‘Tis the season for the annual investment outlook, with a new year and some might argue a new decade ahead of us. While some pundits hold fire on their prognostications until January, a few big-name investment firms have just come out with their 2020 prognostications.

Among the early entrants was Franklin Templeton, which provided its predictions last week in Montreal and again yesterday (Dec. 10th) in Toronto. Also yesterday, Vanguard put out a release headlined Economic and Market Outlook 2020: Lower Growth Expectations in the New Age of Uncertainty.

Franklin Templeton is a well-known manager of actively managed mutual funds, and has now been in Canada for 65 years, going back to Sir John Templeton’s famous Templeton Growth Fund. Vanguard is best known for its “passive” or indexing approach to investing, both through index mutual funds and ETFs, although it is also an active manager. But their respective outlooks for the next year and decade are not too different, with investment returns projected to stay positive, albeit with cautions to investors not to expect quite as strong returns as they have received in the last decade.

Vanguard said global growth is set to slow in 2020, driven by US and China trade concerns and continued political uncertainty leading to depressed global economic activity.

Todd Schlanger, senior investment strategist at Vanguard Canada, said: “Investors should prepare for a lower-return environment over the next decade, with periods of market volatility in the near-term. We expect uncertainty stemming from geopolitics, policymaking, and trade tensions to undermine global growth over the coming year … For Canada, the picture is slightly rosier, with a resilient labour market and robust wage growth leading to growth levels stronger than most developed economies in 2020, with a slight improvement over 2019.”

Vanguard’s main bullet points were these:

- It forecasts continued slowdown in global growth but Canada will be a bright spot among developed economies: Canadian growth is forecast at 1.6%, U.S. growth forecast at 1.0%, Eurozone, 1.0%, China at 5.8%

- Canadian equity market returns are forecast to be 3.5%-5.5%, annualized over the next ten years

- Canadian fixed income returns are likely to be 1.5%-2.5%, annualized over the next ten years.

Vanguard says global central banks have moved from expected policy tightening heading into 2019 to additional policy stimulus amid weakening growth outlooks and inflation shortfalls this year. It expects the US federal reserve to cut the federal funds rate by 25 to 20 basis points before the end of 2020. However, it expects the Bank of Canada to keep interest rates at current levels throughout 2020. While Canadian growth is stable, rising household debt levels and high exposure to global economic uncertainty “skew the balance of risks to the downside.” Schlanger advises Canadian investors to prepare for volatility over lack of trade clarity and slowing economic growth in the U.S. by maintaining diversified portfolios, keeping investment costs low and focusing on the long term while tuning out the daily noise.

Global stocks still have more performance potential than global bonds

Meanwhile, Franklin Templeton believes global stocks have “greater performance potential than global bonds, supported by continued global growth.” Over the next seven years it forecasts strong return potential for both bonds and equities in Emerging Markets. And with short-term interest rates below historical averages, “we see a lower performance potential for government bonds.”

Franklin Templeton recommends a multi-asset approach to deal with an environment of desyncronized global growth and moderate inflation worldwide.

