By Hélène Massicotte, Rockstar Finance

By Hélène Massicotte, Rockstar Finance

Mike and Jonathan walk the talk. They both have made sound financial decisions that enabled them to leave their corporate lives (either through retirement or redirection), allowing them to shift their focus toward what they wanted to do next without having to have money be the primary driver.

How can we start stacking the deck in our favor to do the same? By:

- Following the “Seven Eternal Truths of Financial Independence”

- Focusing on one important formula

- Forgetting traditional notions of retirement

#1. The “Seven Eternal Truths of Financial Independence”

When it comes to managing money, most of us want to improve our odds of success. That means ensuring we behave in a way that reduces the financial obligations that work to limit our personal and professional choices. The authors suggest the following behaviors can do a great deal to help us increase our financial flexibility:

- Live below your means

- Pay yourself first

- Get out of debt

- Buy a home and pay it off as soon as possible

- Be an owner, not a loaner

- Never say no to free money from your employer

- Take the government up on its few offers of free money

Two of these include interesting twists on the theme beyond what is usually covered in what’s considered mainstream financial advice:

#4. Buy a home and pay it off as soon as possible. This is great advice for those among us who want to own a home, but the authors take it one step further: we should look at our home as part need and part want. Need is the bare minimum of what we need in a home: shelter, basic utilities, safety, minimum square footage, proximity to other needs, etc. Want are the extras beyond what we need: extra space, extra features, better privacy, less noise, better outdoor space, better-than-needed neighborhood, etc.

Looking at housing this way can help us consider the appropriateness of the largest physical asset class we’re likely to ever own. It’s easy to justify buying too much house, thereby turning a good purchase into a bad one, and this “need vs want” can help us keep the inflation in check.

#5. Be an owner, not a loaner. This suggests that, though bonds are lower-risk investment vehicles, they won’t offer the returns that equity can, even when these are risk-adjusted. The authors suggest a diversified portfolio that includes high-quality dividend paying stocks and stress that qualifying dividend-paying stock income also offers some tax advantages over bond-related income for investments that are held in non-tax-sheltered accounts.

#2. The Freedom Formula

Mike and Jonathan managed to increase choice in their lives by focusing on one important formula:

PASSIVE INCOME > NON-DISCRETIONARY EXPENSES = FREEDOM

The authors suggest that the greater our access to passive income of all types (investment returns, pension income, social security), the more we can feel free to choose what we want to do. And the greater the freedom to choose, the greater our peace of mind and the more likely we are to speak our mind and to pay attention to what we really want in life. All great reasons to maximize these income sources.

Once you take the need for money out of the equation, work can be a wonderful source of happiness and freedom. (pg. 21)

As we can appreciate, many of the seven points highlighted in #1 support this formula by contributing to passive income and/or reducing non-discretionary expenses. And, the lower our fixed monthly expenses are, the lower our need for regular income to cover recurring obligations.

#3. Rethinking Retirement

Securing a solid financial future is only a means to an end for these gentlemen. Along with a growing pot of freedom money, the authors want us to question the relatively recent invention that is “retirement.” To them, retirement is a “life will be better when” carrot that was created to keep us focused on working and not on thinking about what we want out of life at every step along the way.

Securing a solid financial future is only a means to an end for these gentlemen. Along with a growing pot of freedom money, the authors want us to question the relatively recent invention that is “retirement.” To them, retirement is a “life will be better when” carrot that was created to keep us focused on working and not on thinking about what we want out of life at every step along the way.

Many people allow their lives simply to happen to them, focusing only on getting through the next day, week, or month. Years fly by and valuable time is wasted, until the day they eventually wake up and wish they had taken charge of their lives and set goals earlier. To avoid this from happening to you, you need to know what you want out of life, then figure out a way to get there. (pg. 122)

Mike and Jonathan stress that we need to focus on work we find interesting and fulfilling at all stages and that, as our financial footing becomes increasingly secure, we start to feel freer to trade off some earning potential for a greater sense of meaning and purpose. They also offer compelling evidence that being engaged in life (at work, in the community, with friends and family) is good for our health and promotes longevity. What justification for finding meaningful work that aligns with our values!

By focusing on what we want to do as opposed to what we need to do—thanks to good money management—we can work on various career acts, stay interested in learning and experiencing new things and stop thinking about “retiring” altogether.

Bottom Line

The Victory Lap Retirement sends us a clear message: not only does prudent personal finance management provide financial security, it is also an important ingredient in living a longer and more fulfilling life because it gives us the freedom to reinvent ourselves as many times as we like, at any age.

