Investors could have done a lot worse over the past 30 years than investing in the Mawer Balanced Fund. Mawer, which epitomizes the art of boring investing, has been nothing short of consistently brilliant: with annual returns of 8.5 per cent since the fund’s inception in 1988.

Investors could have done a lot worse over the past 30 years than investing in the Mawer Balanced Fund. Mawer, which epitomizes the art of boring investing, has been nothing short of consistently brilliant: with annual returns of 8.5 per cent since the fund’s inception in 1988.

Investment giant Vanguard doesn’t have the same longevity or track record here in Canada, but its launch of the Vanguard Balanced ETF portfolio (VBAL) gives investors another one-stop investing option.

This post will go under the hood and compare VBAL to the Mawer Balanced Fund for investors looking for a one-stop investing solution for the next two to three decades.

About Vanguard

Vanguard is legendary in the United States and is largely credited for pioneering low-cost index investing. It came to Canada in December, 2011 and now offers nearly 40 ETFs and four mutual funds to Canadian investors with a total of $17 billion in assets under management (Dec 2018).

VBAL was introduced by Vanguard Canada in January, 2018 as part of a new suite of asset allocation ETFs (including VGRO and later VEQT). These funds have proven popular among Canadian investors and have collectively gathered more than $1 billion in assets.

Before their introduction, investors did not have access to a one-stop ETF solution. Instead, they’d have to build multi-ETF portfolios to get exposure to Canadian, U.S., and International equities, plus another ETF or two for fixed income.

Vanguard turned that around with what I’ve called a game-changing investing solution. VBAL represents the classic 60/40 portfolio.

Vanguard Balanced ETF (VBAL)

VBAL is a fund of funds. That means its underlying holdings are made up of other Vanguard funds. So rather than seeing a bunch of individual stocks and bonds in VBAL’s holdings, you’ll instead see these seven products:

- Vanguard US Total Market Index ETF

- Vanguard Canadian Aggregate Bond Index ETF

- Vanguard FTSE Canada All Cap Index ETF

- Vanguard FTSE Developed All Cap ex North America Index ETF

- Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- Vanguard US Aggregate Bond Index ETF CAD-hedged

- Vanguard FTSE Emerging Markets All Cap Index ETF

The fund’s mandate is to maintain a long-term strategic asset allocation of equity (approximately 60%) and fixed income (approximately 40%) securities. It’s as diversified, globally, as you can get: with a whopping 12,318 stocks and 15,412 bonds wrapped up inside this one-stop balanced ETF.

VBAL has net assets of $675 million (June 30, 2019). Its distribution or dividend yield is 2.58 per cent (dividends paid quarterly). Its management expense ratio or MER is 0.25 per cent.

Investors can purchase VBAL through a discount brokerage account and it is an eligible investment inside an RRSP, RRIF, RESP, TFSA, DPSP, RDSP, or non-registered account.

VBAL’s performance data only goes back to its inception date of January 24, 2018. It has returned 4.05 per cent annualized since that time, and 10.44 per cent year-to-date (July 30, 2019).

Justin Bender, a portfolio manager at PWL Capital, has simulated the returns as if the fund did exist for the past 20 years and found the following annualized returns (as of June 30, 2019):

- 1-year return – 5.09%

- 3-year return – 7.22%

- 5-year return – 6.62%

- 10-year return – 7.95%

- 20-year return – 5.34%

You can read more about VBAL and its fact sheet and prospectus here.

About Mawer

If Vanguard is legendary for pioneering low cost investing, Mawer has achieved cult-like status among active investors for an incredible track record of outperforming its benchmarks. Mawer was founded in 1974. It’s a privately owned, independent investment firm, managing over $55 billion in assets. Mawer has locations in Toronto, Calgary, and Singapore.

While its philosophy is ‘be boring,’ Mawer’s performance is anything but. Of its 13 mutual funds, eight have beaten their benchmark index since inception: including the Mawer Balanced Fund, which trounced its benchmark over the last decade (9.9 per cent to 7.8 per cent).

Mawer gets its results from being different than the index: yes, this is not your average Canadian closet indexing fund. Its Canadian equity fund has just 41 holdings, compared to 239 in the benchmark S&P/TSX Composite Index. Mawer’s U.S. equity fund has 61 holdings and matches up well against the vaunted S&P 500.

Mawer discusses its boring investing approach in the Art of Boring podcast.

