By Ian Duncan MacDonald

Special to the Financial Independence Hub

Did you ever try to defend investing in the stock market when the risk averse shouted that no one can foretell the future and investing is just a crap shoot?

The Canadian Pension Fund’s purchase of several million more shares of Royal Caribbean Cruises Ltd in the fourth quarter of 2019 is an example of our inability to foretell the future. Due to COVID-19, Royal’s shares dropped a billion dollars in the first quarter of 2020. With assets of $420 billion, our pensions are not in jeopardy, but it may well be years (perhaps decades) before Royal Caribbean share price recovers to its former glory.

“Capital value is going to fluctuate over time,” was the pension fund’s response to the hit. They are right. As long as the pension fund does not sell these depreciated shares, they will technically never take the billion-dollar hit.

Not having to sell is the joy of investing with the public’s money. The next time you lose a few thousand on your stock pick you can tell your spouse, who is questioning your investment skills, “It’s a long-term play. At least it wasn’t a billion dollars like those professionals at the Canadian Pension Fund.”

Until COVID-19, investing in cruise lines looked like the safest of investments. Every year their boats were full of more and more baby boomers with the time and money to splurge on the non-essentials of life.

The $46 billion-dollar cruise industry is dominated by Miami based Carnival Corporation (CCL/NYSE), Royal Caribbean Cruises Ltd (RCL) and Norwegian Cruise Line Holdings (NCLH). In 2019, these three gave boat rides to 80% of the 26 million cruise passengers in the world. Between them they employed 272,000 in 200 ships. These now under utilized assets are tied up at docks with only a hope that some of them might tentatively begin cruising again August 1, 2020.

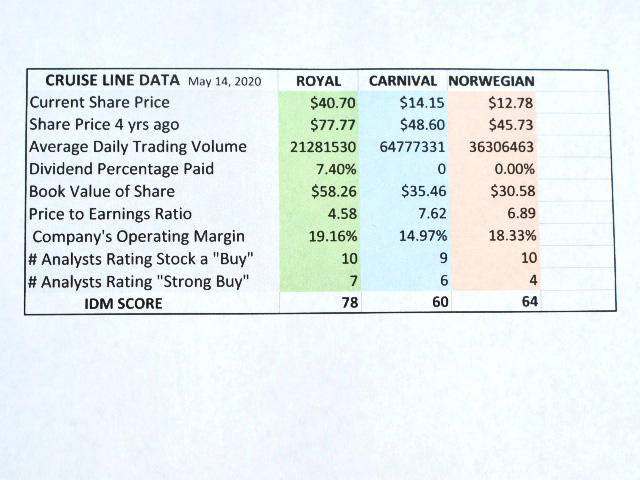

Would cruise shares make a good edition to now add to your portfolio? The following chart gives you an idea of how speculative an investment they might be:

Do you find it interesting that despite the pandemic, analysts are rating all these stocks as buys and strong buys? Based on this limited data, did the pension fund choose the best one to add to their portfolio? Interestingly Royal paid a dividend in April; this appears to be the last dividend they will be paying for the foreseeable future. The other two have not paid dividends this year.

Supply 20 times more than Demand

The book values of these three companies are well ahead of their current share price, which indicates a bargain. Admittedly, “book values” are calculated by accountants and are not the same as the “market values” that might be realized if the company’s assets were liquidated. Currently, the supply for cruise ships is probably 20 times greater than the demand.

The price to earnings ratio is low confirms that the shares are not overpriced. The operating margins for the three reflects their historical sales minus the expense to realize those sales. With little new revenue now coming in, their operating margins will probably be a minus figures when more current financial information is released.

The IDM score at the bottom of the chart is a measuring stick and summary to quickly evaluate stocks. It is based on the data currently available to the public. It does not reflect the dire straights that these businesses are now in. The scores reflect those of the profitable well-run companies that these three once were just a few months ago. Normally any score over 70 indicates a very desirable stock to own. Anything over 50 is normally a safe stock purchase. (You can learn more about the IDM score at informus.ca).

No matter how good a score it may be, an internet searches always needs to be done to determine whether recent negative information might disqualify a stock from being purchased. For example, the cash burn for Royal Caribbean Cruises is reported to be $250 million a month. They have pledged as security several of their ships to secure a 3.3 billion bond issue. Those buying the bonds are gambling that Royal’s revenues will have recovered within the next 12 months. They may be basing this optimism on the fact that 55% of the Royal Caribbean clients, who had booked cruises in 2020, are accepting vouchers for a future cruise instead of a cash refund. This willingness to forego cash may reflect the “high end” market that Royal Caribbean caters to in its brands like Silver Sea Cruises, Azamara Cruises and Celebrity Cruises.

