By Erin Allen, Vice President, Direct Distribution, BMO ETFs

(Sponsor Blog)

As of May 31, 2024, the U.S. stock market accounts for approximately 70% of the MSCI World Index1, making it a significant component of global equity markets: and likely a substantial portion of your investment portfolio as well.

While Canadian investors often favour domestic stocks for tax efficiency and lower currency risk2, incorporating U.S. stocks can enhance exposure to sectors where the Canadian market — predominated by financials and energy — falls short, particularly in technology and healthcare.

For Canadian investors looking to tap into the U.S. market affordably and without the hassle of currency conversion, there are numerous ETF options available. Here are four strategic ways to build a U.S. stock portfolio using BMO ETFs, catering to different investment objectives.

Low-cost broad exposure

If your objective is to gain exposure to a broad swath of U.S. stocks that reflect the overall market composition, the S&P 500 index is your quintessential tool.

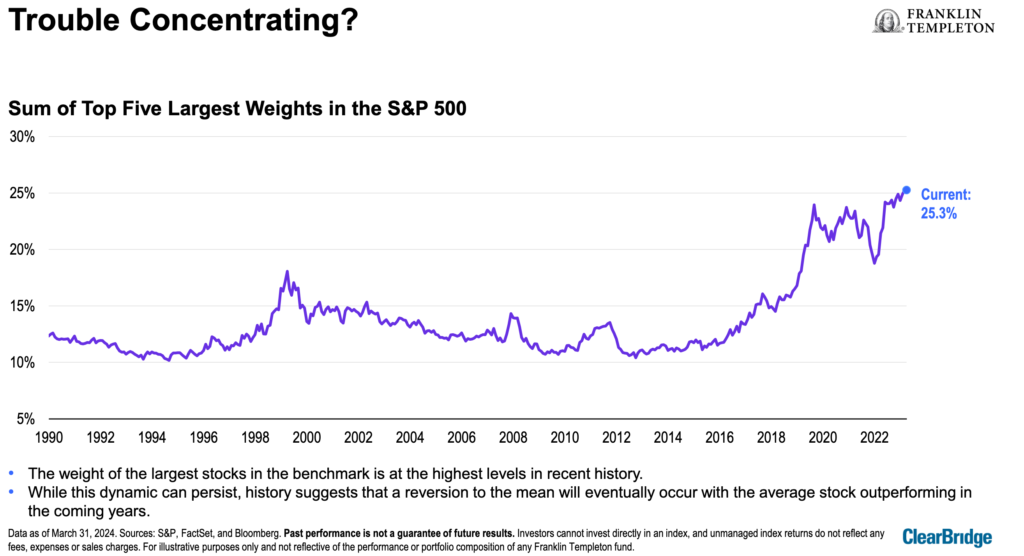

This longstanding and highly popular benchmark comprise 500 large-cap U.S. companies, selected through a rigorous, rules-based methodology combined with a committee process, and is weighted by market capitalization (share price x shares outstanding).

The S&P 500 is notoriously difficult to outperform: recent updates from the S&P Indices Versus Active (SPIVA) report highlight that approximately 88% of all large-cap U.S. funds have underperformed this index over the past 15 years.3

This statistic underscores the efficiency and effectiveness of investing in an index that captures a comprehensive snapshot of the U.S. economy.

For those interested in tracking this index, BMO offers two very accessible and affordable options: the BMO S&P 500 Index ETF (ZSP) and the BMO S&P 500 Hedged to CAD Index ETF (ZUE), both with a low management expense ratio (MER) of just 0.09% and high liquidity.

While both ETFs aim to replicate the performance of the S&P 500 by purchasing and holding the index’s constituent stocks, they differ in their approach to currency fluctuations.

ZSP, the unhedged version, is subject to the effects of fluctuations between the U.S. dollar and the Canadian dollar. This means that if the U.S. dollar strengthens against the Canadian dollar, it could enhance the ETF’s returns, but if the Canadian dollar appreciates, it could diminish them.

On the other hand, ZUE is designed for investors who prefer not to have exposure to currency movements. It employs currency hedging to neutralize the impact of USD/CAD fluctuations, ensuring that the returns are purely reflective of the index’s performance, independent of currency volatility.

Large-cap growth exposure

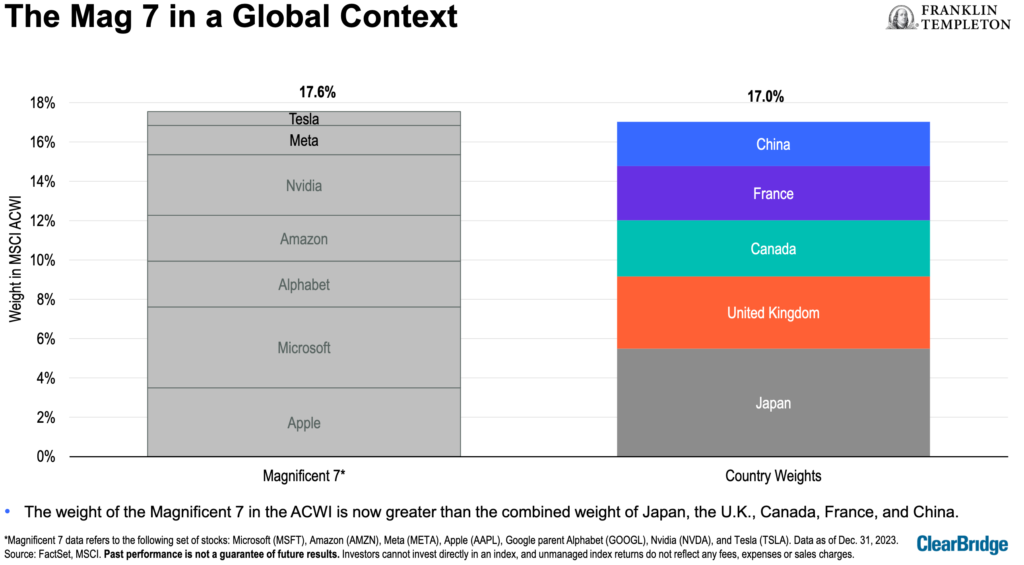

What if you’re seeking exposure to some of the most influential and dynamic tech companies in the U.S. stock market, often referred to as the “Magnificent Seven?”

For investors looking to capture the growth of these powerhouse companies in a single ticker, ETFs tracking the NASDAQ-100 Index offer a prime solution. As of June 27, all of these companies are prominent members of the index’s top holdings4.

The NASDAQ-100 Index is a benchmark comprising the largest 100 non-financial companies listed on the NASDAQ stock exchange. This index is heavily skewed towards the technology, consumer discretionary, and communication sectors, from which the “Magnificent Seven” hail.

BMO offers two ETFs that track this index: the BMO Nasdaq 100 Equity Hedged to CAD Index ETF (ZQQ) and the BMO Nasdaq 100 Equity Index ETF (ZNQ). Both funds charge a management expense ratio (MER) of 0.39%. Again, the key difference between them lies in their approach to currency fluctuations.

Low-volatility defensive exposure

You might commonly hear that “higher risk equals higher returns,” but an interesting phenomenon known as the “low volatility anomaly” challenges this traditional finance theory.

Research shows that over time, stocks with lower volatility have often produced returns comparable to, or better than, their higher-volatility counterparts, contradicting the expected risk-return trade-off. Continue Reading…