By Mark Seed

Special to the Financial Independence Hub

You’ve worked your entire life. You put some money away; invested, watched that money now and then over time.

Yet instead of living it up for everything you’ve worked so hard for you’re counting coins to make ends meet.

I don’t want this to happen to me. I don’t want it to happen to you either.

Inspired by an article I read some time ago, why retirement might not work out for you, I’m going to go on the offensive: here are 10 ways I plan to get retirement ready.

Retirees or prospective retirees please chime in!

1.) I will favour stocks over bonds

Most retirees are worried about out-living their savings. With inflation as a massive wildcard in our collective financial future, this fear is not unwarranted.

One way to combat inflation is to own more stocks (for growth) than bonds (for income security when equities tank) in retirement. You could argue that a 70/30 stock to bond split might be a good starting point to enter retirement with.

I own 100% equities in our portfolio now. We have that bias to equities because I consider my future defined benefit pension plan “a big bond.” Eventual Canada Pension Plan (CPP) and Old Age Security (OAS) payments in our 60s will also be part of our fixed-income component.

Got a pension plan? Lucky you. Consider that a big bond.

Here are the facts about taking OAS you need to know.

While it might be scary (for some) to watch the volatility of your stock portfolio go up and down like a yo-yo short-term, owning a nice blend of stocks and bonds should help you combat inflation rather well.

What % of stocks and bonds and cash do retirees out there use today?

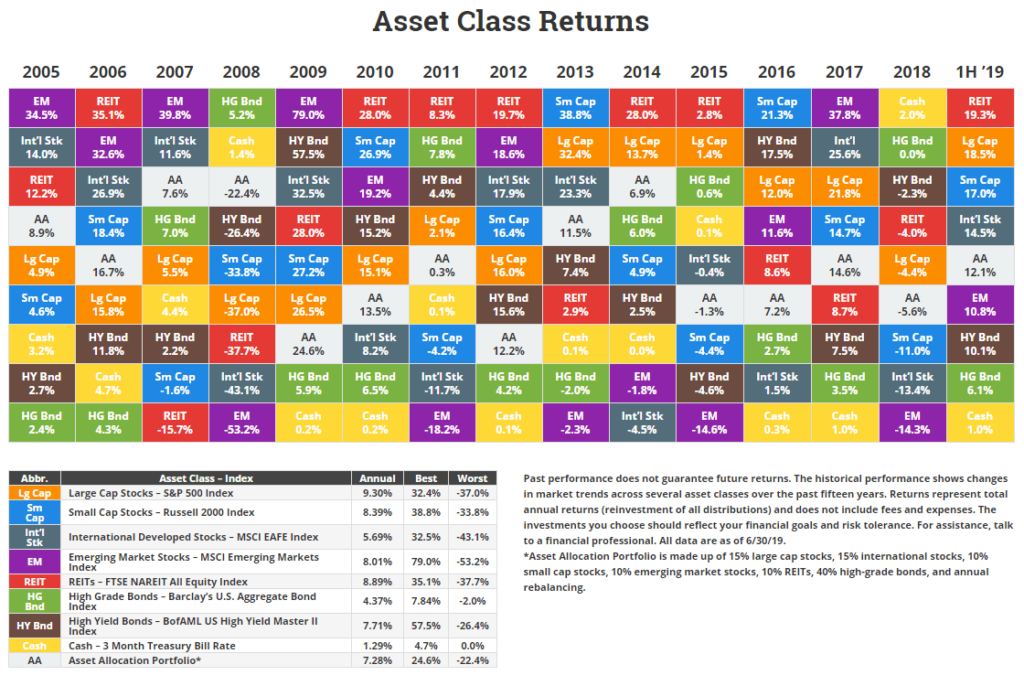

2.) I will embrace diversification

Diversification is important when it comes to investing because by doing so, you can enhance returns while reducing the portfolio risk long-term. A pretty great deal.

For most of us, diversification means an appropriate mix of stocks and bonds, a blend of small-cap, medium-cap, and large-cap stocks; owning various sectors of the economy; owning stocks from countries or investing in economies from around the world.

It can also mean owning assets that are not always correlated to common stocks, like real estate investment trusts (REITs).

Source: NovelInvestor.com

While diversification will never guarantee you big profits, it will help you eliminate the risk of investment losses given that not all assets move in the same direction at the same time.

When it comes to getting ready for my semi-retirement, I may consider owning some low-cost, all-in-one asset allocation Exchange Traded Funds (ETFs) to increase the diversification across my portfolio while simplifying my investing approach for my senior years.

These are some of the best all-in-one ETFs to own.

3.) I will consider a die-broke plan

My parents are very fortunate to have defined benefit pension plans and have a bit of RRSP/RRIF money to draw down in the coming few years. I’ll be working on their strategy this year.

They also own most (not quite all) of their home.

With good planning and careful spending in their 70s, they will definitely have enough money to live comfortably for a few more decades: thanks to their workplace pensions and government benefits.

However, they are not planning to leave any inheritance: and that’s more than OK with the kids (!).

They have a die-broke or at least a near die-broke plan to around age 95

I think this makes great sense. Working backwards (from age 95), you can calculate a more measured approach to spending money now while earmarking some funds to fight any longevity risk.

At the end of the day, as our lawyer said recently to us when we closed on our condo purchase: “it’s only money.”

