By Jim McKinley

Special to the Financial Independence Hub

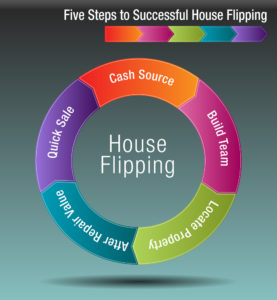

If you’ve been looking forward to trying something new in retirement, flipping houses might be the ticket. If you want to be a successful house flipper, follow these steps from Financial Independence Hub to get your business off on the right foot.

1.) Figure out Funding

Funding for house flipping generally comes from two places: investors or hard money loans. Each way has its benefits and drawbacks.

Investors can be a great option because you are bringing someone into the business who wants it to succeed. The money investors give you can also be used more freely than funds from a loan. Auctions, for instance, are an excellent place to pick up homes for cheap, but they often require cash. Most loans won’t cover auction purchases, so investors are an excellent way to open up the world of foreclosed auction homes for you.

The downside to investors is that because they also have an investment in the business, you might have less freedom than you would if you were on your own. Their opinions become as weighty as yours, and you may have to bend to their will when your opinions differ on what to do because they have the money.

Hard money loans are another option for business financing. Instead of basing their approval on you, lenders consider the potential value of the house after repair, called the ARV. If approved, they’ll give you not just the purchase money for the house but what you’ll need to flip it, too, and if the loan goes south, they can get their money back by selling the property. The main drawback to these loans is steep interest.

2.) Know what to look for

The ideal house for flipping is located in an up-and-coming neighborhood, meaning young families and professionals are looking to buy there. It’s located on a good street with low crime and is near nice schools.

According to HGTV, the best houses have areas that can be improved immensely simply by painting. They have solid builds with an attractive layout and unique pieces that give them character. Although it can be tempting to choose homes that could use extreme renovations, those kinds of fixes can take significant time. It’s important to remember that every month you spend working on the house is time that you’re losing money through your loan or paying bills to keep the house up and running. Continue Reading…