By Mark Yamada, PUR Investing Inc.

Special to the Financial Independence Hub

From zero assets in 1989, to $79 billion in 2000, to $2.7 trillion into 2015, it has been quite a ride for global exchange-traded funds (ETFs). Few financial sectors have approached the over 25% compounded annual growth that ETFs have enjoyed. Yet many industry observers are disappointed.

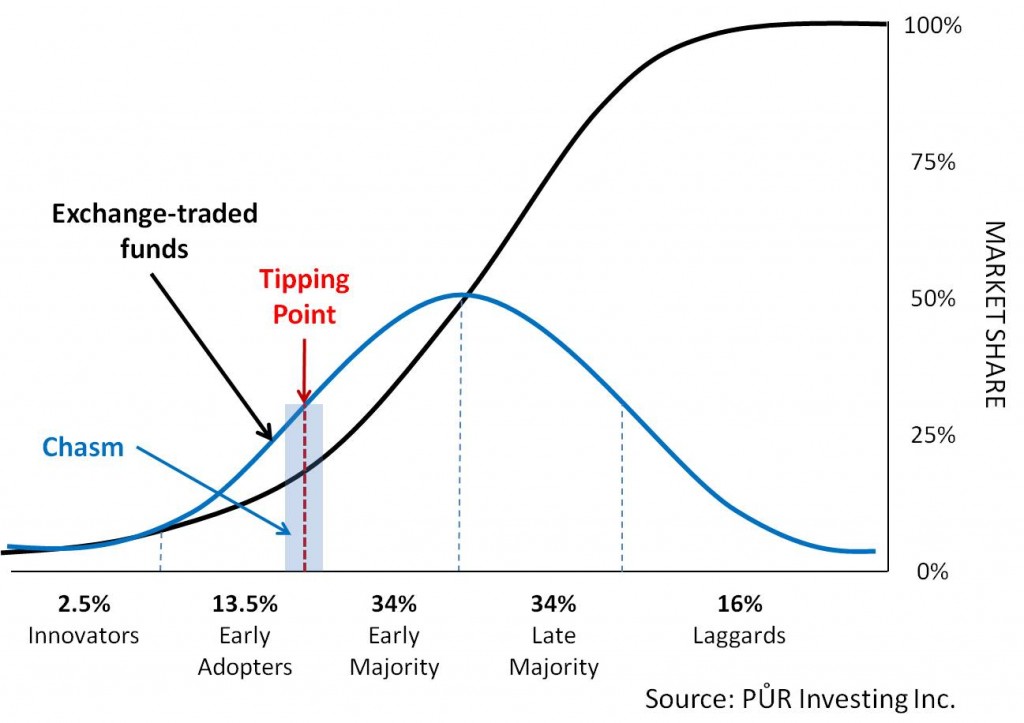

ETFs’ value proposition is well known: diversification, professional management, shared expenses, all the benefits of mutual funds at a fraction of the price plus better transparency and continuous intraday trading. Yet ETFs represent only 12% of US and 6% of Canadian mutual fund assets (10% if US-traded ETFs owned by Canadians are included). If ETFs are so much better than mutual funds, why haven’t they replaced them by now?

Adopting new ideas

The theory of diffusion of innovation was introduced in 1962 by Everett Rogers, who wondered why the adoption of hybrid corn seed took 13 years even though it offered a 20% improvement in yields. Rogers described the stages through which products and ideas pass from introduction to acceptance; awareness, interest, evaluation, trial, and adoption.

The chart shows the progression from innovators to early and late adopters and finally laggards. Laggards are described by author Simon Sinek as those who purchase a touch-tone telephone because they can’t buy a rotary one anymore. Early adopters evaluate new products and ideas, see benefits and take the risk to incorporate them into their lives.

ETFs near the tipping point

An important and critical “tipping point” or critical mass occurs at 15%-18% acceptance. When achieved, the 68% early and late majority follow early-adopter leadership in short order. Bridging this critical 15%-18% has been described as “crossing the chasm” by venture capitalist and author Geoffrey Moore.

This is where ETFs find themselves today. Will they cross the chasm into broad acceptance or remain a subset of retail investing?

Why people buy mutual funds

Canadian mutual fund sales generally languished for 58 years from their introduction in 1932 until 1990, when the banks entered the fund business and validated the space. Over the next 25 years, a generation of Canadian investors (baby boomers) has gotten into the habit of using funds. Behavioral finance tells us that old habits die hard — even more so when complex issues like finance and investing are involved.

Anchored to old beliefs, investors rely on advice. In Canada, many advisors are paid by product suppliers: loads and trailing commissions in the case of mutual funds. This arrangement compromises the advice through no fault of the advisor. A consequence is the steady growth of another part of financial services, compliance. The 1976 Securities Act in Canada consisted of about 270 pages; today it exceeds 4,000!

Changing behavior

The elimination of trailing commissions in the UK and Australia in recent years has started a transformation. Formally aligning advisor compensation with their clients’ interests through fee-based relationships is doing advisor credibility a great favour. If a doctor attends a convention in an exotic location with all expenses paid for by a drug company and then prescribes you that company’s drug, how would you feel?

Even if it were truly the best course of treatment, the advice is tainted by the compensation structure. Advisors claim they already have their clients’ best interests in mind but the compensation system should reinforce their advice, not compromise it. In the UK, 11,000 advisors dropped out.

But every industry has marginal players and if the average level of advice improves, consumers benefit. Pursuant to the tipping point, Australia is instructive. Aussie ETF assets under management doubled in a year following the elimination of trailers.

Canadian advisors are encouraged by their firms to transition to higher-value fee-based practices. As the industry continues to unbundle and CRM2 disclosure improves transparency of costs and performance, will ETF use increase or decrease? What if 83,000 MFDA-registered fund sales people could sell ETFs?

Advisor acceptance of ETFs is important in moving across the chasm, but not essential. A new generation will look to the internet for investing information and some will try robo-advice, a proliferating form of on-line investment guidance. The $15.7 billion AUM for US robos is expected to grow to $155 billion in 5 years (MyPrivate Banking GmbH). All major robo-advisors use ETFs exclusively.

Crossing the chasm

The internet took 20 years to hit its tipping point because the cost of computer access slowed adoption. Today, robo advisors and discount brokerage accounts make ETF access easy. Millennials will use ETFs but what about baby boomers who control most of the wealth?

Costs in retirement for boomers become acutely important. Furthermore, if the only investment strategy an advisor can recommend is a conservative balanced portfolio, boomers may decide to save 1.0% a year and go it alone. Advisors prepared with comprehensive ETF solutions when the tipping point hits will win … big!

Mark Yamada is president of PŮR Investing Inc., a registered portfolio manager and software development firm. Disclosure: PŮR Investing Inc. sub-advises for, and provides risk-based model portfolios to, Horizons ETFs.