Mawer Balanced Fund

Mawer’s Balanced Fund (MAW104) is also a fund-of-funds. Its underlying holdings are made up of:

- Mawer Canadian Bond Fund Series O

- Mawer US Equity Fund Series O

- Mawer International Equity Fund Series O

- Mawer Canadian Equity Fund Series O

- Mawer Global Small Cap Fund Series O

- Cash & Cash Equivalents

- Mawer New Canada Fund Series O

- Mawer Global Bond Fund Series O

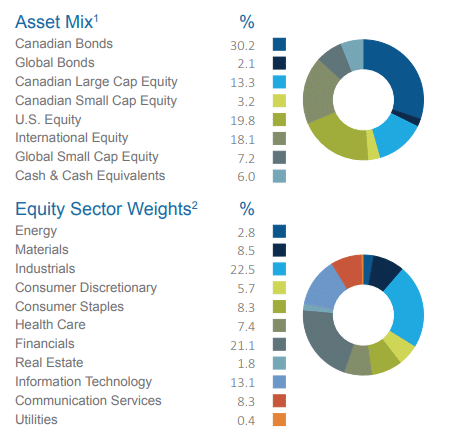

An actively managed product, the Mawer Balanced Fund invests in Canadian, US, and International equity securities, plus Canadian government and corporate bonds primarily through funds managed by Mawer.

The fund’s manager aims to buy companies at a discount to intrinsic value to construct the equity portion of the portfolio, while focusing on sector allocation, security selection, and trading strategies on the fixed income side.

The Mawer Balanced Fund has net assets of $4 billion (June 30, 2019). Its management expense ratio or MER is a reasonable 0.91 per cent.

Investors can purchase Mawer Mutual Funds through most major online discount brokerages, with the exception of RBC Direct Investing. A minimum initial purchase of $5,000 per fund, per account is required. Once the initial minimum is met, there are no minimum requirements for additional investments.

As mentioned, Mawer’s Balanced Fund has returned 8.5 per cent a year since inception in 1988. It has returned 10.4 per cent year-to-date (June 30, 2019). The fund’s longer term performance is as follows:

- 1-year return – 7.0%

- 3-year return – 7.4%

- 5-year return – 7.8%

- 10-year return – 9.9%

You can read more about the Mawer Balanced Fund through its fund profile here.

Final thoughts

Mutual funds get a bad reputation from investor advocates like me, but to be fair they should not all be painted with the same criminally expensive brush. Mawer’s performance track record speaks for itself, and I think that’s a mark of being different than the index, AND keeping costs reasonable (under 1 per cent).

True, investors in Mawer’s Balanced Fund have done extraordinary well for the past three decades. I’d argue, though, how much of that is skill and how much is attributable to other factors? We also don’t know what the returns of the next three decades will be. Fund managers at Mawer will retire or move on, and replacements might not deliver the same outcomes. Then there’s the reversion to the mean: a fund that’s outperformed for so long might find itself under performing for the next decade or more as their strategy falls out of favour.

Enter Vanguard’s VBAL: the one-stop investing solution for the next thirty years. Sure, it doesn’t have the same track record and historical performance of the Mawer fund. But VBAL is built on low cost, globally diversified principles that don’t need “conviction” and “skill” to succeed. All it needs to do is capture the market’s returns over an investor’s lifetime.

Where would you rather park your retirement savings for the next 20-30 years?

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on August 13, 2019 and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on August 13, 2019 and is republished here with his permission.

The simple answer here is that Mawer wins but Robb Engen can’t let that be the case because he’s based his blog and his financial business on selling the ‘fact’ that ETFs are the best solution for all investors. A Robb Engen column will never ever say that a mutual fund is better than an ETF so this is an artificial comparison and thus his conclusion, that casts aspersions on the Mawer fund, is based on pure conjecture. What if Mawer has done ‘extraordinarily well’ not by skill but through some other dark, mysterious means. Perhaps he means luck? If someone is extraordinarily lucky for thirty years I’d say there’s some real skill involved. Oh, but we don’t know what the returns of the next three decades will be. Duh, no, only the psychics among us know anything about the next three decades, including the returns of the world’s indexes. Contrary to his implication, it’s possible that all indexes will go through their historic gyrations and end up exactly where they are today in October of 2049 – and that they will underperform the Mawer Balanced Fund. To imply otherwise is unfair and probably untrue since Engen’s crystal ball is no clearer than anyone else’s.

Easy there Sir Milton, why the negative tone? The research shows it’s very difficult for active management to outperform their benchmark especially over the long-term, but there are exceptions.

Cheer up

Hi Robb,

Another excellent article from you. I held my kids resp in maw104 for years, and recently switched over to vgro.

Cheers,

Sam

Why not both? Hold some in actively managed Mawer to protect yourself in a recession, and some in VBAL for the low fees in case everything ends up good.