By Marie Engen, Boomer & Echo

Special to the Financial Independence Hub

You’ve been saving all your working life and now that you have entered your retirement phase, it’s time to start drawing from your savings. In some circumstances there will be people who will be able to live off their dividends and interest alone. Most retirees, however, will have to start spending the money they have saved.

Once you have decided on the amount of income you need annually for your retirement lifestyle and determined how much of it will come from your guaranteed pensions, the remainder must be withdrawn from your nest egg.

You may have multiple accounts and both registered and unregistered savings. Your investments could be stocks and bonds, ETFs and/or mutual funds. You might be in a position where you must withdraw a minimum amount from your RRIFs.

This example will show you how you can manage your retirement withdrawals, taking the total of all your accounts as a whole. It assumes dividends and interest will be reinvested, but you can use them as part of your yearly cash allotment if you so choose. You just have to adjust as necessary.

A model for retirement withdrawals

Meet newly retired Rodney and Pamela O’Brien. They have a retirement nest egg totalling $500,000. They have carefully worked out a budget taking into account their desired spending and the regular income they will receive. They have determined that they will require an extra $20,000 throughout the year, which will come from their savings.

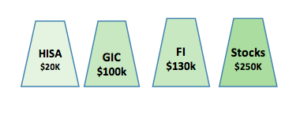

The asset allocation the couple is comfortable with is a 50-50 split between cash/income and stocks. They made some adjustments to their portfolio in order to have $20,000 in a High Interest Savings Account, and structured a 5-year GIC ladder to pay out each year thereafter. Their remaining funds are in bond index mutual funds, Canadian dividend stocks and a Global Equity ETF.

Here is their portfolio at the beginning of Retirement Year #1 ($500,000):

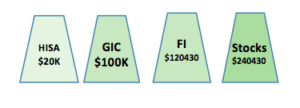

At the beginning of the second year, the couple replenishes the HISA from the first maturing GIC. They now have to rebalance their portfolio. They find that their fixed income has increased to $142,610 and stocks have declined to $238,250. They sell $20,000 worth of fixed income to buy a 5-year GIC and another $2,180 to add to their stocks to maintain their original allocation.

At the beginning of the second year, the couple replenishes the HISA from the first maturing GIC. They now have to rebalance their portfolio. They find that their fixed income has increased to $142,610 and stocks have declined to $238,250. They sell $20,000 worth of fixed income to buy a 5-year GIC and another $2,180 to add to their stocks to maintain their original allocation.

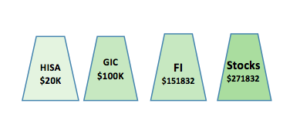

As sometimes happens, the past year was a great one for investment returns. The fixed income increased to $124,765 and the stocks increased to $269,281. This year the O’Brien’s rebalance by selling their stocks – $20,000 buys another GIC, and $8,725 goes towards their fixed income investments. The HISA is replenished with the next maturing GIC.

As sometimes happens, the past year was a great one for investment returns. The fixed income increased to $124,765 and the stocks increased to $269,281. This year the O’Brien’s rebalance by selling their stocks – $20,000 buys another GIC, and $8,725 goes towards their fixed income investments. The HISA is replenished with the next maturing GIC.

Again, stocks had a great year and the couple’s stock investments surged to $318,166. Fixed income, however, dropped to $125,498 due to an interest rate increase. They sell some stocks for their new GIC and an additional $26,336 to top up their fixed income.

Again, stocks had a great year and the couple’s stock investments surged to $318,166. Fixed income, however, dropped to $125,498 due to an interest rate increase. They sell some stocks for their new GIC and an additional $26,336 to top up their fixed income.

In the past year stocks took a beating and the O’Brien’s equities dropped to $190,282. However, fixed income was up a bit to $160,282. They can rebalance as shown below, but they also have the option of not replenishing their GIC ladder this year, and even the following year, in hopes that the stock market recovers.

In the past year stocks took a beating and the O’Brien’s equities dropped to $190,282. However, fixed income was up a bit to $160,282. They can rebalance as shown below, but they also have the option of not replenishing their GIC ladder this year, and even the following year, in hopes that the stock market recovers.

The O’Brien’s will continue in this manner each year, adjusting their portfolio as necessary to maintain their asset allocation.

The GICs give them to have a good cash cushion that they can draw on in the event of a prolonged drop in the market so they don’t have to withdraw investments at a loss.

This is a simplified example, but it gives you an idea of how you can manage your retirement withdrawals.

If you are at, or close to, this stage I highly recommend you read Daryl Diamond’s Your Retirement Income Blueprint – now in its second edition – which provides detailed strategies to draw down retirement funds and help you to manage your retirement income.

Marie Engen is the “Boomer” half of Boomer & Echo. In addition to being co-author of the website, Marie is a fee-only financial planner based in Kelowna, B.C. This article originally ran at the Boomer & Echo site on April 21, 2016 and is republished here with permission.