Special to the Financial Independence Hub

We’ve all seen the headlines: “Interest rates are on the rise.” The United States has raised rates three times since December and the Bank of Canada is now on the move after seven years of silence. Here’s what you need to know and how to prepare:

How high will rates go?

Before we start worrying about how this impacts our investments, let’s first look at how high we can expect them to go.

To do this we simply need to open the history books and look at (on average) how many times the Bank of Canada has raised interest rates when entering an increasing rate cycle. They never simply raise rates once and be done with it; they typically raise in a continuous cycle over the course of several years. Here’s what I mean:

- 1999–2000: 4 rate hikes

- 2002–2003: 5 rate hikes

- 2004–2007: 10 rate hikes

- 2010: 3 rate hikes

So, on average, whenever the Bank of Canada starts a cycle of raising interest rates we can expect to see approximately 5–6 increases.

It’s safe to say we won’t get back to the days of 16% interest rates as seen in the early 90’s, but we can expect to get back to the 3%–6% range that we saw throughout the early 2000’s.

Between 1990 and 2017 Canadian interest rates have averaged 5.92%, so as we currently sit at 0.75% we have quite a way to go. Here’s what I mean. Please refer to the graph that’s at the top of this blog. As you can see we are just starting to come off the bottom: early days!

When do higher rates start to impact investments?

Just because interest rates are moving higher doesn’t necessarily mean bad news for the stock market, at least not yet.

Take the US for example. In their last four rate increase cycles they raised interest rates 10 times (on average) during each cycle. The US stock market (S&P 500) moved up an average of 23% during each of these cycles.

So, it’s not all doom and gloom, but there is a point at which we need to start getting concerned.

This tipping point typically comes once we get into the 4%–5% range. Why?Because as we near the end of a rising interest rate cycle it can start to slow down the economy in a number of different ways:

Firstly, it means higher borrowing costs for corporations and consumers, (i.e. higher mortgage rates, auto loan rates, lines of credit, etc). For corporations, this means less profit because they are spending more money on interest.

Secondly, it means more competition between bonds and equities. Right now you can get stock dividends paying a nice 4%–5%, but as bonds get up into this same range we start to see an outflow of cash from the equity markets and into the bond markets – seeing as bonds are incredibly less volatile, and if they are paying the same yield, people will naturally go with the less risky investment.

Essentially, bonds start competing with the equity markets, and with so many baby boomers retiring on fixed incomes they can’t afford the volatile swings of the stock market so they switch to bonds.

How long until we need to start worrying?

As mentioned above, markets don’t typically start to feel the impact of rising interest rates until we reach the 4%–5% range.

With Canada currently sitting at 0.75%, and the US at 1.25%, clearly, we have a long way to go and are still quite early in the cycle. So, nothing to worry about in the near-term.

However, we can likely expect to see one more rate increase this year, and a few more next year. And if we compare this with the speed at which the bank has historically raised interest rates, it’s safe to say we still have 1–2 years until we need to start worrying.

What investments benefit from rising rates?

I get this question fairly often and cover it in Building a Bullet-Proof Portfolio. The short answer is rate-reset preferred shares.

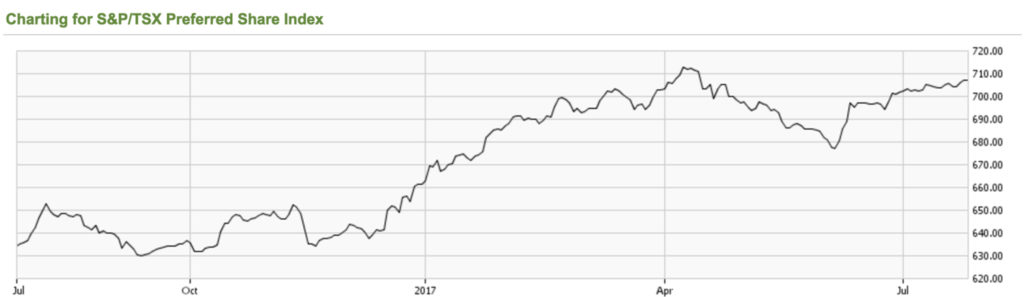

Here’s what the S&P/TSX Preferred Share Index has done over the past year:

As you can see rate-reset preferred shares are on the rise.

If you don’t currently own preferred shares in your portfolio I encourage you to consider them. In addition to a strong potential for capital gains in a rising interest environment, preferred’s pay a sweet 5% dividend – nothing better than getting paid while you wait!

How high do you think rates will go? Comment below.

Key takeaway: don’t panic. We are only at the very beginning of the rising interest rate cycle, with a long way to go. Not until we reach the 4% mark do we need to start worrying about the impact on the stock market and economy, which is still 1-2 years out.

In the meantime, there’s no need to make any drastic moves in your portfolio, but you should own preferred shares in order to benefit from rising interest rates. They also currently pay an attractive 5% dividend while you wait to cash in your capital gains

Matthew Wilson is an entrepreneur, investor, and co-founder of Calgary Beer Week. Having started his first company at age 11, he now works as an advisor to start-ups and early stage organizations, helping to build their business model, sales, and marketing strategies. He currently writes at GRGcollective.com about personal finance, entrepreneurialism, and personal development. For useful ideas on improving personal and professional performance, join his free newsletter.

Matthew Wilson is an entrepreneur, investor, and co-founder of Calgary Beer Week. Having started his first company at age 11, he now works as an advisor to start-ups and early stage organizations, helping to build their business model, sales, and marketing strategies. He currently writes at GRGcollective.com about personal finance, entrepreneurialism, and personal development. For useful ideas on improving personal and professional performance, join his free newsletter.

I sense those numbers 3% – 6% are high. I could be wrong but it seems that canada has too heavy of debt load to manage beyond 3% anytime in the near future. It’s interesting that you don’t heed the strongest indicator of future interest rates. The Current Interest Rate. Time will tell.

Thanks for your comments Phil,

Yes, with the Canadian household debt ratio now at nearly 168% the BoC no doubt has a fine balancing act to play out over the coming quarters. I would anticipate them being very gradual in their tightening process, perhaps even peaking slightly shy of the 3% level. With housing starting to pull back, coupled with higher rates, we should see consumer spending begin to cool. The recent rally in the $CAD is also going to be a strong factor in how the BoC reacts as they attempt to sustain exports. Time will certainly tell.