Carnival caters to “first-time” cruisers

Carnival Corporation caters to a different market. Their focus is on “first-time” cruisers This strategy has captured 47.4% of the world’s cruise passengers in their 105 ships sailing under their brands: Carnival Cruise Line, Princess Cruise Line, Costa Cruises, AIDA Cruises, Holland America Line, P&O Cruises, Cunard Line and Seabourn Cruise Line. Their annual sales were US$21 Billion and from this they netted out 2 Billion in Net Income. This revenue represents 39.4% of the industries’ revenues. It is a high-volume operation that needs to fill 254,000 beds and requires 150,000 employees to cater to their clientele.

Royal Caribbean’s emphasis on quality captured 23% of the passengers and 20.2% of the industries revenue.

Norwegian Cruise Lines is considerably smaller but very cost efficient. With only 9.5% of the passengers they have captured 12.6% of the industries revenue.

On January 10, 2020 Royal Caribbean shares opened at $134.17 (probably helped by the massive purchase by the Canadian Pension Fund). On March 23, 2020, the shares hit their most recent low of $24.03.

On January 21st Norwegian Cruise lines shares opened at a high of $59.00 by March 19 they hit a low of $8.03.

On December 30, 2019 Carnival Corporation hit its high of $51.64 but by April 2, 2020 their price as down to $8.01.

The good news is that they have all recovered substantially from their recent lows. The bad news is that they are a long way from their highs of just a few months ago.

For every pessimistic seller, there must be an optimistic buyer. Those who bought at the recent lowest share prices have already made nice gains. Will the shares continue to climb? The optimists will say yes and buy. The pessimists will take their money and invest in companies that are not contingent on the desire of those able to spend on luxuries like cruise vacations. With unemployment expected to climb into the plus 20% range, companies providing necessities will probably seem like a safer investment than cruises. Uncertain times bring both great opportunities and great risk.

After graduating from McMaster University, with $100 left in his pocket (but no student debt), Ian Duncan MacDonald hitch hiked home to Sudbury to work four months as a labourer in International Nickel’s smelter. In four months, he had saved enough to seek his fortune in the big city.

After graduating from McMaster University, with $100 left in his pocket (but no student debt), Ian Duncan MacDonald hitch hiked home to Sudbury to work four months as a labourer in International Nickel’s smelter. In four months, he had saved enough to seek his fortune in the big city.

In Toronto, he was immediately hired by Dun & Bradstreet as a credit reporter. While he had expected to be a reporter for the rest of his life, D&B had other plans. Within four years, he was General Manager of their Marketing Services Division. Three years later, at the age of 28, he was responsible for the sales, marketing and advertising for all three divisions of the company.

At 32, he left D&B to build Screening Systems International Ltd, for a large conglomerate, which led to his interest in collections. Moving to Creditel of Canada Ltd. he became Senior Vice President. Subsequently bought by Equifax, he remained there until his retirement in 2005. In anticipation of his retirement he incorporated Informus

At 32, he left D&B to build Screening Systems International Ltd, for a large conglomerate, which led to his interest in collections. Moving to Creditel of Canada Ltd. he became Senior Vice President. Subsequently bought by Equifax, he remained there until his retirement in 2005. In anticipation of his retirement he incorporated Informus

Inc. to sell his art, his publications and consulting services (www.informus.ca.)

His book “Income and Wealth from Self-Directed Investing” provides a detailed system, plus stock scoring software, which arms someone who has never invested with the knowledge they need to successfully and safely generate income and wealth for the rest of their lives.

Disagree with your point that Carnival Corp focuses on “first time” cruisers and other lines don’t. RCL targets the first time cruiser with their Oasis class ships.

Princess, Holland American, Cunard and Seabourn have incredibly loyal passengers and very strong loyalty programs. Azamara, Celebrity and Royal Caribbean are strong brands with good loyalty programs.

All cruise lines have found their easiest sell is to previous passengers.

I doubt RCL can maintain their dividend due to debt levels and empty ships generating no cash flow.

RCL debt $11.8B with 92x debt to equity. CCL $14.4B but 59x debt to equity and NCLH $8.8B with 202x debt to equity. NCLH is most likely to go bankrupt imo.

Sold my CCL shares (held for shareholders onboard benefits) to realize capital loss but will likely buy back.

bon voyage!