By Fritz Gilbert, TheRetirementManifesto.com

By Fritz Gilbert, TheRetirementManifesto.com

Special to the Financial Independence Hub

Did you know a looming Bear Market Crisis is approaching?!

I just read it on the internet, so it’s got to be true!

To make matters worse, I just retired a month ago.

Uh Oh! (Am I screwed?)

Today, some reality about Bear Markets, along with 6 steps to consider as you structure your retirement portfolio.

A Looming Bear Market

Ok, I’m having a bit of fun with the “read it on the internet” line, but the reality is that a Bear Market WILL happen. I’m not being prophetic, just stating the facts. Since before the days of the tulip mania in 1637, bear markets have always been will us, and they always will. We’ve benefited from a very nice bull run. We’re being naive if we think that it will never end.

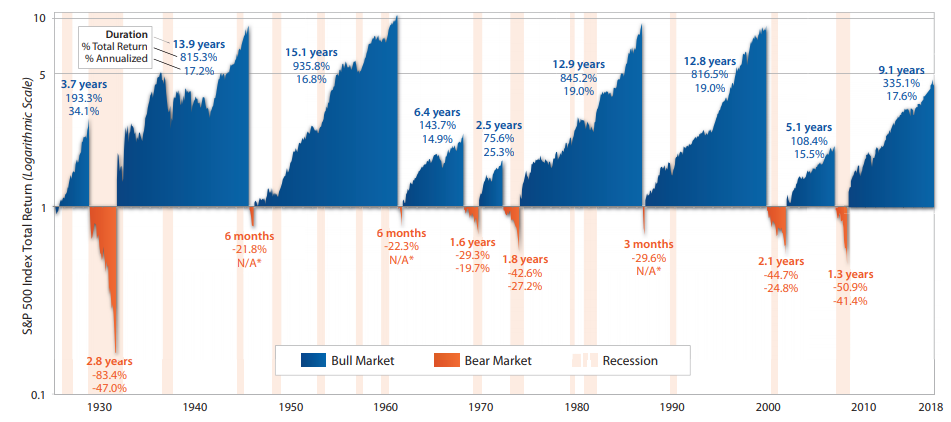

Since 1900, we’ve had 32 Bear Markets, defined as a correction of 20% or more. Do the math, and that averages out to a Bear Market every 3.7 years. The average bear market lasts 367 days (the longest was 34 months!). Here’s what they look like graphically:

The Looming Bear Market Will Drive A Retirement Crisis

I actually did read an article on the internet about the looming bear market crisis. In “The Next Bear Market In Stocks Will Drive A Retirement Crisis,“ the author states:

“A recession could decimate even substantial retirement portfolios.”

Further, the author goes on to say that Social Security and Medicare, and the resulting increase in taxes, increase in eligibility age and reduction in benefits “would be a disaster” for those dependent on the safety net.

Add to that the Voices Of Worry over the global debt pile up and the underfunded status of many state & local pension funds and things could get really, really ugly.

Maybe I shouldn’t have retired early.

Too late now, I guess I’d better get to work on building a Bear Market Crisis Prevention Plan.

The Looming Bear Market Crisis

We all know a Bear Market is coming. It’s been an increasing theme in the blogosphere, with even the esteemed Financial Samurai taking risk off the table. America’s wealthy are moving to cash. Ben Carlson of A Wealth of Common Sense has 36 Obvious Investment Truths to remind folks that you should protect yourself.

I’m not a panic-driven investor, screaming a scare tactic headline to drive traffic (tho, if you’re reading this, I guess it worked, right?). Rather, I’m reminding folks of the reality of how the markets work and encourage you to think about it as you develop your retirement portfolio strategy. Yes, stocks have historically outperformed over the long-term, and will likely continue to do the same. Just recognize that the road can be bumpy, and plan accordingly to avoid getting bitten by a bear when you can least afford it.

A Bear Market Crisis Contingency Plan

The reality is that bear markets have always been with us, and always will. Unfortunately, we never know when that snake is going to strike, so it’s best to wear snakeproof boots along the path of retirement. Following are some steps I’m taking, as an early retiree, to defend our portfolio against the risk of a bear attack. View them as suggestions, and pick and choose as appropriate for your situation.

