I have a lot of books about Retirement and Financial Independence in my personal library, but I seldom go through any one twice. Today’s review is an exception because of a lunch I had with a friend we’ll call Albert (not his actual name).

I have a lot of books about Retirement and Financial Independence in my personal library, but I seldom go through any one twice. Today’s review is an exception because of a lunch I had with a friend we’ll call Albert (not his actual name).

Albert is a former client with whom I’ve kept in touch. He’s now 70 and just begun to retire. Because of various circumstances, he was unable to engage in most of the basic practices described here at the Hub, so no taxable or non-registered savings for Albert.

Fortunately for him, he bought a house in Toronto at something like a third of what’s it’s worth now, and it’s that home equity that has allowed him to finally stop working. He has no dependents and after going over the pros and cons took out a reverse mortgage.

The Joy of Not Working

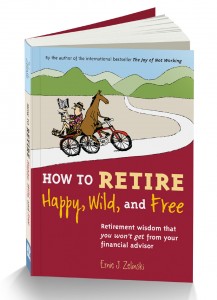

But that’s not what this blog is about. Over our lunch, Albert told me he’d been at the public library to check out books about Retirement. Two were by a Canadian writer who has achieved massive international success through self publishing: Ernie Zelinski. He’s written 15 books but the two best-known were the ones Albert got from the library: The Joy of Not Working and How to Retire Happy, Wild and Free. I told him I’d read both a long time ago and likely reviewed them when they first came out.

Retrieving Wild & Free from my office shelves, I noticed I had read it in November 2003, when I was 50 and (as it turned out), still more than a decade from my Findependence Day. I started to flip the pages and noted I had underlined many passages, some of which I reproduce below.

It holds up well. Note the subtitle of Wild & Free: “Retirement Wisdom that you won’t get from your financial advisor.”

Connoisseur of Leisure is now 65

Zelinski is an interesting character. He lives in Edmonton, Alberta and opted for semi-retirement when he was 30, despite having a net worth of minus $30,000 at the time. Born in 1949, he turned 65 last summer. Zelinksi, who is unmarried, has long described himself as a “connoisseur of leisure” who used to work just two or three hours a day.

That work was mostly writing his books, generally in various Edmonton coffee shops. He religiously adhered to a daily writing regime that clearly worked for him: as of 2015, The Joy of Not Working has sold 280,000 copies, Zelinski told me this week.

Zelinski self-published Joy between 1991 and 1997, at which point he handed it to Ten Speed Press, later acquired by Random House. While it has slightly outsold Wild & Free, he makes more from the latter because it’s self published. He says it was rejected by 35 British and American publishers and sent me three rejection letters to confirm it. One New York giant publishing house told him in 2003 that “the retirement shelf” is quite crowded but “we hope you prove us wrong.”

I’d say he did: He has since negotiated 111 book deals with publishers in 29 countries. The two big titles continue to sell, so much so he says he can’t qualify for Old Age Security. “I’m making the best money ever in my life. Only 1% get it clawed back … I guess I’m a 1 percenter among 65-year olds.” He now works about half an hour a day. How he spends the other 23-and-half hours you can divine from his books.

Do we focus too much on the financial side of retirement?

As I perused the pages of Wild & Free once again, I was struck by how little the book dealt with the usual financial matters that the personal finance press tends to focus on. Here’s one passage I had underlined 12 years ago:

“… the biggest mistake you can make with your retirement planning is to concentrate only on the financial aspects.”

Some of the points in the chapter summaries include “You are never too young to retire,” “Retiring too late means you don’t get another chance to do it right”, “Life is short — and so is money,” and “It’s better to live rich than die rich.”

The book nicely touches on the dilemma debated just last week in a MoneySense blog I wrote that was repurposed here at the Hub under the headline, “Retirement Planning would be so much easier if we knew (exactly) when we were going to die.”

I have to admit that once I re-read the passages I had underlined in 2003, and much more that I hadn’t the first time around, I thought to myself: “Why am I working so hard when I really don’t have to?”

It’s not about loafing but about staying active

Zelinski’s list of things you can do in Retirement takes multiple pages to list and it got me thinking about my own oft-postponed semi-retirement. When I put the book down for the second time, I was even inspired to go back to a hobby that had obsessed me between 2004 and 2011 or so: Internet bridge. Over those years, I had encountered many cyber personalities from around the world and was pleased to reencounter several of them once I did.

While Zelinski doesn’t use the term Findependence, his vision of Semi-Retirement is certainly consistent with this website’s insistence that our last few decades need to have purpose:

“This I can assure you: You won’t find genuine joy and satisfaction by spending all your time sleeping, relaxing, loafing, and watching TV, hoping to live up to the ideal of a true idler … To retire happy, wild, and free, you must stay active.”

As I have noted in other blogs about Extreme Early Retirement, Zelinski is certainly no loafer: he was smart enough to get out of the corporate jungle early in life so he could become an entrepreneur: in addition to his publishing empire he still speaks a bit. Sounds corny but it’s another case of “do what you love and the money will follow.”

I could go on at length but if you want more, go ahead and buy the book, or for $2.99 you could buy this summary e-book by Bob Matthews. It certainly made me think and I’d love to hear from Zelinski fans who have implemented his ideas over the years.

Just drop me a line at jonathan@findependenceday.com. In fact, Ernie himself supplied me with a few letters from readers who achieved an even more happy, wild and free retirement than the author himself.

We’ll revisit them in a few weeks.