By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

It’s a given that home buyers will pay a premium to live within big city limits: close proximity to work, lifestyle benefits and a comparatively healthy job market mean homes within a municipality’s core are in high demand.

While the concept of moving to further-away communities with lower real estate prices isn’t new, the suburbs near Canada’s largest cities are becoming a buying destination for home seekers at a faster pace. For example, homes within the Greater Toronto Area’s 905 region have appreciated 56.96 per cent over the past years, fueled by demand from spillover buyers from the 416.

This trend is mirrored on the west coast, where popular commuter cities Maple Ridge, Pitt Meadows and New Westminster have appreciated 6.5, 72.8 and 73.4 per cent, respectively.

Car commute costs add up

However, a long-standing argument against “driving until you qualify” is the opportunity cost of longer commutes. Those who choose to drive to an office in the downtown core need to factor in the cost of purchasing and maintaining one or more vehicles, as well as insurance, gas and parking. For this reason, neighbourhoods closest to well-serviced transit lines, such as rail, light rail or bus lines, tend to appreciate in value faster than their car-accessible-only counterparts.

“The cost of owning and operating one or more personal vehicles greatly outweighs the cost of taking transit,” states the Metro Vancouver-commissioned “Housing and Transportation Cost Burden Study”. It found the average auto-related commuter costs range from $13,500 to $17,700 annually, a “significantly higher amount than the average annual transit costs.”

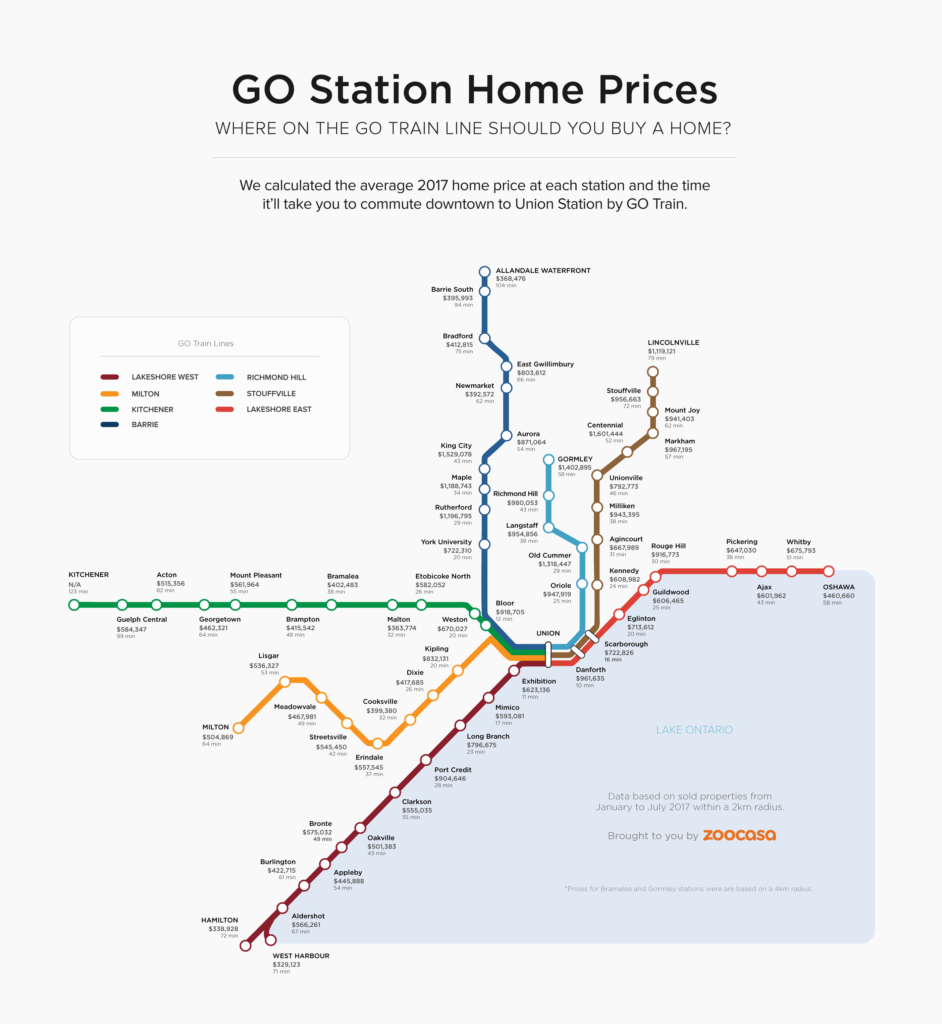

That makes a pretty strong argument for suburban buyers to stick close to local transit stations when buying. But what regions provide the greatest value vs commute cost? To find out, Zoocasa crunched average home prices and transit pass prices in Canada’s two largest housing markets: Toronto and Vancouver. (Please refer to the infographic at the top of this blog.)

Toronto commuters could save $395,667

That’s the difference between purchasing the average home in the 416 compared to one in Malton, the most affordable neighbourhood located along the GO Transit Line, which services the majority of the Greater Toronto Area with commuter trips to downtown Union Station.

And it’s no wonder buying in a 905-area suburb has growth in popularity; even traditionally lower-priced home types, such as Toronto townhouses for sale, are above the maximum mortgage qualification amount for the median household of $78,280. That would qualify for $545,692, compared to the average home price of $759,441 in the city. That’s prompted buyers to turn to real estate in Hamilton, Brampton and Niagara for improved affordability.

To illustrate how far your buying funds will go across the region, Zoocasa broke down the average home price within a two-kilometre radius on the GO Transit line:

The top three cities especially affordable within a 45-minute ride:

- Malton: $363,774 (Kitchener line)

Monthly cost to commute*: $251.90 - Cooksville: $399,380 (Milton line)

Monthly cost to commute: $220.55 - Bramalea: $402,483 (Kitchener line)

Monthly cost to commute: $277.25

*Based on the cost of a Go Transit Presto pass for 42 trips / month.

Vancouver commuters could save $285,100

That’s the difference between purchasing a home for the average price in Metro Vancouver ($1,029,700, and New Westminster, a community situated northwest between pricier Port Coquitlam and Burnaby and only a 23-minute Trans Link (Sky Train or Sea Bus) trip to downtown Vancouver.

In the west coast city, the gap between average home price and income is even wider: households earn a median of $79,930, qualifying them for a maximum mortgage of $618,790, compared to the average real estate price tag of $1,029,700. As a result, buyers are exploring other parts of the lower mainland for affordable housing options.

- New Westminster: $644,600 (Trans Link Zone 2)

Monthly cost to commute*: $126

- Pitt Meadows: $649,600 (Trans Link Zone 3)

Monthly cost to commute: $172

- Maple Ridge: $663,500 (Trans Link Zone 3)

Monthly cost to commute: $172

*Based on the cost of a monthly Trans Link Sea Bus or Sky Train pass for 42 trips / month.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.