By Graham Bodel, Chalten Advisors

Special to the Financial Independence Hub

There are many pitfalls that can trip up Canadian investors as they try to save and invest sensibly for the long run. High and/or hidden fees, poor diversification, inappropriate investments for a given risk tolerance, under-utilization of tax efficient accounts are a few we see regular, but the one that might just have the largest negative impact is behavioural.

You see, when it comes to investing unfortunately people are psychologically hardwired to do the opposite of what’s good for them. In an October 2008 op-ed piece in the New York Times Warren Buffett advised investors to:

“be fearful when others are greedy, and be greedy when others are fearful.”

Words of wisdom but easier said than done, especially in the grips of the financial crisis.

Investors hurt by emotions

But it doesn’t take a financial crisis to spur fits of fear and greed — in fact, investors are prone to these emotions a lot of the time and it hurts them. The data shows that individual investors who often use mutual funds as their investment vehicle of choice, perform much worse than the funds in which they invest.

This is because they invest more of their money during times of euphoria when markets are at their peak or when certain funds are performing well and they sell more of their investments during market bottoms at times of panic or when certain funds are performing poorly. (You’re supposed to buy low and sell high, not the opposite). Investors get caught in a performance chasing struggle driven by fear of either missing out or losing their shirt.

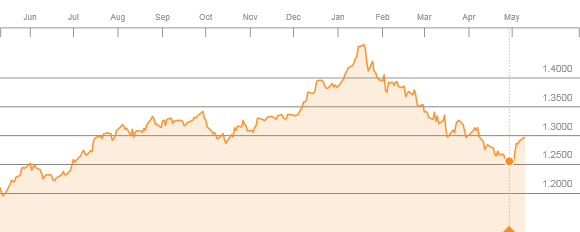

One of the biggest drivers of this psychological roller coaster for Canadians in the last couple of years has been the Canadian dollar. The following chart from Bloomberg Markets shows the USD/CAD over the last year:

The loonie hits its weakest point in mid-January which was actually the end of a long decline from the last point where the CAD was at par with the USD back in January of 2013. Canadian investors tend to be too overweight Canadian stocks and bonds and this hurt through mid-January. Having exposure to investments denominated in currencies other than Canadian dollars provided a return booster during that period. Unfortunately this is where the poor behaviour kicks into high gear. In December of 2015 investors piled out of Canadian equity and bond funds an into US and global funds. According the Financial Post in January at the very trough of the loonie:

The loonie hits its weakest point in mid-January which was actually the end of a long decline from the last point where the CAD was at par with the USD back in January of 2013. Canadian investors tend to be too overweight Canadian stocks and bonds and this hurt through mid-January. Having exposure to investments denominated in currencies other than Canadian dollars provided a return booster during that period. Unfortunately this is where the poor behaviour kicks into high gear. In December of 2015 investors piled out of Canadian equity and bond funds an into US and global funds. According the Financial Post in January at the very trough of the loonie:

“of the five best selling fund types in December, four were global or US focused. Of the five worst, four were Canadian, reflecting the continued flight from our slumping equity markets and devaluing loonie.”

Timing couldn’t be worse

The timing couldn’t have been worse! The turnaround since then has been steep, at least until the beginning of May this year when the trend seemed to reverse again. You can understand how investors and their advisors can become really frustrated. Performance chasing can be a killer in these circumstances. Rob Carrick chronicled this really well in his Sunday Globe & Mail article “How the rising loonie is costing Canadian investors” capturing the sentiment as follows:

“They made a lot of money when the dollar was falling, but this year’s reversal has cost them. They’re annoyed about this turn of events and wondering who to blame. God help us when the housing market falls. People are going to self-combust.”

The reality unfortunately for many investors is that they didn’t make a lot of money when the dollar was falling because they waited to invest in foreign markets when the dollar had already fallen and are now being punished for chasing performance.

The evidence shows clearly that trying to time the market is extremely difficult and that is especially true of currency markets. Carrick suggests some investors may want to hedge foreign currency exposure to mute this type of volatility. Whether you hedge or keep currency as a source of risk and return in your portfolio, the most important thing is to just set a target allocation to domestic and foreign stocks and bonds that suits your risk profile and trade only when things drift out of balance. That will force you to buy low and sell high and that is good investing behaviour.

Graham Bodel is the founder and director of a new fee-only financial planning and portfolio management firm based in Vancouver, BC., Chalten Fee-Only Advisors Ltd. This blog is republished with permission: the original can be found on Bodel’s blog here.