6 Steps To Bear Market Protection

Following are 6 Steps I’d suggest you take if you’re within 5 years of retirement, or already in retirement:

1. Assess Your Risk Tolerance (& Capacity)

Just because you’re comfortable with risk doesn’t mean you have the “Capacity” to absorb risk. While tolerance measures you’re the amount of risk an investor is comfortable taking, it shouldn’t be viewed in isolation. As you approach or enter retirement, you shouldn’t take on risk you can’t afford simply because you’re comfortable taking that risk.

Risk Capacity is more of a numbers game and indicates how much risk your portfolio can withstand in the event of potential losses. As your income declines in retirement and your time horizon for recovery shortens, the reality is that you have less risk capacity than you had earlier in your career, when future earnings and a longer time horizon gave you an extra buffer against the impact of a bear market.

Factor in both Risk Tolerance and Risk Capacity as you work through the remaining 5 steps of protection.

2. Don’t Retire Before You’re Ready

I once had a wise Uncle who told me “Don’t Retire Before You’re Ready, you’ll never make the kind of money you’re making now, and once you walk away it’s all but impossible to replace.” Smart man, my uncle, and I listened.

I worked One More Year than “The Numbers” said I had to. Why? Because I listened to my Uncle, and because I’m conservative in my approach to finances. I weighed the pros and cons of working one more year, and decided it was the best approach for my wife and me. The additional year has created an additional financial buffer against a potential bear market, and the peace of mind in our retirement of having that buffer was worth the additional year of work for me. Make up your own mind, but realize than an extra year of work provides a nice safety net if you’re able to endure the cubicle for a bit more time.

3. Asset Allocation & Retirement Income Strategy

As you approach retirement, your asset allocation should become more conservative due to your declining risk capacity. At the same time, you need to generate a dependable income which will last a lifetime (and a lifetime of inflation). This balance is, in my view, one of the most difficult elementsin the retirement planning process.

Because of the importance of this step, I’d encourage you to read “How To Build A Retirement Paycheck From Your Investments” for the details of our strategy to balance the tradeoff of risk and income. There’s more to this step than I’m comfortable summarizing in this paragraph, but suffice it to say you need to ensure your portfolio has sufficient liquidity (e.g., cash) to ride out a bear market. Yes, you MUST have equities in a retirement portfolio to provide growth and mitigate inflation risk, but you can’t have too much of your asset allocation dedicated to stocks given your reduced risk capacity. Use a time segmentation approach to avoid putting the money you need for the next 7-10 years into stocks.

4. Don’t Take More Risk Than You Need

As you determine when you’re going to retire, it’s important to realize the advantage of having the largest possible portfolio in place before you pull the plug. The larger your portfolio in relation to your spending (income) requirements, the less return your portfolio will need to earn to last a lifetime. While working one more year is certainly not appealing to most, make sure you’ve thought through the benefits before you discount the approach.

With a larger portfolio, you can reduce the allocation you have to commit to stocks, and increase your allocation in more conservative asset classes (typically bonds, though they also contain an element of risk). To quote a line from Roger Whitney’s excellent book Rock Retirement:

“What’s the minimum effective dose of investment risk I need to take to be in a position to achieve my goals”. Roger Whitney

That sentence had an impact on me as I put together our retirement income strategy, and I’ve decided on a slightly more conservative asset allocation as a result. Our current asset allocation is 50% Equity / 30% Bonds / 10% Cash / 10% Alternatives, and I’m very comfortable with that balance as we start our retirement.

Working one more year has allowed us the luxury of building up our cash reserves to a 10% level, essentially eliminating Sequence Of Return Risk (or, having to sell stocks during a downturn). Sure, we may be giving up a bit of return, but the numbers say we can afford the lower returns associated with the lower investment risk, and we’ll still be in a position to achieve our goals. (Yes, Roger, I’m listening, and sleeping well at night.)

5. Use A Conservative Withdrawal Rate

The BEST study I’ve ever read of safe withdrawal rates is this 26-part series: The Ultimate Guide To Safe Withdrawal Rates, by Early Retirement Now. “Big ERN” retired in June 2018, same as me, and he’s been a friend who I’ve followed closely. He’s a real numbers guy, and his analysis is amazing.

Bottom Line: He argues convincingly that the old 4% “rule of thumb” is outdated, and a much safer approach given the state of today’s markets is ~3.25%. For example, if you have a $1M portfolio, a 4% rate says you can spend $40,000 in year 1 (increase annually for inflation), whereas the 3.25% guideline drops it to $32,500.

I could never have done the analysis that Big ERN did, but I respect his work and have incorporated his advice into my thinking.

