Special to the Financial Independence Hub

2019 TFSA limits will likely see an increase to $6,000 for 2019, up $500 from $5,500 in 2018. But is taking advantage of the TFSA the right choice for you?

The big story

Most Canadians still don’t understand the TFSA or know if it’s the right type of account for them. More room is great but according to the CRA in 2015, only 10% of Canadians are currently maximizing their TFSA limits1. Also, the CRA has looked to collect over $75 million in past audit penalties over improper use of the TFSA2.

The history

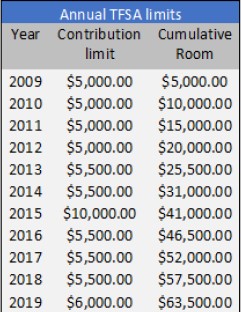

Starting in January 2019, annual TFSA room of $6,000 will be provided to each Canadian resident over the age of 18. Since 2009, Canadian residents have been able to contribute a small portion of their after-tax savings into this tax-free account. If you still are paying taxes on interest, dividends or capital gains on your investments in a non-registered account, it’s time to review the TFSA. If no contributions had been previously made, your TFSA room accumulates over time and a full $63,500 contribution could be made January 1, 2019.

The contribution you make today can grow without any tax implications in the future. If you over contribute, the CRA will penalize you 1% per month on any amount over the approved threshold. A best practice is to check first with the CRA to determine your personal TFSA limit for the calendar year.

The contribution you make today can grow without any tax implications in the future. If you over contribute, the CRA will penalize you 1% per month on any amount over the approved threshold. A best practice is to check first with the CRA to determine your personal TFSA limit for the calendar year.

Improper use

If you accidently, or purposefully, over-contribute to your TFSA, the CRA will impose a 1% per month penalty on the overage. This may be overstating the obvious, but over-contributing is a bad idea. You would have to reasonably expect your investments to grow higher than 12%/year (assuming simple math with a January 1stcontribution) to break even. Having TFSAs at two or more institutions may be a way you lose track of your contribution room. Ensure you check with the CRA to understand your annual TFSA contribution limit.

Another example of improper use could be frequently trading stocks within the TFSA, aka ‘day trading.’This may be considered a ‘business activity,’ as perceived by the CRA and you could be taxed personally on all the income, dividends and capital gains.

Spousal successor

An important but often overlooked benefit to utilizing a TFSA is as an estate planning feature: the spousal successor declaration. This allows you to designate your spouse to become the ‘owner’ of your TFSA should you pass away. This is a better option in most cases than simply adding your spouse as a beneficiary, where they would just receive a tax-free payment that may or may not be exempt from tax in the future.

A prudent investment strategy

As a Canadian individual, you can hold almost any investment that is Canadian- or US-domiciled. The ideal strategy tends to target growth for the future, as this will provide the biggest long-term benefit. Based on the historical risk vs. reward characteristics of equity vs. other investment options, a stock-based portfolio inside the TFSA would give the greatest opportunity for your long-term growth. Your entire situation, risk tolerance, and investment experience needs to be fully analyzed and understood before any recommendations are made.

The TFSA can also be used to build up a source of tax-free income in retirement. This could be a huge advantage for anyone who otherwise relies on taxable income from pensions, government benefits and RRSP/LIRA (RIF/LIF) withdrawals. Withdrawing from a TFSA to top up your annual income instead of a RIF/LIF in a specific year may also help in avoiding the OAS clawback.

If you are a small business, entrepreneur or are incorporated, you’ll need extra guidance to ensure the TFSA fits in correctly with your overall plan.

Tie it together

The contribution limit is likely going up but is this the right type of account for you and if so are you using it correctly? While the TFSA isn’t the most important part of your investment plan, it can be an important complimentary piece to your retirement puzzle. This is for you to explore with our help as we can lay out all the options for your specific goal and we can fully understand your personal and financial situation before contributing to ensure it lines up with your investment, tax and retirement plan.

Sources

- CTV Staff, July 2017, “CRA looks to collect $75M over improperly used TFSAs”, sourced from: https://www.ctvnews.ca/business/cra-looks-to-collect-75m-over-improperly-used-tfsas-1.3489026

- Dale Jackson, December 2017, Globe and Mail, “Ten Years on, the TFSA’s success could lead to its demise”, sourced from: https://www.theglobeandmail.com/globe-investor/globe-advisor/ten-years-on-the-tfsas-success-could-lead-to-its-demise/article37383270/

David Miller, BFS, CFP®, R.F.P., CIM®, is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. Along with an honors degree from Mount Royal University’s Bachelor of Financial Services Applied program in 2005, David is a Certified Financial Planner® Professional (2007), Chartered Investment Manager® (2014) and Registered Financial Planner (2017). David has been providing advice to high net worth and affluent individuals and families for over 10 years. He left a major bank in 2016 to help fulfill his drive to provide client centered advice. David prides himself on providing Canadians with the ability to make informed financial decisions with increased financial literacy and support.

David Miller, BFS, CFP®, R.F.P., CIM®, is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. Along with an honors degree from Mount Royal University’s Bachelor of Financial Services Applied program in 2005, David is a Certified Financial Planner® Professional (2007), Chartered Investment Manager® (2014) and Registered Financial Planner (2017). David has been providing advice to high net worth and affluent individuals and families for over 10 years. He left a major bank in 2016 to help fulfill his drive to provide client centered advice. David prides himself on providing Canadians with the ability to make informed financial decisions with increased financial literacy and support.

Disclaimer This post should not be construed or interpreted to be investment advice or direct financial planning advice.Any data, information and content on this blog is for information purposes only and should not be construed as an offer of advisory services. Related information is presented ‘as is’ and does not make any express or implied warranties, representations or endorsements whatsoever with regard to any products or service. It is solely your responsibility to evaluate the accuracy, completeness and usefulness of all opinions and information provided. This post does not warrant and makes no representations about the accuracy, reliability, completeness or timeliness of the content, be error-free or that defects in the information will be corrected. The law is constantly changing, and your situation should always be consulted with the proper professional. All links and images have been cited and are owned by those individuals under their individual sites.