By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

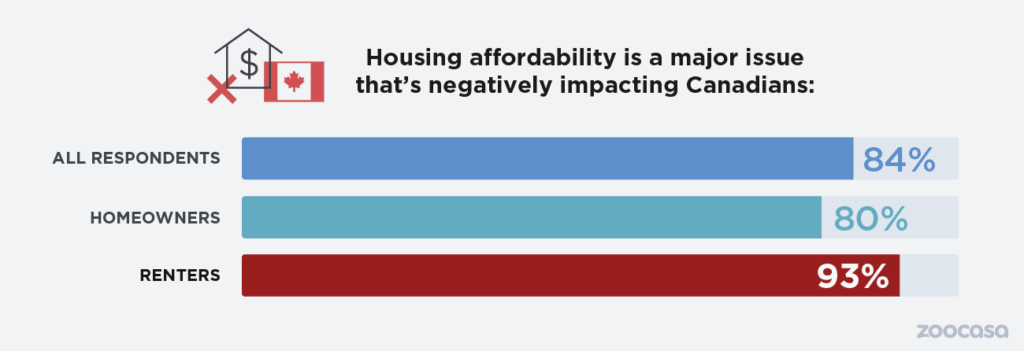

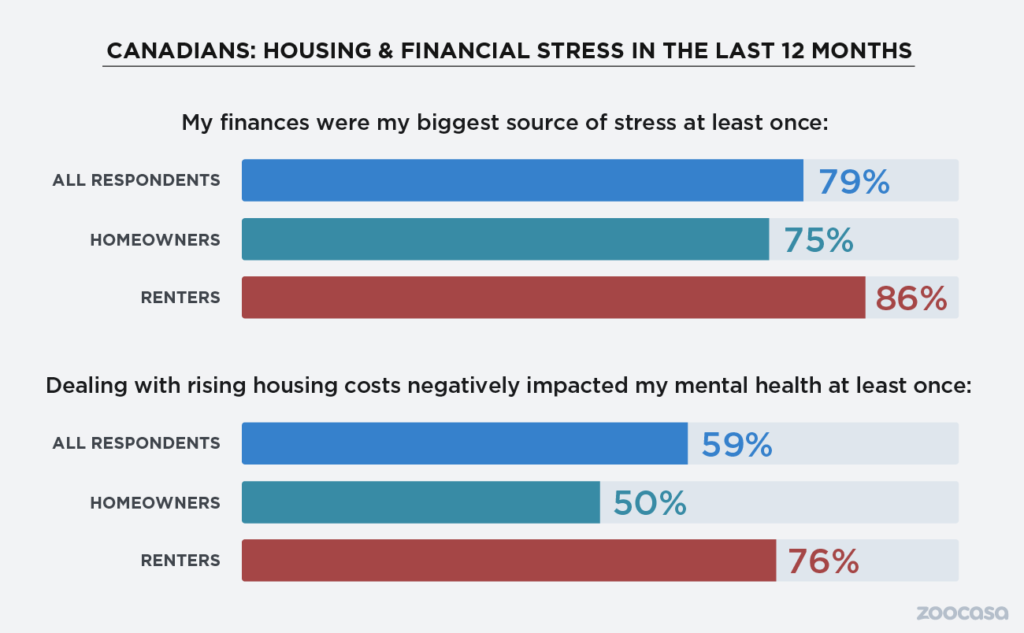

Election season may have come and gone, but the need for affordable housing remains a top-of-mind issue for Canadians, regardless of governing political party. According to a recent national survey conducted by Zoocasa, a whopping 84% say they feel the ability to afford a home is a major issue that’s negatively impacted the population: and 78% feel the government needs to make it a priority focus.

As well, the survey findings reveal that anxiety around affordability extends beyond those who wish to get onto the property ladder; while renters express particularly strong feelings of uncertainty (93%), current homeowners are also feeling the squeeze from spiralling home values, with 80% in agreement.

Let’s take a look at the top concerns indicated by Canadians.

Incomes can’t keep pace with Real Estate prices

It’s no secret that prices for houses for sale in markets across Canada have seen enormous growth over the last five years. According to the Canadian Real Estate Association, the national average home price now exceeds half a million dollars, at $515,500 (though it should be noted that removing Vancouver and Toronto houses and condos from the equation would trim that total to $397,000).

