“Retirement at sixty-five is ridiculous. When I was sixty-five I still had pimples.” — George Burns (1896–1996) Comedian, actor, singer and writer

“Retirement at sixty-five is ridiculous. When I was sixty-five I still had pimples.” — George Burns (1896–1996) Comedian, actor, singer and writer

There are three retirement accounts everyone ought to understand. They are the RRSP, the TFSA and the RRIF (Registered Retirement Income Fund). I submit that the early part of each year is preferred to review the RRSP and TFSA. That leaves the RRIF to be dealt with well before year-end.

Start paying special attention to planning the RRIF, even if you don’t yet need one.

Be very mindful of the RRIF. Recognise its purpose and how it complements the other two accounts. Review it periodically to ensure it stays on track.

The RRIF is firmly entrenched as a prominent retirement planning vehicle, serving as an essential foundation of retirement nest eggs. For example, starting a RRIF at 71 implies long planning, often to age 90 or more: especially if there is a younger spouse or common-law partner.

Three conversion choices for RRSPs

RRIFs typically result from the aftermath of mandatory RRSP conversions. Three conversion choices include cashing the RRSP, purchasing a variety of annuities and using the RRIF account. The RRIF is most popular because it provides considerable flexibility. Avoid cashing RRSPs.

RRIFs are income withdrawal plans. RRSPs are savings plans that must end the year you turn age 71. No RRIF deposits are allowed after the conversion process. That’s one very important reason to become aware of RRIF details. I summarize some ideas from my RRIF playbook.

RRIF Philosophy

My approach integrates the RRIF into the total investment and retirement plan. A diversified game plan having the appropriate asset mix and tolerance for risk is a must. Become familiar with the taxation of investment income. Some investments, like stocks and other equities, may make more sense owned outside the RRIF as the dividend tax credit is otherwise lost.

Investors should focus on sustaining retirement income streams for long time horizons: especially professionals and self-employed who don’t have employer pensions. RRIF strategies become far more important planning tools for these groups.

Investors may own more than one RRIF. However, I suggest keeping the number of RRIF accounts to an absolute minimum. Eligible RRIF investments are the same as the RRSP. Investment strategy need not change after conversions, provided it accommodates RRIF withdrawals. Investors who require income from the RRSP may be better off not converting the RRSP until age 71. RRSP withdrawals can be made as and when required until age 71. All RRSP income is taxed like salary.

Designate beneficiaries for each RRIF, such as spouse or children. RRIF accounts can be passed to the surviving spouse upon first death. Ultimately, estate values can be preserved for your beneficiaries. You want to avoid the RRIF becoming taxable income for the estate upon death of the first spouse. Three opportunities to designate or modify beneficiaries exist at the time of conversion, drafting of new wills and opening new investment accounts.

Reflect on the milestones your family nest egg needs to accomplish as you contemplate the RRIF. Then mull over these questions:

- Are you pursuing your best interest?

- Are you receiving objective and unbiased advice?

- Are you happy with your investment and retirement plan?

- Would another opinion benefit your situation?

Key Tips

Think in terms of family needs and long-run strategies. Plenty of ongoing patience is a critical ingredient. Slow and steady moves will get you there. Capital preservation becomes more valued over time. RRIFs can be spousal or regular, depending on the type of converted RRSP.

Contemplate implications of health issues, high inflation, long life, low returns and large investing losses. Each one of these spoilers can turn your well-designed pathway upside down. The impact of just one or two of them can devastate retirement.

For example, it’s easy to incur sizeable costs for a retirement facility, even for just one spouse. Paying for medicine can be very costly. Stay aware of your available options. Developing a “what if?” scenario helps quantify the possible severity on your action plan.

Understand RRIF investment risks as capital losses cannot be offset against personal gains. Receiving RRIF payments near year-end allows greater income growth inside RRIFs. If part of the RRIF payment is not required for spending, consider funding a TFSA with the excess cash.

Significant flexibility is a key advantage offered by RRIFs. Each situation can be customized every year. Investors can choose draws above the minimums, the frequency of draws and the investments; three decisions that make the RRIF very flexible.