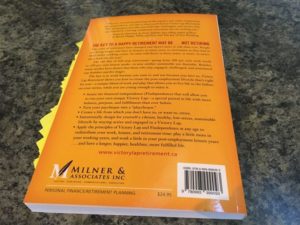

Where you can find the book: Amazon @ $14.99

Where you can find the author: Jonathan @ findependencehub.com and Mike @ victorylapretirement.com

Other suggested books of this type: “Get a Life, Not a Job” by Paula Caligiuri; “Born for This” by Chris Guillebeau; “The Joy of Not Working” & “Career Success Without a Real Job” by Ernie Zelinski, “Findependence Day” by Jonathan Chevreau (fiction)

Books on purpose and meaning: “Drive” by Daniel Pink, “Man’s Search for Meaning” by Viktor Frankl, “More Than Money“, “Why We Work” by Barry Schwartz

Book on rethinking how we work and live: “The Way We’re Working Isn’t Working” by Tony Schwartz

Bonus: A Short Interview With Mike and Jonathan

Mike and Jonathan agreed to a short Q&A. Here’s what they had to say [edited for length and clarity]:

Q1: If there was one thing you could change in how you transitioned from the daily grind to what you do today, what would it be?

Mike: I should have taken some time off (three months) before starting on the book. You need time to recharge, regroup and reflect before jumping into something new.

Jon: For me, the transition was sudden: from full 5-day-a-week employment to full self-employment, albeit with a contract with my former employer to ease the transition. Ideally, a “Victory Lap” should be planned for a year or more in advance, and you would line up one or more contracts and perhaps “gear down” with your employer to four days a week, then three days a week, while gradually adding alternative streams of income.

Q2: Writing a book is quite a process that includes lessons learned along the way. What did you learn while writing “Victory Lap Retirement”?

Mike: I found that writing was very therapeutic and soul cleansing for me. It was hard at the beginning but over time it turned into a form of active meditation which improved my overall well being. I can’t meditate in the traditional sense but writing just seems to calm me and show me the way, especially early morning writing before I have a coffee. I used to get up at 4:30 in the morning to write the book and things just seemed to flow.

Jon: I actually learned quite a bit about the “Victory Lap Retirement” concept itself even as I was writing about it. I had left full employment in May 2014 (aka my [personal] “Findependence Day”) and launched the Financial Independence Hub in November the same year (which is how Mike got in touch with me and married my ideas on “Findependence” with his post-Findependence Victory Lap lifestyle concept). So for me, and probably him, we were learning about it by doing it ourselves day by day. I suppose “Findependence Day” [book] involved a little bit of art imitating life but with VLR, the lifestyle we were entering mapped to the book-in-progress and vice versa. The book taught us as we went, and as we went and implemented the lessons, they fed back into the book: a nice virtuous cycle.

Q3: What’s your favorite book?

Mike: Anything written by Seth Godin, but his book “What To Do When It’s Your Turn” really got to me while writing VLR. I realized by gaining financial independence that it was now my turn and it did not make sense to me to waste my turn by simply retiring in the traditional sense. There is so much to do and accomplish in the years ahead.

Jon: “The Master Game” by Robert S. De Ropp. [I]t describes all the life games in a kind of hierarchy. The higher games are the Art Game, the Religion Game, the Science game. The lower games are the Moloch Game (war), Cock on Dunghill (fame), Hog in Trough (money). There’s even “no game, no aim” – the Householder Game, which is just existence. And finally, the highest meta game which is the book’s title: The Master Game, where the goal is enlightenment.

Q4: What are you excited about these days?

Mike: I’m excited about the mission I’m on: convincing financial advisors and financial planners to provide lifestyle planning assistance to their clients. Financial planning fails without lifestyle planning so they need to step up to the plate as they are in the best position to provide this assistance. I’m also excited about building the VLR community and running my weekly blog at victorylapretirement.ca. Let’s just say that I’ve created a life that I don’t have to retire from!

Jon: Getting “Victory Lap Retirement” on the road and seminar circuit, thereby bringing in enough revenue that I can cut back on the short-term writing projects; then as I add more passive sources of income to the mix (tapping more pensions etc.) writing some new books I have in mind, some extensions of VLR, some more creative works (such as a possible sequel to my financial novel, “Findependence Day“.)

Q5: If you could magically gain one new quality or ability, what would it be?

Mike: I would love to be able to dance like people on Dancing With The Stars.

Jon: I suppose greater fiction-writing talent: the ability to craft moving descriptive passages, develop fully-formed fictional characters and more facility to create and execute plots.

******

All book reviews include affiliate links to Amazon.com or other places they’re sold. Thank you to all those who support our site by going through these links!