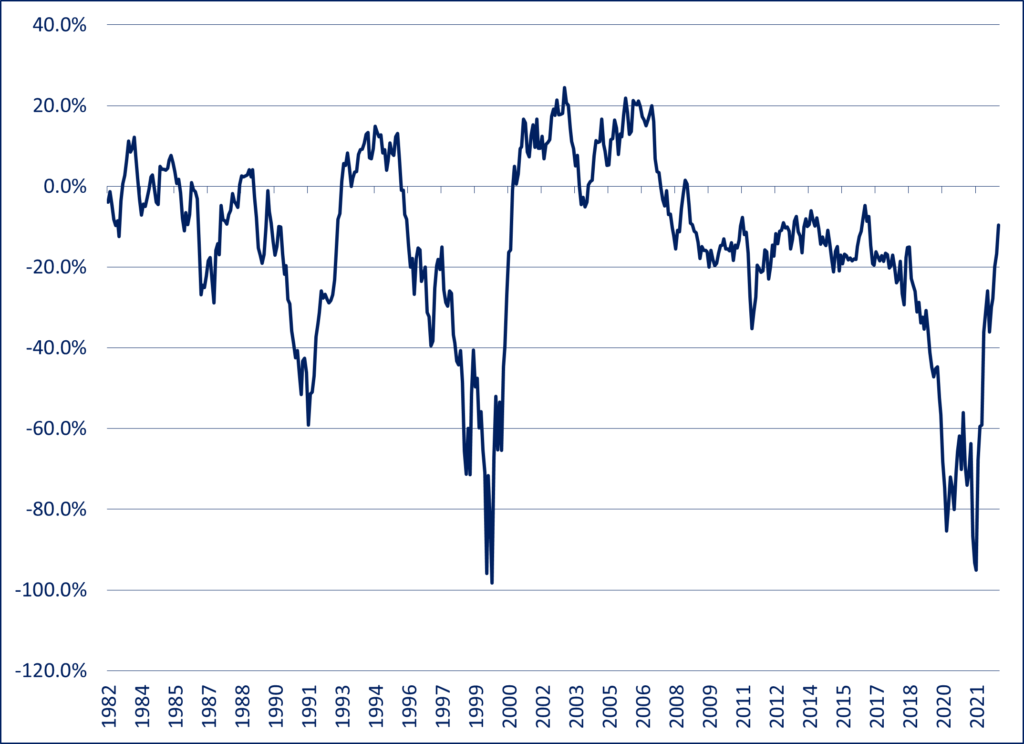

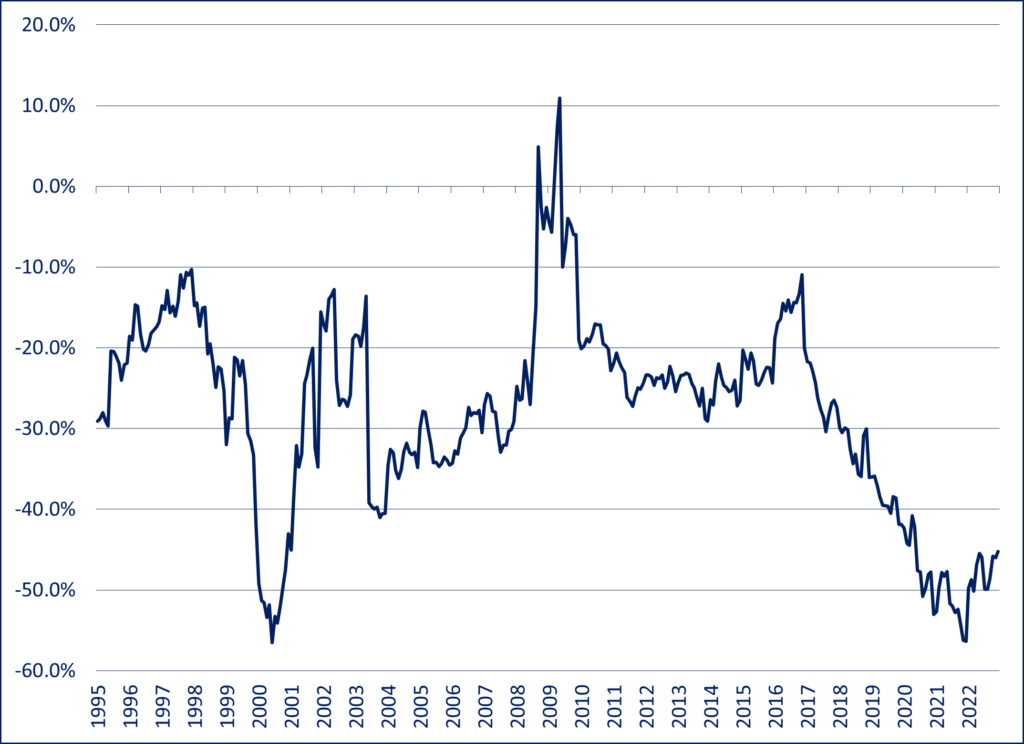

Are you a patient investor? Or are you looking at your portfolio multiple times a day, having the itch to sell everything? Despite having done DIY investing for over a decade and making my shares of investment mistakes in the past, I am still learning about investing on a daily basis.

One key lesson I’ve learned is short-termism will hurt your investment. As investors, we need to have patience and a long term view.

What is short-termism?

Per Wikipedia, short-termism is giving priority to immediate profit, quickly executed projects and short-term results, over long term results and far-seeing action.

On the surface, it seems that short-termism is associated with investment strategies like day trading, momentum trading, short selling, and options trading. However, I believe many investors that invest in individual dividend stocks and passive index ETFs often fall into the short-termism trap as well.

How so?

On one hand, it’s about short-term profit taking. On the other hand, it’s about paying too much attention to the short-term share price movement and feeling the need to tweak your investment portfolio. Some common portfolio management questions I’ve seen on Facebook and Twitter are:

“Should I take profits when the stock goes up and re-invest the money later? Give me a reason why I shouldn’t sell and should just hold?”

“I purchased Royal Bank at $110. It’s frustrating seeing the share price going up to $150 and then dropping back down to $125. Should I sell when the stock is at a 52-week high and buy back when the stock price dips?”

“I have a small paper loss on Brookfield Asset Management, I don’t think the company is doing well, should I sell and invest the money elsewhere?”

“I bought some Apple shares recently. Apple had a terrible quarter and I’m down. I’m convinced that Apple is going to crash and burn. Should I sell and run now?”

