By Mark Seed

Special to the Financial Independence Hub

The Financial Independence Retire Early (FIRE) movement certainly has legs, and maybe rightly so.

Like any good movement, it takes courage to do what others don’t care to do.

Financial independence takes know-how, it takes discipline to hone your financial behaviours; it takes time to remain invested when others are jumping in and out of the market. It also takes saving your brains out thanks to a good salary and let’s not forget lots of luck. Regarding the latter, you need a strong bull market – a long one – and we’ve had it for a decade or more.

It’s not that I fully disagree with the FIRE movement and what some folks are striving for. I think many FIRE principles have great merit and kudos to those that live by these rare principles:

- Save early and often, in great quantities.

- Live frugally and avoid financial waste.

- Avoid long-term debt that is not used for wealth generation.

- Optimize your investing (i.e., keep your costs low and diversified) to realize your financial goals sooner than later.

I’ve written about FIRE before on this site. A few times.

I even questioned if FIRE was right for me. I know that answer.

Why I’m tired of retire early in FIRE

In some circles (not all thankfully), the focus of FIRE is on “retire early” part. Work hard, make good money with the intention of leaving the corporate rat-race sooner than later. That’s fine and definitely aspirational – if that was the end of it. However I’ve become tired (and maybe a bit cynical) of some members of the retired early crowd. Why?

Because they still work and claim themselves retired …

If you expend energy, trade time or services for any income that’s work, people.

If that’s your blog endeavour: if that blog makes money and use that money for living expenses that’s work.

If that’s book royalties: if marketing and selling your book makes money and you use that money for living expenses that’s also work.

If that’s making videos or growing your influencer status online: if that too makes money and you use that money for living expenses this is also, guess what, work.

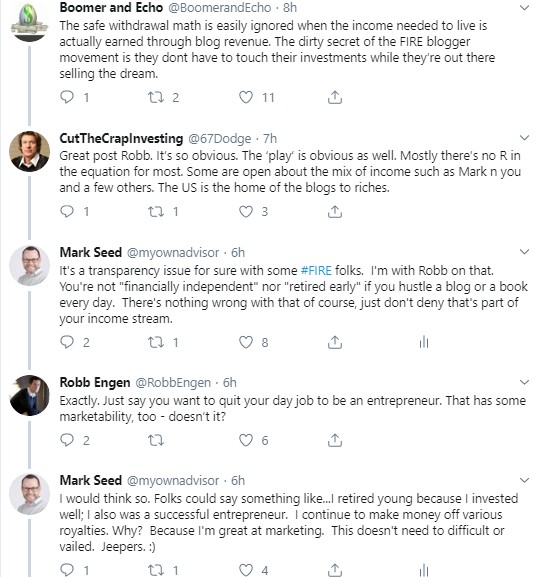

I posted a few tweets on this very subject recently: some of these concepts people agreed and disagreed with me on:

For those that disagreed, maybe my definitions are too traditional. I’m too old-school-Webster’s for you.

However, I do feel if you perform duties for wages or expected income; if you exert yourself physically or mentally for sustained periods of time for a particular outcome (money); if you engage if any activity in any manner to earn a livelihood (to earn money, to spend that money eventually): like it or not folks, you’re working.

Why I’m a fan of the financial independence part of FIRE

Maintaining your wealth and being happy doing it? That sounds better and far more honest to me.

That’s the perspective that CFP Graeme Falco once shared on my site – when discussing his practical guide to financial independence book.

Like Graeme, I believe far more in the FI part of FIRE than the RE (retire early) part.

In my opinion, financial independence is the amount wealth you need so when you are no longer dependent on any active source of income (i.e., work), you can rely on the income generated or withdrawn from your savings to live from. Those savings could be from stocks, bonds, gold, real estate, and much more. That could also mean you still wish to work – on your own terms. More on that in a bit.

Is the 4% withdrawal rule for FIRE enthusiasts enough?

It depends.

Many claims have been written about the “safe 4% rule” by various FIRE enthusiasts.

Let’s back up and talk about that.

The 4% rule is the percentage of your portfolio you can safely withdraw per year, assuming no catastrophic poor sequence of returns occur, that will allow you to keep your portfolio “safe” to withdraw from using a balanced ~ 60%/40% stock/bond asset allocation. More specifically, in 1994, financial adviser William Bengen introduced the concept of the 4% rule: who found that retirees who withdrew 4% of their retirement portfolio balance, and then adjusted that dollar amount for inflation each year thereafter, would create a paycheck that lasted for 30 years.

