By Kylie Ann Martin

Special to Financial Independence Hub

The dream of retiring early is no longer a niche pursuit reserved for the ultra-wealthy. Thanks to the Financial Independence, Retire Early (FIRE) movement, thousands of professionals are restructuring their lives to exit the traditional workforce decades ahead of schedule.However, many aspiring retirees focus exclusively on their “magic number” — the total net worth required to stop working.

While having a significant nest egg is crucial, the true engine of a sustainable early retirement is not the size of the pile, but the efficiency of the flow.

Early retirees must plan for 40 to 60 years of living expenses, navigating market swings, inflation, and longevity risk. A smart strategy for tracking, adjusting, and optimizing income and withdrawals is what keeps your portfolio lasting — and your freedom intact — long after you leave the traditional workforce.

The Shift from Accumulation to Distribution

For the majority of an individual’s career, the focus is on Accumulation. You earn a salary, minimize expenses, and invest the surplus into growth-oriented assets. The upward trajectory of your net worth measures success.

The moment you retire early, the game changes entirely. You move into the Distribution phase, where the primary objective is no longer growth at all costs, but the consistent generation of liquidity to fund your lifestyle.

The challenge of early retirement is that your assets must serve two masters: they must provide enough cash for today’s bills while continuing to grow enough to outpace inflation for the next half-century. This transition requires a psychological and mechanical shift.

You are no longer “saving” for the future; you are managing a private endowment where the “yield” must be carefully harvested without killing the “golden goose.” Learning how to balance your inflows and outflows effectively is the first step in making this mental leap from a steady paycheque to self-funded sustainability.

Managing the Sequence-of-Returns Risk

One of the most significant threats to early retirement is “Sequence of Returns risk,”which is the danger that the stock market will experience a major downturn in the first few years of your retirement.

If you are forced to sell stocks to pay for living expenses when the market is down 20%, you are effectively locking in those losses and depleting your principal at an accelerated rate.

Effective cash flow management mitigates this risk by ensuring you never have to sell equities during a bear market. You can achieve it through a “bucket strategy” or a cash buffer. Many financial experts suggest streamlining your liquid assets by keeping two to three years’ worth of living expenses in low-volatility accounts.

When the market is up, you replenish the cash bucket from your gains; when it is down, you live off the cash and give your portfolio time to recover.

Strategies to Make your Money Last

To thrive over a 40-year retirement horizon, you need a dynamic withdrawal strategy. Rigidly adhering to a “4% rule” may not be enough if inflation spikes or market conditions remain stagnant for a decade.

A proactive approach to spending in retirement involves creating “guardrails”—predefined rules that dictate when you should belt-tighten and when you can afford a luxury purchase.

Dynamic spending adjustments

Instead of withdrawing a fixed amount adjusted for inflation, dynamic spending allows you to reduce your “paycheck” during market dips. This preservation of capital during downturns is one of the most effective ways to extend the life of a portfolio.

