By Atul Tiwari

Special to the Financial Independence Hub

New research from a colleague has me thinking about hindsight. The trouble, as the saying goes, is that hindsight is 20/20 — and you can’t benefit from it after the fact.

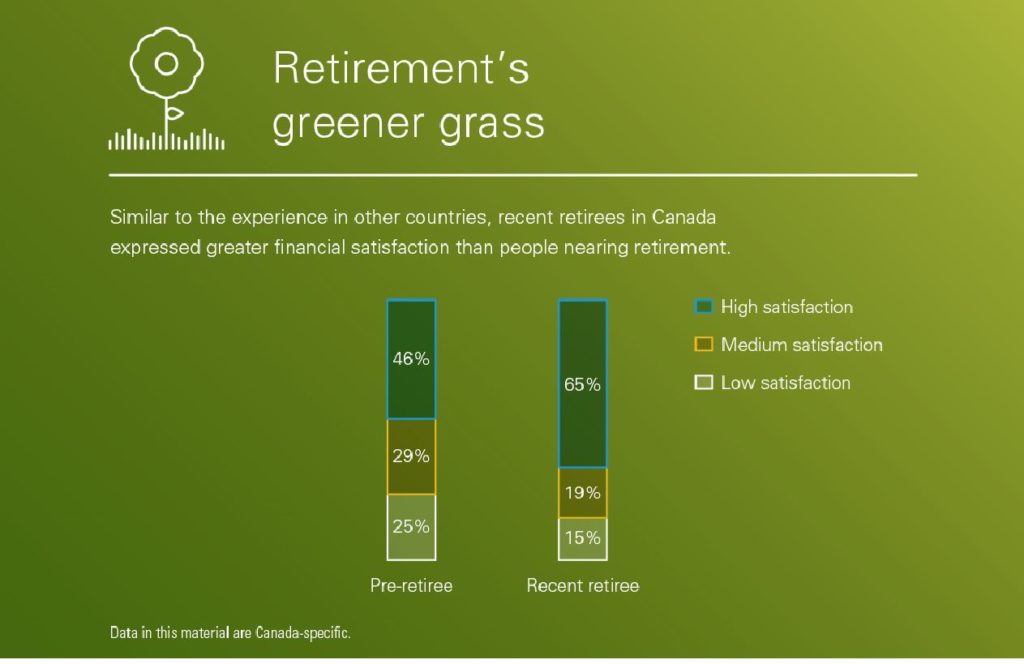

But why not try to benefit from someone else’s hindsight? My colleague Anna Madamba of the Vanguard Center for Investor Research found in a new study that recent retirees were largely satisfied with their financial situations in retirement, but, if they could, would still do some things differently in preparation.

With the benefit of retrospect, 43% of Canadian survey respondents “agreed” or “strongly agreed” that they would have saved more — a higher percentage than garnered by any other answer.

But perhaps it’s too simple to suggest that pre-retirees should just follow the example of others. Many people know at some level that they need to save more. Whether they do often comes down to two things: competing priorities and insight into how much money they’ll have (and need) in retirement.

Obstacles to saving more

The former is more challenging than the latter, owing in large part to a long-term increase in Canadian housing prices and corresponding rise in debt levels. Home-sale prices in Canada rose 14% in 2016 and 38% over the last five years, with an even larger jump in major cities such as Toronto and Vancouver. Spending on housing eats up a large part of the budget for young savers and even those closer to retirement who may be helping their children with housing expenses.

Financial advisers can help their clients keep retirement saving in the foreground. Understanding client expectations for retirement, and modelling how much retirement income is required to meet those needs, can help make what may seem like a distant event seem more “real.” It’s always easier to save for something tangible.

Clients who weren’t in position to make lump-sum RRSP contributions to reduce their 2016 tax bills may be encouraged to start reducing their 2017 tax bills now, through smaller regular contributions over the course of the year.

A powerful savings tool

But saving for retirement is multi-faceted. Investors require strong financial plans, professional advice and savings discipline. Keeping the cost of investing low is part of that discipline and allows investors to keep more of their returns for themselves. In our low-yield environment, the importance of saving and low-cost investing.

Foresight can be a powerful tool for warding off wistful hindsight.

Atul Tiwari is managing director and head of Vanguard Canada. He is also the chairman and a director of the Canadian ETF Association.

Atul Tiwari is managing director and head of Vanguard Canada. He is also the chairman and a director of the Canadian ETF Association.