Our conservative 3% withdrawal approach is yet another step we’re taking to avoid the decimating impact of a bear market on our retirement portfolio. Yes, it means spending a bit less in retirement than you’d be able to do using a 4% withdrawal rate, but the peace of mind of knowing your portfolio will likely last a lifetime is a nice tradeoff.

A side note: I’m not a fan of the “increase your annual spending with inflation,” which is a tenant of the traditional 4% Withdrawal Rate. Rather, we’re using a “Floor & Ceiling” approach, where we’ll adjust our spending annually based on our Net Worth year-end update. If our portfolio has taken a significant hit in a bear market, this annual adjustment will result in a slight reduction of spending the following year, offsetting the bear’s bite.

6. Build Some Defense Into Your Portfolio

While the majority of our holdings are in low-cost diversified mutual funds (think, Vanguard), I’m a huge fan of diversification and believe it can play a significant role in defense against a bear market. In the 10% of our asset allocation which is in “Alternatives,” we own a variety of asset classes which could provide some protection.

I’m not a “gold bug,” but we’ve got gold (VGPMX, DGL and some physical coins). Gold only comprises ~2% of our portfolio, but if things really go nuts this could provide a year’s worth of living expenses to give more traditional assets a time to recover. We also hold REITS (VGSIX), Inflation-protected bonds (I-Bonds), and Peer-To-Peer lending (Prosper & Peer Street). Combined with a widely diversified equity and bond portfolio (Domestic & International), it’s highly unlikely that everything we own would be down at the same time.

In the worst case, if we consumed the entire cash liquidity in Bucket 1 and we were still in a bear market, we’d likely have something we could sell from to cover our spending without being forced to sell at a significant loss. Consider diversifying your portfolio to build a portfolio of asset classes which have a chance of moving to different beats. When one is down, you may be fortunate to have something that’s up that will put food on the table.

Finally, I should also mention that we chose to enter retirement 100% Debt Free. While not specifically cited as a defense against a bear market, the fact that we have eliminated debt certainly reduces our cost of living in retirement. If necessary, we can hunker down for a very long time at a reduced spending level to ride out the storm.

Put another way, I’ve no worries about eating cat food in our later years. I hope you can say the same.

Further Reading

If you’re interested in reading other articles I’ve written about market volatility, feel free to browse:

- I’m Scared Of A Crash…Where Should I Put My Money

- 5 Moves I’ve Made In Today’s Market Volatility

- Are We In A 15 Year Bull Market?

- What If You Live To 100?

Conclusion

A Bear Market is coming.

I wish I could tell you when, but I can’t. Rather than try to time the market, think through your personal Bear Market Contingency Plan. These 6 Steps can give you some ideas which may be applicable to your situation. The important thing is to think about it before it arrives, and have a plan of action so you don’t do something stupid ifwhen the market tanks. It’s a lot easier to put plywood over the windows before the hurricane arrives. The same principle applies to your investments. Are you ready for a storm?

What About You?

Are there other things you’re doing as a defense against the looming bear market? Do you agree that, at some point, a bear market is inevitable, or is it all just “scare tactics” that we can choose to ignore? Let’s chat in the comments …

Fritz Gilbert is the Founder of The Retirement Manifesto, a blog dedicated to helping people Achieve A Great Retirement. After 30+ years in Corporate America, most recently as a Commodity Trader, Fritz retired as planned in June 2018 at Age 55. He and his wife are looking forward to extended travel and “giving back” to their community through charitable work in retirement. This blog was published on his website on July 18, 2018 and is republished here with his permission.

Fritz Gilbert is the Founder of The Retirement Manifesto, a blog dedicated to helping people Achieve A Great Retirement. After 30+ years in Corporate America, most recently as a Commodity Trader, Fritz retired as planned in June 2018 at Age 55. He and his wife are looking forward to extended travel and “giving back” to their community through charitable work in retirement. This blog was published on his website on July 18, 2018 and is republished here with his permission.

Great post. Looks like we semi retired in the same month. Congrats and good luck. I still have no problem with the 4% rule, even inflation adjusted. It was all easily achieved through the last two major market corrections with simple asset allocation and risk management. One might also enjoy 4% or more, until the major correction appears. We can use a spend rate as protection and follow the markets. But again, I have no problem with the 4% or more. Heck my big Canadian dividends are over 4% and with dividend growth, I’m getting some nice income increases.

Dale @cutthecrapinvesting