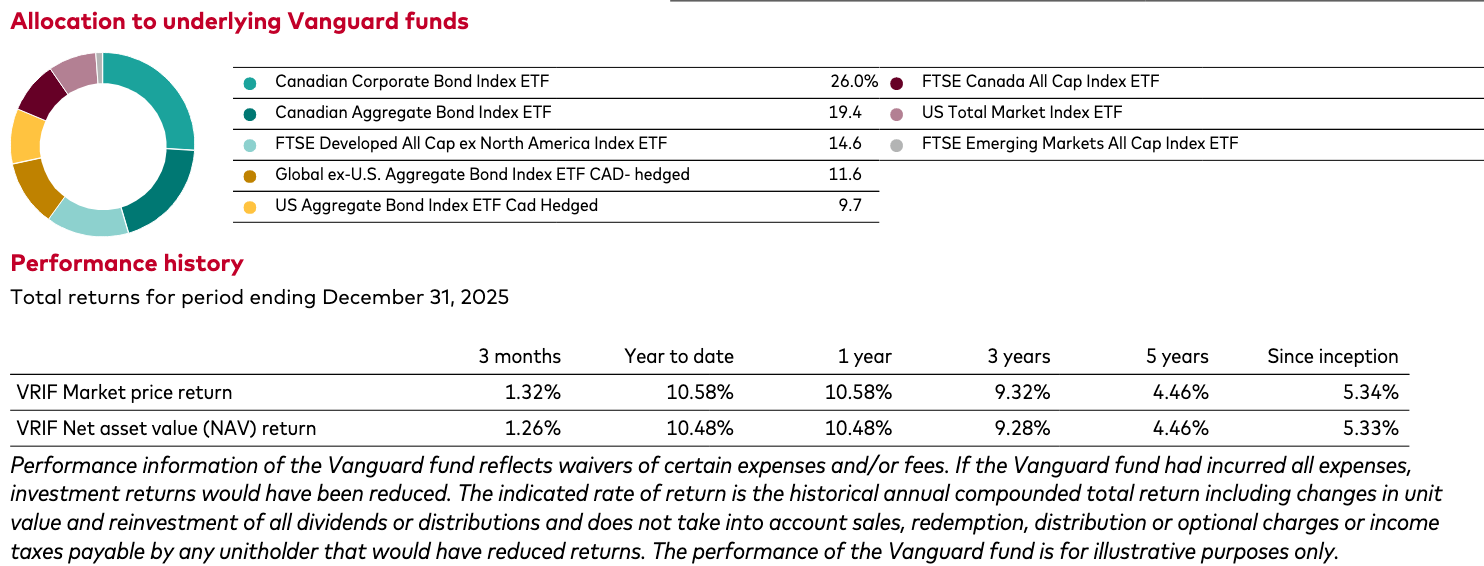

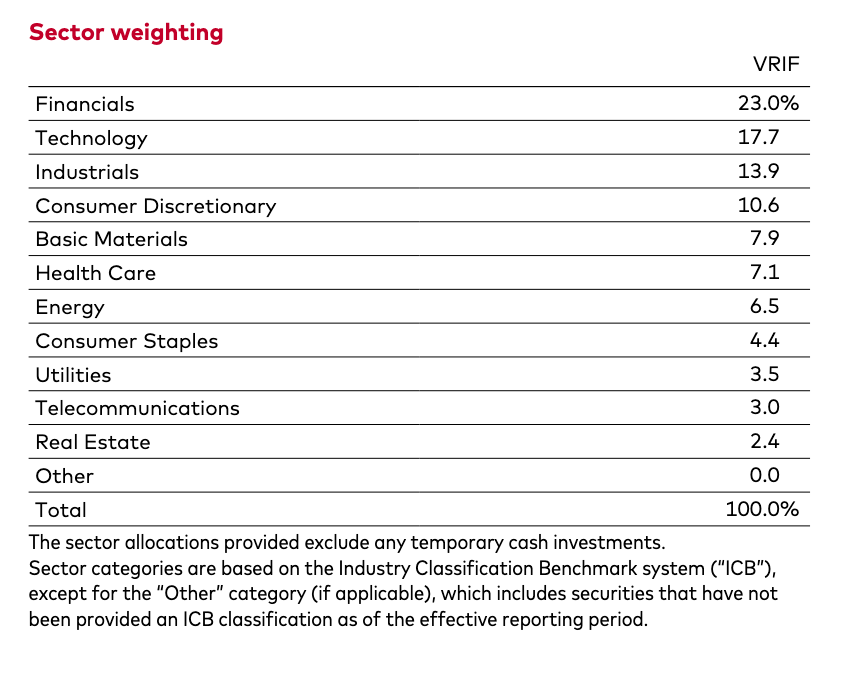

The role of yield-producing assets

Diversifying into assets that provide natural income — such as real estate or dividend-paying stocks — helps bridge the gap between your needs and your portfolio’s growth. This reduces the friction of selling assets and provides a more predictable monthly floor for your budget. Continue Reading…