This has left the majority of Canadians – 91% – feeling as though home prices have outstripped wages in their city or town, while another 92% say they feel rising home prices have reduced the ability of middle-class Canadians’ abilities to purchase a home.

As a result, in order to seek out greater affordability, more than half of first-time buyers said they’d leave their current location and move to a market with lower home prices, contributing to what’s referred to in real estate circles as “driving until you qualify.”

Other homeownership hurdles

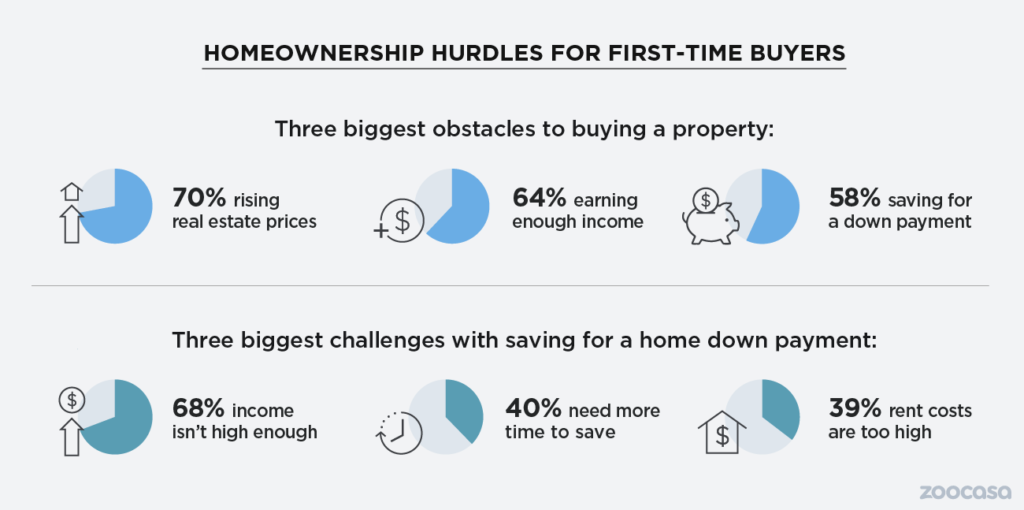

But rising home prices only tell a portion of the story: while 70% of respondents agree they’re the largest obstacle to getting on the property ladder, the inability to save enough for a down payment also ranks highly on the list of challenges.

The main reasons Canadians can’t pull a large enough nest egg together include not earning enough income to effectively save (68%), while 40% say they’d need more time to pull the necessary funds together.

However, a noteworthy finding was that those currently in the rental market are facing already too-high shelter costs to set enough aside to save for homeownership, with a total of 39% indicating as such.

Homeowners pinched by rising costs

While it’s widely known that the Canadian housing market is a challenging environment for those looking to purchase their first home, even those currently with a foothold in the market are feeling the pressure from rising home costs.

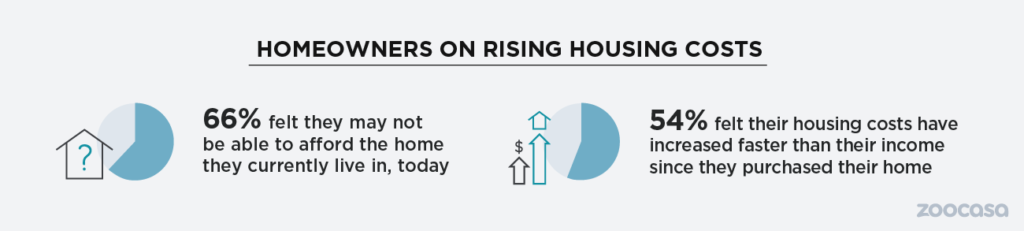

While a total of 69% of homeowner respondents say that owning real estate has helped them accumulate wealth, they’ve also acknowledged that their carrying costs have ballooned as a result of the rising market; a total of 54% report these costs have increased at a faster clip than incomes since they bought their homes.

As well, for these homeowners, timing has been of the essence, as 66% say they aren’t sure they’d be able to afford the home they currently live in, if they had to purchase it amid today’s market conditions.

Penelope Graham is the Managing Editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download its free iOS app.

Penelope Graham is the Managing Editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download its free iOS app.