Corporate tax cuts were a focal point of Donald Trump’s campaign — and Trump says lowering corporate taxes will be a priority in his first 100 days as president.

Based on the initial market response to Trump’s victory, lowering tax rates looks to us like the most important factor driving the market.

Equity markets, of course, like it when taxes are cut. It naturally means more after-tax earnings that can be reinvested or distributed to shareholders — and, importantly, an improvement in valuation ratios that many think look extended under present circumstances.

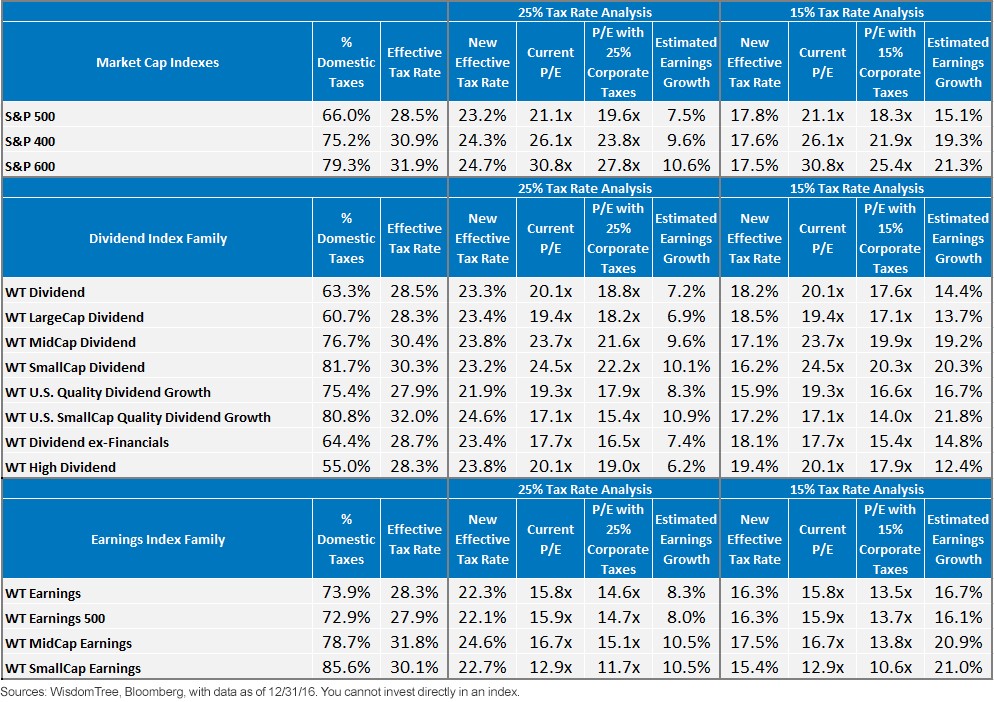

We published an initial sensitivity analysis to look at how various assumptions on tax rates might impact the earnings growth and ultimate market valuations across a market cap-weighted index set of the S&P 500, S&P 400 and S&P 600 — and across the sectors in those indexes. We have updated our original analysis to also include domestic WisdomTree Indexes; we also have updated our initial model for estimating the potential tax benefit that shows new results for the cap-weighted index family.1

Lower Tax Rates = Big Earnings Growth and Market Moves in Small Caps

To summarize the results, a simple model shows the following: the more earnings (and taxes paid) that come from the U.S., the greater the earnings growth would be from a tax cut, because by and large, the companies with revenue across the world already have lower effective tax rates.

Indexes with a higher percentage of profitable companies — and thus companies that pay more U.S. taxes — potentially stand to benefit more than indexes with more unprofitable companies. The indexes with more revenue from the U.S. tend to be mid- and small-cap indexes.

Indexes weighted by Profits benefit more than Dividends

The WisdomTree Earnings Index family — which only includes profitable companies and weights companies based on profits — shows a potential improvement in earnings that is higher than the WisdomTree Dividend Index family.

Why?

We have examined the potential gains from lower tax rates across sectors, and the two sectors that stand out the least as beneficiaries are the Energy sector and Real Estate sector.

Companies in the Real Estate and Energy sectors tend to make up a bigger percentage of the dividend Indexes than the earnings Indexes.

Real estate investment trusts (REITs) already pay little taxes at their trust level if they distribute at least 90% of their income.2 They thus also do not benefit as much from new policies.

A number of energy companies, particularly large-cap energy companies, have a global revenue base and pay more taxes overseas. They stand to benefit less from U.S. tax rate cuts and thus would see less meaningful increases in earnings and improvements in valuations. They also have depressed earnings today, so, based on the changes we modeled, they may not see much improvement from that side either.

