By Ed Rempel

Special to the Financial Independence Hub

Wouldn’t it be great if you could save a lot more for your future without affecting your day-to-day cash flow?

One of the main things people learn when they first have a retirement plan done is that you need to invest more than you thought to have the future that you want. But with all the day-to-day expenses, it can be difficult to find the money to contribute as much as you would like to your RRSP.

The RRSP gross-up strategy is a simple strategy that can make a huge difference for you. It can enable you to easily contribute 40 to 70% more to your RRSP.

The strategy works if you already expect a tax refund. If you contribute monthly to your RRSP or have various tax deductions or credits, you probably expect a tax refund.

It is smart to gross-up every RRSP contribution you make.

You have three options with your tax refund:

- Spend it.

- Invest it.

- RRSP gross-up strategy.

Here is how the RRSP gross-up strategy works. Instead of investing your tax refund when you receive it in March, you contribute a gross-up amount in February that will be refunded by your tax refund.

For example, if you have been contributing $1,000/month to your RRSP and are in a 40% tax bracket, you should already get a tax refund of about $5,000. Instead of investing the $5,000 refund when you receive it in March, you can invest $8,333 in February during RRSP season. This contribution increases your tax refund by $3,333, so you get a tax refund of $8,333 to pay for your contribution.

You can make the February contribution from cash or a credit line. You get it back a month or 2 later.

The formula is:

Expected tax refund / (1-Marginal tax rate) = Gross-up

$5,000 / (1-40%) = $8,333

With the RRSP gross-up strategy, you contribute $8,333 in February during RRSP season, instead of just your $5,000 tax refund in March. This is a 67% larger contribution.

We have just created an extra $3,333 in your RRSP and have not used any money from your day-to-day cash flow!

Benefits

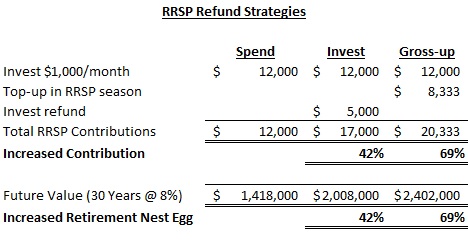

This may be a simple strategy, but the benefits are huge, especially if you do this every year. Here is a comparison of your three refund options:

Over 30 years, this one little strategy can add $1 million to your retirement nest egg compared to spending your tax refund, and $400,000 compared to investing it. That’s huge!

Your tax refund

Do you have plans for spending your tax refund? If not, then the RRSP gross-up strategy is perfect for you.

For many people, though, they want to use it for a trip, a home improvement, or to pay off a debt. The main reason they contribute to an RRSP is to get a tax refund.

Your tax refund may feel like free money, but it is not. It is a loan from the government. Remember, you have to pay the tax back when you withdraw it from your RRSP.

Most importantly, if you spend the refund, will you have enough to retire with the lifestyle you want?

People that have a retirement plan are much more likely to do an RRSP gross-up. One of the biggest benefits of having a retirement plan is that it changes your focus to thinking long term. You know how much you need to save to become financially independent, so you focus on how best to find the money to contribute.

It is much easier to use your tax refund effectively than to find an additional $8,333 ($700/month) from your monthly cash flow somehow – right?

“Never put dry pasta into your RRSP.”

Talbot Stevens advises to gross-up all your RRSP contributions in his book “The Smart Debt Coach.” He compares the smaller dry pasta to your after-tax cash and the larger cooked pasta to your before-tax dollars.

When you gross-up your contribution, you are putting your before-tax dollars into your RRSP.

“Never put dry pasta into your RRSP.” In other words, it is smart to gross-up all of your RRSP contributions every year.]

Estimating accurately

This is purely a tax strategy, so the only risk is estimating incorrectly. If you estimate a gross-up of $8,333, but then your tax refund is only $6,000, you are short the difference.

A good estimate includes looking at your total income, including taxable benefits, and all your tax deductions. Contributions to a group RRSP or pension do not give you a tax refund. Looking at the expected changes from your last year’s tax return can be very helpful.

You should also know how your income relates to the tax bracket. For example, you contribute $8,333, but only half is in the 40% tax bracket and the other half pushes you down to the 30% tax bracket. Your tax rate on the $8,333 is lower, so you should estimate a lower gross-up.

Your best estimate may be from your financial planner, if he prepares your tax returns, understands tax and knows what has changed in your life.

Summary

The RRSP gross-up strategy is a simple way to find 40% to 70% more to contribute to your RRSP without affecting your day-to-day cash flow.

With all your day-to-day expenses, it can be hard to find money to make a proper RRSP contribution. Using your tax refund in this highly effective way can give you a much more comfortable retirement.

There is a little effort involved in estimating the gross-up accurately. Your financial planner may be able to help you.

One sharp client pointed out to me that the benefit from this one strategy is more than the entire cost of a financial planner over your lifetime.

People that have a retirement plan are much more likely to do an RRSP gross-up. A retirement plan changes your focus to thinking long term. You know how much you need to save to have the life that you want, so you focus on how to find it.

“Never put dry pasta into your RRSP.” It is smart to gross-up all of your RRSP contributions every year.

The RRSP gross-up strategy can make it much easier to achieve financial independence and live the life you want.

Ed Rempel, CPA, CMA, CFP is a popular financial blogger, fee-for-service financial planner, and an expert in many advanced tax & investment strategies. He is a certified financial planner with a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans. He has been an active blogger for more than 10 years. He loves sharing his insights on his blog “Unconventional Wisdom” at https://edrempel.com/

Ed Rempel, CPA, CMA, CFP is a popular financial blogger, fee-for-service financial planner, and an expert in many advanced tax & investment strategies. He is a certified financial planner with a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans. He has been an active blogger for more than 10 years. He loves sharing his insights on his blog “Unconventional Wisdom” at https://edrempel.com/