By Dale Roberts, CuttheCrapInvesting

Special to the Financial Independence Hub

The week just completed was budget week in Canada. And government finances certainly get most of the attention and most of the ink. But there were some investment issues that made it into Budget 2019. Not the larger societal issue of Canadians paying the highest mutual fund fees in the developed world combined with the standard and unscrupulous and unethical practices of the typical financial ‘advisor’ in Canada.

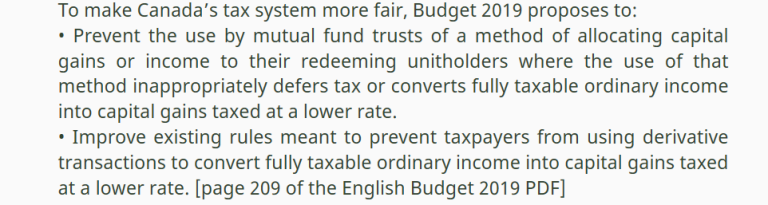

Nope, this made it into the budget. From a post on holypotato.net and John Robertson the author of The Value of Simple:

The derivative transaction mention means they will target total return ETFs such as Horizons’ TSX 60 Total Return (TRI) index ETF. Here’s the link to HXT, which replicates the TSX 60 by way of swaps. These funds are derivative based and they can be incredibly tax efficient. They remove the funds’ income. From Dan Bortolotti in this MoneySense article…

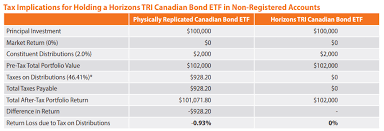

There are several advantages to building an ETF with a swap rather than holding the stocks or bonds directly. The first is tax-efficiency. The most important advantage of swap-based ETFs is their potential to defer or reduce taxes. As we’ve noted, these ETFs do not pay dividends or interest, which means you won’t be taxed on any income as long as you hold your units. All of the gains in the fund are considered capital gains, which are not taxable until you eventually sell the holding. And even then, capital gains are taxed at only half the rate of regular interest income and foreign dividends. (Canadian dividends enjoy favourable tax treatment too, but for high-income earners, capital gains are still taxed at a lower rate.)

And this ETF allows Canadians to invest at an incredibly low MER of just .03% with rebate. Horizons offers a suite of total return funds that includes US and International stock indices plus Canadian and US bonds. One could build a tax-efficient portfolio. [Editor’s Note: The chart shown at the top of the Hub version of this blog shows a Horizon bond ETF that operates along similar principles.]

Eat the rich investors

There is almost $1.9 billion in the HXT. There is well over $1.6 trillion in Canadian mutual funds. Now certainly not all of those funds are crap, but most of ’em are quite poor due to average fees in the area of 2.2% annual. Of course couch potato investors will know that passive low fee index investing drastically outperforms high fee actively managed funds over longer periods.

So instead of going after the 2.2% fee junk, they go after the .03% offering.

I’d estimate that the amount that Canadians pay and lose needlessly to high fees is in the range of $20,000,000,000 or more annually. Yes that’s $20 billion. That’s massive. It’s so massive it’s the size of our annual deficit projections. Ha. I’m not sure that picking up some tax scraps to the tune of tens of millions of dollars from swap based funds is going to close the deficit gap.

But of course this has nothing to do with tax revenue generation or fairness. And my disappointment with this measure has nothing to do with the targeting of swap based funds. Maybe it’s the right thing to do to close tax efficient investment vehicles, we can all make up our own minds on that.

I simply think it’s asinine to skip over a massive societal issue such as the squashed retirement goals and dreams of typical Canadians. We lose a massive amount of monies to high fees and unscrupulous switching behaviour where Canadians are switched from fund to fund to generate additional fees for the advisors and the mutual fund companies.

To see the effect of high fees on your investments over longer periods I’d invite you to read Larry Bates’ Beat The Bank. And on larrybates.ca you can check out how much you will lose to fees by clicking on the T-REX Score link. It’s astounding. You might hand over half of your investment wealth (needlessly) in fees over an investment lifetime.

Larry is a former banker who tells all and lays out the sad truth as to what actually happens in the investment industry. Canadians told me what ‘goes on’ when I was an advisor with Tangerine Investments. Tangerine offers a wonderful suite of lower fee index-based portfolios. In my position at Tangerine I would conduct portfolio analysis of clients’ external holdings. It was not pretty. How they were treated and the information that they were fed by their ‘advisors’ was alarming. Poor investments combined with poor advice or no advice is not a good combination.

So instead of helping Canadians retire with 30%, 40%, 50% or more, we’re going to take some small change out of the pockets of a few affluent investors.

Kill the tax efficient investment options, sure, go ahead. I’d be happy to sacrifice those for some common sense policy and regulatory moves that protect the Canadian investor.

I won’t hold my breath.

Canadians: Help yourselves … you have options

You can access the advice you need and obtain low fee investment portfolios. Have a read of my Canadian Robo Advisor reviews. You can also access a fee-for-service advisor. You can get the advice you need and pay as you go. You might self-direct and create an ETF Portfolio. You can use a One Ticket Asset Allocation Portfolio: well diversified investments with fees in the range of just .20% annual.

I discovered a long time ago that politicians and regulators do not have your back. Heck, it’s a self-regulated industry. It’s up to you to take an interest in your own financial affairs.

Questions to Dale cutthecrapinvesting@gmail.com or better yet leave a comment on this post. Maybe send this post to your MP, friends and family.

Thanks for reading. Kindly hit those share buttons for Twitter, Facebook and LinkedIn.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on March 22, 2019, and is republished on the Hub with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on March 22, 2019, and is republished on the Hub with his permission.