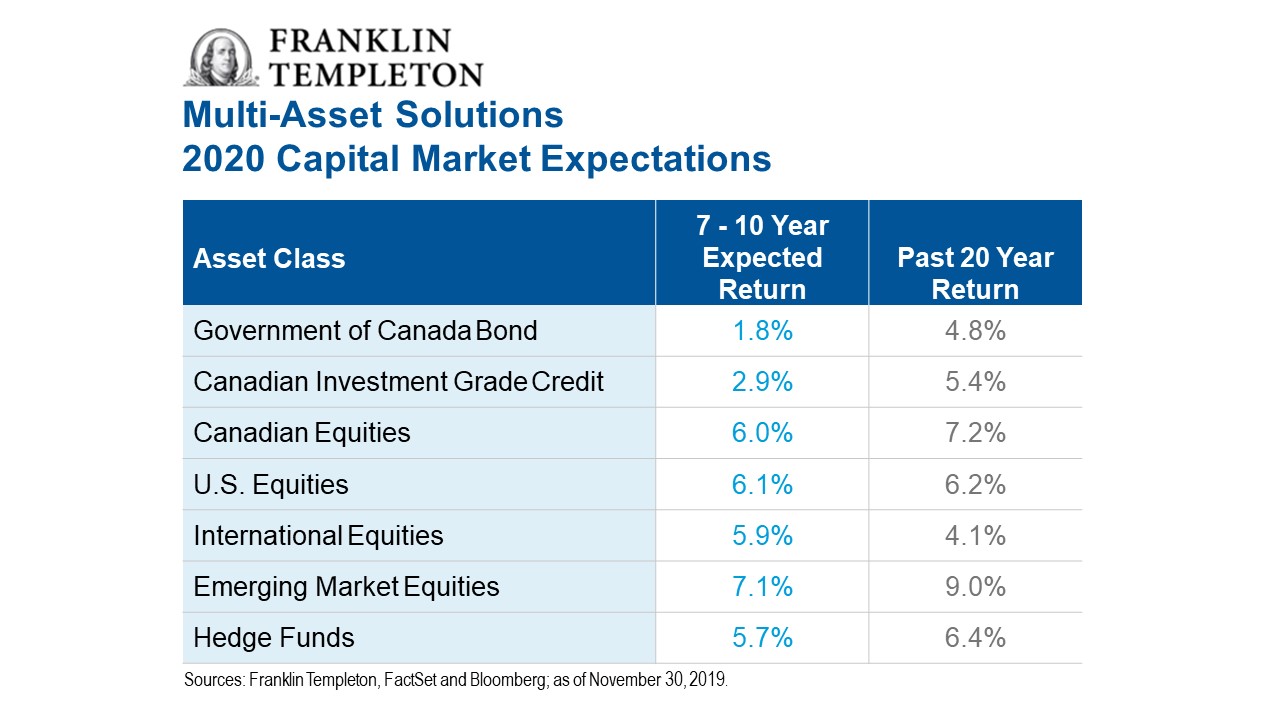

Bill Yun, executive vice president and investment strategist for Franklin Templeton Multi-Asset Solutions (pictured left) said the firm’s 7-year outlook for Canadian bonds the next 7 years is about 1.8% a year, versus 4.8% the past 20 years. Equity return expectations are all positive but reduced from the performance of the prior 20 years: 6% going forward for Canadian equities, versus a historical 7.2%; 6.1% for US equities compared to 6.2% the previous two decades; International equities are projected to return 5.9% versus an historic 4.1%; Emerging Markets 7.1 versus 9% historic, and hedge funds 5.75 compared to 6.4% in the past.

Global central banks have little ammo left

One positive for Canada is that the Bank of Canada has more room to cut rates to cope with an economic slowdown than most central banks in the rest of the world. Canada and the US both have room to cut but Europe does not, Yun said. Some rates are negative in parts of Europe.

Within Canada, Ian Riach, portfolio manager with Franklin Templeton Multi Asset Solutions, outlined certain “tactical” shifts the firm is taking in the domestic market. Generally, Riach is cautious on Canadian equities, neutral on Canadin bonds, and expects a weaker Canadian dollar. He is underweight Canadian stocks for its long term strategic asset mix and favours US stocks over Canadian stocks.

Riach said he was not sure how long the Canadian consumer can keep doing the heavy lifting on the economy: since the financial crisis American consumers have been deleveraging while Canadians have been borrowing more, which constitutes a head wind for growth of the domestic economy. He also made the usual criticism that Canada’s economy is heavily weighted to just three sectors (financial 22%, energy 13.4%, materials 5.2%) and that high consumer debt is a negative for Canadian banks. As a result, Franklin Templeton is underweight Canadian stocks and trying to reduce so-called home country bias. “We think Canadian equities are vulnerable to further disappointments and prefer to be underweight until we are more confident on the growth front.”

A ‘lower for longer’ growth environment

Canadian interest rates are higher than most countries, bucking the trend elsewhere, which is why the loonie has done well this year against the US dollar. However, “We think rates could drop across the whole curve. The risk/reward for long dated bonds is attractive.” He expects the Bank of Canada will reduce rates “some time in 2020.”

While positive on US stocks, Riach says valuations could get overextended, seeing as most of Trump’s tax cuts have worked their way through the system. Still, “we believe the US economy will continue to grow.”

In an interview, Riach projected bond returns at 2% a year and 6 to 6.5% for developed market equities and 7 to 7.5% for Emerging Market equities. That would translate into returns of 4 to 4.5% a year for a standard balanced portfolio split 60% stocks to 40% bonds.

While investors sometimes look back and throw out 10% as a typical long-term average annual return for stocks, the historic figure over the last 10 to 30 years has been closer to 8%, Riach told me. Going forward, he expects North American developed stocks to return about 6% a year: “Valuations are not extended but are a little stretched.” With interest rates so low, even if you add an equity risk premium of the historical 4% on top of 2% bond returns, “that gets you to 6% for equities in North America.” And as he said in front of the broader audience, Emerging Markets (including China) should be closer to 7%.

Asked about the record economic expansion that’s well into its 11th year, Riach said “time doesn’t kill bull markets. Economics or recession derails bull markets. We don’t see a recession in the cards but we really don’t see accelerating growth either unless we get more normal monetary stimulus and maybe some fiscal stimulus, with companies beginning to spend more. They’ve been borrowing a lot and a lot of the money central banks have been giving to the market is going into financial assets and not found its way into what I call the real economy. Consumers are highly leveraged, which is a headwind. We think we’re in a ‘lower for longer’ growth environment.”

Alternative assets

While the term multi-asset solutions appears to be just another name for the classic balanced portfolio, Franklin Templeton is also talking up the benefits of alternative asset classes. Included in its information package provided to advisors and investors was an overview of the Franklin Global Real Assets Fund. Launched in 2017, it invests in a global portfolio of private and public real assets, targeting a stable income-focused returns with a historically low correlation to the traditional asset classes of publicly traded stocks and bonds. This consists primarily of real estate and instrastructure investments, with lesser amounts of such other “real assets” as agriculture, timber and water.