And the questions go on and on…

Why do we fall into the short-termism trap?

There are many reasons why we fall into the short-termism trap. Some of the common reasons I believe are:

- The need to be correct – we as investors want to see our investments increase in value once we make the purchase. When this happens, it means we’re right and made the correct investment decision. If the share price goes down, that must mean we are wrong and are terrible at investing. The need to be correct becomes a burning desire. Nobody wants to be told that they are wrong and be the laughingstock.

- The need to be validated – we all have the need to be validated by others but for some reason, this need is even stronger when it comes to investing. We want others to validate that we made the right investment decision so we can feel good inside. The desire to be validated can be like drugs, once someone validates you, you begin to want even more. The need to be validated is a very slippery slope…

- Looking for gains right away – It’s exciting to see investment gains. It is even more exuberating to see significant gains in a few days. It’s like going to the casino and winning 1000 times on your bet or winning the lottery. Why wait for five years to see multi-bagger gains when you can get the same type of gains in a week? Long-term investing is for losers!

- Ego – for some reason we all believe we are better investors than who we truly are. Believe me, I fall into this trap from time to time. Deep inside, we believe that we can predict how companies will do in the future accurately by looking at past performance and public information.

How to escape the short-termism trap?

So how do we escape the short-termism trap? I think the best method is to understand your short-term, medium-term, and long-term goals. Are you investing for the short-term or are you investing for the long-term? Knowing this will dictate what kind of investments you should buy. Continue Reading…