By Jonathan Chevreau

Financial Independence Hub

On Wednesday, the Financial Post ran an online column of mine it titled Life After Retirement: Your Working Career Probably Isn’t Over Yet — Welcome to the Encore Act.

Regular Hub readers will know that if I had my druthers, the headline would read more like “Why Work won’t end after your Findependence Day.” (that is, the day you achieve Financial Independence).

I don’t view the terms Retirement and Financial Independence as interchangeable. By definition, Retirement (or at any rate, traditional full-stop Retirement funded with a generous Defined Benefit pension) means no longer working for money. Financial Independence (aka Findependence), on the other hand, can occur years and even decades before traditional Retirement and so seldom means the end of productive work.

This very web site — which just passed six months in existence — is dedicated to clarifying this distinction. And of course the site also constitutes a big element of my own personal Encore Act: next Tuesday will be the one-year anniversary of my own Findependence Day. In my case, I define that as no longer working as an employee of a giant corporation or government entity, and having the financial resources to work if I choose to, and not if I don’t.

How to find your Encore Career

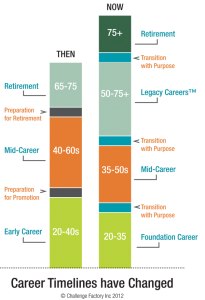

As it happens, I do so choose to stay engaged, a philosophy that’s hardly unique to this site. Sheryl Smolkin’s Retirement Redux site takes a very similar view, which is why our two sites frequently exchange content. A good example is Sheryl’s piece How to find your encore career, which we later ran here on the Hub. The illustration used in both pieces, and reproduced above, was created in 2012 by Lisa Taylor and her Challenge Factory Inc. It sparked a fair bit of social media commentary on both sides of the border. We plan to have a guest blog by Lisa some time in the near future.

The new stage of our much longer lives

If you just glanced at the above image originally, look again. Pay attention to the bar on the right and the piece labelled Legacy Careers, which runs from age 50 to 75+. Notice the life span is much longer under this scenario and much of this huge chunk of extra time is being spent in a new phase of productive work. Breakthroughs in Life Expectancy means these Encore careers may run much longer we initially expect.

I will be talking about these themes in an upcoming keynote address for the National Elder Planning Conference in Niagara Falls on June 15th, entitled How Longevity Changes Everything. Details of the conference here. The thrust of my talk is something that Change Rangers’ Mark Venning has often championed, as the Hub noted in this piece: Plan for Longevity, not Retirement.

Findependent banker launches encore career

A regular new blogger at the Hub is Michael Drak, a long-time banker who has also reached his Findependence Day and is well on his way to launching his own Encore Act as an author and speaker. An early fan of this site and frequent commenter, he’s totally on side with the terms Financial Independence and Findependence, as you can see in his debut post that ran earlier this week, titled One Thing I Wish My Father Had Taught Me.

In our conversations with Michael, I’ve often observed that you may end up “busier than you’d like” in post-Findependence Encore Careers. Certainly, I’ve been busier than ever since Findependence arrived. Technically, I’m a pensioner: after I turned 62 this April, I began to collect the Defined Benefit pension I built during my 19 years as a full-time employee of the National Post/Financial Post. I did so because there was no actuarial advantage to delaying the pension any longer, as there is with CPP or OAS, which I am not yet tapping.

But I’m hardly “retired.” For all intents and purposes, I’m working similar hours as when I was employed, albeit without sick days or paid vacations. But I believe that as long as I take care of myself on the diet and exercise fronts, that I still have a decade or two ahead of me of productive work.

Banks see opportunity with Decumulating Seniors

Another site that explores these themes is Lee Anne Davies’ Agenomics site. Lee Anne was quoted in Thursday’s Financial Post in an article about BMO Private Banking’s new “Continuity” program for wealthy Canadian seniors. See BMO targets high-net-worth seniors in new Wealth Management program.

In the article, Lee Anne observes that “Banks have viewed aging clients as those who have declining profitability. As individuals draw down their assets to live in retirement, they no longer fit the business model of many institutions that want to see asset growth.”

Decumulation Institute

That may be true to a degree but as we have observed in the Decumulation section here, financial services companies are starting to see real opportunity in the drawdown phase of life. Earlier this year we focused on John Por and his Decumulation Institute in a piece entitled The Decumulation Dilemma of Defined Contribution pensions. Last Friday was the the third meeting of prominent actuaries Por gathers together roughly each quarter, and the Hub will report on the proceedings next week.

Finally, in my monthly online ETF column for the FP, we looked at The lowdown on ‘smart’ investment funds, so-called strategic indexing ETFs or “Smart Beta” ETFs based on factor indexes.

Observant regular readers may notice this edition of the weekly wrap is a day earlier than usual: normally, we publish it Saturday morning. We’ll be running an interesting aspirational piece tomorrow instead to provide a nice meaty read for the long Victoria Day weekend. Enjoy!

I view Findependence as a second chance to work at something I love vs working just for the money. Health is the wild card here and replacing bad habits with healthy ones is the way to go to increase the odds for a long and happy encore.