This “rule” was stress tested using a range of withdrawal rates on differing portfolios of stocks and bonds using inflation data and investment returns from the mid-1990s going back to 1926. The rule used a portfolio assumption of 60% stocks and 40% bonds but this included historical bond returns close to 5%. Challenge #1: good luck finding bond returns near that today.

Yet another challenge with the 4% rule is it won’t really hold up to a poor sequence of returns. Imagine your healthy $1 million dollar portfolio dropping 10% in year 1 of retirement, then another 10% in year 2 of retirement: when a bear market finally hits us. Your portfolio balance is now down more than $200,000 in just a couple of years of retirement thanks to two very bad stock market years AND your $40,000 per year inflation-adjusted withdrawals. If this occurred to you, and it could, withdrawing 4% as a starter and rising consistently in future years of retirement would probably make you a very nervous retiree. Luckily retirement income needs vary over time from “go-go”, to “slow-go”, to “no-go” years. Hopefully some FIRE folks are considering living off much less than the 4% rule when times get tougher.

Another big issue with Bengen’s study is that it’s focused on portfolio longevity versus income security as the primary driver. I personally have a bias for income from my portfolio whereby I can spend the dividends earned and/or spend the capital as I please.

FIRE enthusiasts or other investors would be best-served to explore one or more of the following ways to ensure they don’t blindly adopt any 4% rule as their golden financial freedom ticket:

- Consider a more bonds or fixed income or a very large cash wedge of 10% or more during retirement. I intend to employ some form of a cash wedge in retirement myself.

- Consider variable percentage withdrawals. I wrote about the VPW method and tool here. I believe this method would result in a far more sustainable portfolio over time.

- Consider buying an annuity as you get older. I demystified annuities on my site here with CFP and annuity guru Alexandra Macqueen.

- Get a side-job or part-time job to cover variable retirement or semi-retirement expenses.

Reminder to the marketing masses: side-jobs and side-hustles for income = working

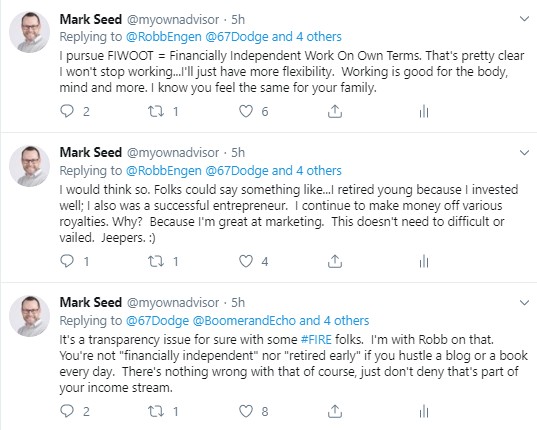

And so item #4 above brings me back to my thesis of this post: side-jobs or blogging or selling books or making money online with videos or selling courses or influencing various brands is working. And that’s OK! Good on you to be an entrepreneur. Great on you to be a successful entrepreneur at that! Just don’t hide it as a FIRE enthusiast. If fact, celebrate it with more transparency. This is how I feel in the same thread on this subject:

Fight fire with FIRE?

So, do I hate the FIRE movement? It might seem that way from this post but hardly.

I just don’t agree with all of it including any of the mass skewed, often tabloid marketing that goes with it.

Which means, I feel Financial Independence Work On Own Terms (FIWOOT)is a FAR more accurate depiction of what I’m personally pursuing: all in good time. FIRE is not for me, which includes the do-nothing-retire-early and never work again part. FIRE by definition is therefore not a claim I wish to personally pursue. I might always work for a living, which includes some form of Victory Lap Retirement.

I bet if some FIRE die-hards used my interpretation above, FIWOOT, my theory is this would be a much better, at least more honest depiction of what they are striving for or have already accomplished without some of the sensational marketing surrounding it.

Let the hate-mail arrive FIRE folks. FIRE principles have merit but let’s have a real conversation about this FIRE-stuff.

Mark

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on August 7, 2019 and is republished on the Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on August 7, 2019 and is republished on the Hub with his permission.