.

In long run, rising yields are a positive

Why? Although it may seem counter-intuitive, if you have a long-term time horizon, an increase in bond yields is usually more beneficial than if yields remained lower as the performance of a bond fund is influenced by the level and slope of the yield curve over time. Another important factor is the pace yields rise relative to the time it takes to recover lost performance. While there could be short-term pain, maintaining a long-term horizon allows an investor to reinvest at a higher yield, which over time typically outweighs the negative short-term impact. Simply put, the higher yields are, the higher the income an investor receives when cash flows are re-invested.

Supporting research has corroborated this thinking. One standout report from PIMCO investigated how rising yield curves affected the long-term returns of the Barclays U.S. Aggregate Bond Index. The report tested multiple scenarios by shifting the yield curve higher either instantaneously, or gradually over time, and analyzed the bond index’s performance. An overarching theme that arose from these scenarios was that if an investor had a long time horizon, an increase in yields could actually be more beneficial for performance than if yields remained lower.

We have conducted similar studies internally. As part of our own investment process, we also run a variety of scenarios where we shock the yield curve over different time periods to analyze the potential impact on the Canadian Bond Fund’s performance. While theoretical in nature, these exercises help us to understand the impact of a range of potential scenarios. It also serves as important input into how we structure the portfolio to balance the tradeoff between short-term risks and long-term returns.

Corporate bonds are a potential offset

Despite the knowledge that higher yields could potentially prove beneficial over a longer time period, we do understand bond holders’ concerns about the risk. At present, we see corporate bonds as a potential offset. In a normal situation, the thesis for corporate bonds is as the economy improves, the Bank of Canada will likely increase interest rates in an effort to temper inflation. Theoretically, in this environment, corporate issuers can become more credit-worthy. It is a fine balance—the risk is that corporate credit spreads could widen, thereby negatively impacting performance.

Ultimately, one of the main tenets of our investment philosophy is to structure portfolios to be resilient to a variety of scenarios: this is true for our Bond funds, as well as our Balanced funds, where bonds play a key defensive role. We believe it is unwise (and very, very difficult) to try to predict interest rates accurately: what the Bank of Canada will do, or how the yield curve is going to react. We may get higher interest rates and yields over the next twelve months, we may not: how much, and how quickly, is what’s really going to matter. Bond holders will not likely regret their decision during an equity correction (which we haven’t had in some time). An environment of rising interest rates and yields may improve bond performance over a long enough time horizon.

Don’t rule out bonds.

James Redpath, CFA, is Mawer Fixed Income Portfolio Manager. Curtis Elkington, CFA, is Mawer Credit Analyst