Figure out your estate plan and work backwards. I suspect in doing so that will help your retirement preparedness.

Do retirees reading this site have a die-broke plan or an estate plan?

4.) I will track my spending (in more detail)

Ideally, all any retiree would need to know is: is enough money coming in to cover what expenses are going out?

Consider the following as part of your back-of-the-napkin calculations:

- Do you have a rolling monthly credit card balance? If so, you’re spending too much.

- Do you have a growing line of credit balance? If so, you’re spending too much.

- Are you able to keep a cash wedge or an emergency fund topped up with cash? If not, you’re spending too much.

To get to retirement in the first place, you probably needed a budget. There is no reason why you shouldn’t keep one throughout retirement.

I plan to up my game in the coming years, to keep a more detailed tracking log of our spending as we enter semi-retirement. This will allow me to better forecast any travel expenses we intend to incur.

For now though, I believe this is a better way to budget.

How do you budget?

5.) I will rely on multiple income streams

Canada Pension Plan (CPP) and Old Age Security (OAS) won’t be enough for us. It might not be enough for you.

While a base-level of income security will be provided from both government programs, for most adults who have worked and lived in Canada for many decades, the sum of this income probably won’t be enough to cover all housing, food, transportation and health-related expenses.

By relying on multiple income streams, beyond government benefits, this will increase your chances to meet retirement income needs and wants.

Here are our projected income needs and wants in retirement. Do you know yours?

6.) I will disaster-proof part of my life

Insurance, I believe in it’s truest form, is about risk management.

For what you cannot afford to lose, and for what you cannot afford to insure yourself, you buy insurance coverage for. In doing so, you are transferring the financial risk away from you to someone else.

In a larger context, you should always insure against a catastrophic financial loss: things you absolutely cannot afford to replace.

For now, that means life insurance is a must in our working years as is some disability insurance coverage.

Here is a previous post about life insurance 101 and what types you might want to consider.

After work is done, or near done, we will re-assess our insurance needs. We may self-insure to some degree but we may also have some group health benefits to pay for in semi-retirement.

Here is what to consider when your workplace benefits are disappearing.

Through some means of self-insurance, we will keep our insurance premiums modest while self-insuring the small stuff.

7.) I will mind my health (I should be doing more of this now …)

It’s no secret our health will deteriorate as we get older.

It’s also no secret that health care is very expensive and getting more expensive all the time.

As I get older, now into my mid-40s, I certainly appreciate all the elements that work together for general wellness.

I’m taking some incremental steps now to be more balanced and holistic when it comes to my health so I have the potential to enjoy many retirement years down the road.

Good health is the ultimate form of wealth.

I have no doubt almost any retiree would agree with me.

8.) I will be tax efficient to the extent possible

Fans of this site will know to date I take a “hybrid” approach to investing:

- Approach #1: we own a number of Canadian dividend-paying stocks for income and growth. We own nearly 30 different Canadian stocks within our non-registered account and across our Tax Free Savings Accounts (TFSAs). We own these stocks because we believe buying and holding our DIY bundle of Canadian dividend-paying stocks will, over time, provide some nice passive income.

You can find more details about how I built my own Canadian dividend stock portfolio here.

- Approach #2: we’re owning more units of low-cost U.S. Exchange Traded Funds (ETFs) inside our RRSPs over time. While dividends from dividend paying stocks are great, we believe this is smart because we’re investing abroad beyond Canada’s borders. In doing so, we’ll add growth and diversification to our portfolio. While we still own some Canadian stocks and some U.S. stocks inside our RRSPs, (names like AT&T, Verizon, Procter & Gamble, and Johnson & Johnson to name a few) but we’re buying more U.S. ETF units every quarter going-forward.

With this approach, I believe we’re rather tax efficient.

You can read about tax efficient investing and what to put where here.

Retirees, what accounts do you remain invested in and what stocks, ETFs, GICs, bonds, or cash do you hold there? Why?

9.) I will (eventually) stay out of debt

I recently had a post about debt management on this site: since I believe you need to manage debt before it manages you.

We have aspirations to semi-retire and work on our own terms in our 50s after all debts are paid off. That means no mortgage, no line of credit, no car payments going-forward. Zilch owed to others.

We believe this is the right path to take since it will increase our financial flexibility.

I know other readers of this site feel differently.

What’s your take on that?

10.) I will avoid financial piranhas (as best I can)

Financial criminals are everywhere, and it’s only getting worse with our digital age.

Here is how and why to ditch your expensive funds from your portfolio.

Sadly, retirees are particularly vulnerable to scams. Criminals target seniors because of their presumed wealth, relatively trusting nature and typical unwillingness to report these crimes.

Arm your financial self and be on continual surveillance.

I wrote about some ways to fight financial fraud here.

Summary

It’s impossible to be perfect but I continue to believe when it comes to financial success, you don’t need to be perfect. You simply need to do some little things consistently well over time. That means:

- Get invested and stay invested.

- When invested, keep your money management costs as low as possible.

- While you are investing, pay down debt until it’s gone.

- Disaster-proof your life.

- Manage your investing behaviour gaps

These are the things we’ll continue to do to get retirement ready. What about you?

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on August 27, 2019 and is republished on the Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on August 27, 2019 and is republished on the Hub with his permission.