RRIF Conversions During 2017

I suggest starting to design RRIF strategy before age 65. Converting the RRSP is mandatory for those who turn age 71 in 2017. These conversions must be finalised by December 31, 2017. All RRSP deposits must also be made by December 31, unless there is a younger spouse.

RRSP room may be lost if it is not used before conversion. The RRIF value on December 31, 2017 is used to calculate the 2018 minimum payment. RRIF payments can also be “in kind” withdrawals of specific investments. More complications may arise, so allow added time. My counsel is to skip “in-kind” transactions.

Withdrawals are not required in the year a RRIF is set up. Be aware that there are other flavours of RRIFs, such as a LIF (Life Income Fund), whose rules are similar. Income tax is not deducted when only the minimum amount is withdrawn from a RRIF. There is no maximum RRIF withdrawal unless it is locked-in, such as an LRIF.

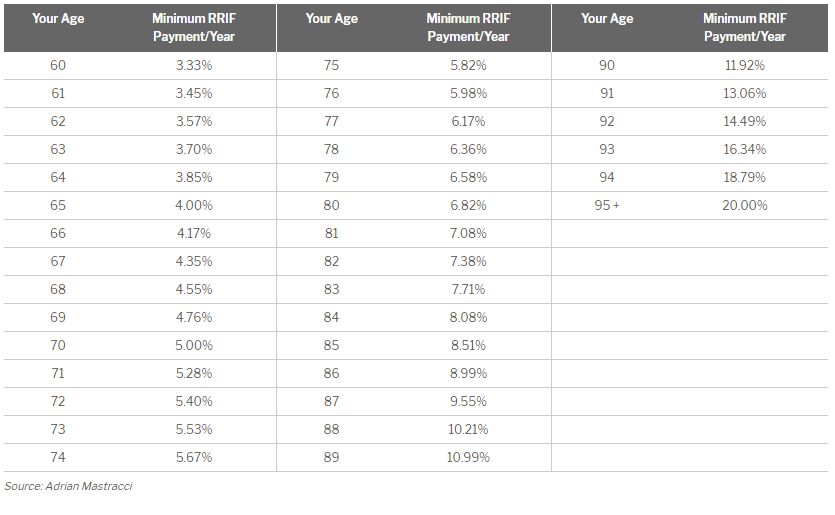

Minimum RRIF draws are governed by the schedule below. RRIF withdrawals commence in 2018 for those who convert RRSPs during 2017. An election sets minimum RRIF payments based on the age of the younger spouse. RRIF withdrawals are taxable as regular income. RRIFs can continue as long as investment values remain after withdrawals.

Voluntary RRIF withdrawals, in excess of minimums, can be made any time. However, if the RRIF resulted from the conversion of a spousal RRSP, the three-year attribution rule applies to withdrawals above the minimum. Also review whether voluntarily creating 2017 RRIF income is beneficial for those now aged 70 or younger.

Some taxpayers may want additional 2017 income, above the RRIF minimum. Payment to you must be received by December 31, for reporting in 2017. Check the applicability of pension credits and splitting provisions for each situation.

Organizing Your RRIF

Here are my summary suggestions that organise your RRIF:

- Coordinate the RRIF with your other accounts

- Focus on managing investment risks you incur

- Ensure that all beneficiaries are designated

- Resist rushing into something if you are not comfortable

- Understand investments owned and being contemplated

- Follow a logical plan designed for your objectives

Stewarding the RRIF is important for your retirement and investment planning. Paying special attention to RRIF details, vis-à-vis your goals, is a valuable exercise.

Be extra careful as you implement the RRSP conversion to the RRIF. Mind the unforgiving rules. Then revisit your RRIF strategies annually to best fit your family needs.

This project can easily benefit from a second set of eyes.

2017 Minimum RRIF Payment Schedule

The minimum payment percentage is based on the previous year-end RRIF value.

Source: Adrian Mastracci

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s new website, where it appeared on September 19th.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s new website, where it appeared on September 19th.