Looking across the WisdomTree Index family below, we’d highlight the following:

- The broad market WisdomTree Earnings Index has about 10 percentage points more domestic taxes being paid than the WisdomTree Dividend Index (73.9% vs. 63.3%). Under an assumption of 15% tax rates, this would translate to potential earnings growth of 16.7% vs. 14.4%, or 2.3% higher with our model.

- Showing how important the WisdomTree earnings-weighted approach can be for lowering valuations and how much these can be improved with a reduction in corporate taxes—if Trump gets his desired 15% tax rate approved—a simple model shows potential gains in reducing price-to-earnings (P/E) ratios from a touch under 16 for a broad market earnings-weighted index or a large-cap earnings index to just 13.5 times earnings.

o Broad market index multiples at around 13 to 14 times earnings would be a very reasonable valuation for broad market exposures. Of course, actual tax cuts may not be as simple as lowering the effective corporate tax rates we are modeling here, but this analysis shows potential gains to be had and how markets may be reasonably priced, particularly with an earnings-weighted approach.

o We also show the calculations at a reduction to 25%: a more conservative assumption, and even here the broad market multiples, on an earnings-weighted basis, would fall below 15 times, a fairly reasonable starting valuation.

- An example of indexes that benefited slightly less from tax rate reductions: the WisdomTree High Dividend Index currently has a meaningful position in energy stocks such as Exxon Mobil, and has a very high percentage of foreign revenue and foreign taxes compared to U.S. indexes; it also has meaningful exposure to REITs. In terms of the total tax exposure of the Index, it saw a 12.4% increase in earnings under an assumed 15% tax rate, compared to 14.4% for the broader WisdomTree Dividend Index or 16.7% for the WisdomTree Earnings Index.

- An example of indexes that benefited more: small-cap indexes with more revenue from the U.S. stand to benefit at greatest amounts across the WisdomTree Dividend and Earnings Index families. In contrast to the S&P 600, which would still have a P/E ratio above 25 under a 15% corporate tax rate scenario, we’d point out the WisdomTree SmallCap Dividend Index with a P/E ratio of 20.3, the WisdomTree U.S. SmallCap Quality Dividend Growth Index at 14.0 and the WisdomTree SmallCap Earnings Index at 10.6 times are reasonably valued small-cap indexes.

Conclusion

The analysis presented herein will be an ongoing work in progress for us. As more details about Trump’s policies become clear, we plan to update this scenario analysis with better models to help clients understand where the market valuations might be affected most by tax reform.

1Our precise calculations estimate an effective tax rate for each index and a new method for calculating this starting effective tax rate when companies have losses resulting in a lower starting effective tax rate and thus a smaller improvement in earnings growth with new tax policy scenarios.

2See, for instance, Mark P. Cussen, “The Basics Of REIT Taxation,” Investopedia.

Jeremy Schwartz is Director of Research for WisdomTree, responsible for the WisdomTree equity index construction process and oversees research across the WisdomTree family. Prior to joining WisdomTree, Jeremy was Professor Jeremy Siegel’s head research assistant and helped with the research and writing of Stocks for the Long Run and The Future for Investors. He is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” Jeremy is a graduate of The Wharton School of the University of Pennsylvania and currently stays involved with Wharton by hosting the Wharton Business Radio program “Behind the Markets” on SiriusXM 111. Jeremy is also a member of the CFA Society of Philadelphia.

Jeremy Schwartz is Director of Research for WisdomTree, responsible for the WisdomTree equity index construction process and oversees research across the WisdomTree family. Prior to joining WisdomTree, Jeremy was Professor Jeremy Siegel’s head research assistant and helped with the research and writing of Stocks for the Long Run and The Future for Investors. He is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” Jeremy is a graduate of The Wharton School of the University of Pennsylvania and currently stays involved with Wharton by hosting the Wharton Business Radio program “Behind the Markets” on SiriusXM 111. Jeremy is also a member of the CFA Society of Philadelphia.

Commissions, trailing commissions, management fees and expenses all may be associated with investing in WisdomTree ETFs. Please read the relevant prospectus before investing. WisdomTree ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates. “WisdomTree” is a marketing name used by WisdomTree Investments, Inc. and its affiliates globally. WisdomTree Asset Management Canada, Inc., a wholly-owned subsidiary of WisdomTree Investments, Inc., is the manager and trustee of the WisdomTree ETFs listed for trading on the Toronto Stock Exchange.

Thanks, a great summary of the potential tax impact. If value (and occasionally price!) is determined by discounting future cash flows to the present day at an appropriate cost of capital then lower taxes should mean higher cash flows and therefore higher valuations/prices. However, you can’t look at the impact on cash flow in isolation. If investors also feel that a higher discount rate is warranted due to perceived heightened systemic risk, that would have a negative impact on valuations. A classic tug of war between numerator and denominator! This type of analysis proved historically to be a good indicator of what might happen to stock performance after cuts to personal tax rates. It will be interesting to see how this plays out. Early days!