by Mark Venning, ChangeRangers.com

by Mark Venning, ChangeRangers.com

Special to the Financial Independence Hub

At the risk of being too serious over a Labour Day long weekend, I decided to lay out some ideas for future blog posts. In the process, I found my way back to my newly refiled library of articles and reports related to a multitude of topics under the theme of aging and longevity.

This is one of my instinctive ways to begin thinking of the future: appreciate the threads of history and see how far we have come along on a particular subject.

Well, as it happens, when it comes to the subject of “Retirement,” maybe not that far. In some ways, the vocabulary associated with this concept still rests in the same dictionary from thirty years ago in the mid-1980’s to early 90’s. During that period in my retail career, I was setting up exhibits at Seniors consumer shows in Toronto, featuring travel-related products to a 55-plus market (which seemed to be the entry level, as I recall).

If you made the circuit up and down the aisles, you could satisfy all your “lifestyle” needs, from the Craftmatic bed (still going strong), to golf-oriented retirement resorts and back support systems. Twice in the day, you could sit in on a retirement planning seminar, featuring the top ten tips to finding financial security, before you returned to see the rest of the show, from RV sales to cremation services and vacation cruises.

Targeting the Seniors market

Fast forward to 1994, I found myself interviewing for, among other things, marketing positions that targeted this same Seniors market. None of that materialized, but I do recall one interview with the Canadian Snowbird Association in Toronto, where I was given a research project and as part of the process, make a business case to prove I really wanted to work with them. Everybody should be so lucky to be asked to do this. Excellent experience as it turns out.

One of the items the director tossed at me as I was leaving that first meeting was a twenty-page set of US and Canadian articles on the organization. Two main shout-out advocacy points for traveling seniors (notably the “over 65 age group”) were their “threatened” out of country medical coverage, and government clawbacks in health spending. Reading this now, by most press accounts this sounded militant back in 1993.

Thorny after all these years?

How far have we really come? Another of the 1993 articles in this batch was a Kitchener-Waterloo Record piece by a retirement planning consultant, John Vince, titled Retirement raises thorny political questions. He mentions dependency ratios, where at that time there was “… roughly five people of working age (18 to 64) for every person aged 65 or older.” Are we still not using that kind of benchmarking now: 23 years on, when at the same time we’re talking about people working well beyond 65?

Vince goes on to say, “This intergenerational politics is moderate so far, but the burden on younger generations is becoming obvious. Already many young people are admitting that they do not expect to obtain the same economic standard of living achieved by their parents.” Sound familiar – if not yet, militant? The 23-year old then is now 46. The circle is still not squared. John Vince could have taken that article and put it in a time capsule for 2016. Like I did.

Retirement pitches haven’t changed much

Still sounding like a common warble from birds in the marketing world, you can listen to any number of infomercials today and even with a slight modification in tone, the pitch in retirement financial solutions has not changed much in basic substance. Intergenerational politics aside, it’s all about how are you going to achieve financial security for your retirement years. Chirp that pitch next time you actually sit down with a 23-year old.

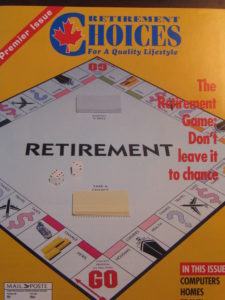

Last, but not least, in the time capsule journey through my refiled library of articles and reports I found a 1994 premier issue of a magazine, Retirement Choices (For a Quality Lifestyle). Bob Rae, Premier of Ontario, was there with his letter of best wishes for the publication saying, “As a growing segment of Ontario’s population nears retirement age, resources that meet their needs will be an invaluable service.” However, the magazine might only be found in my capsule now, while other newer publications still cover the same beat.

The Retirement Game

One of the articles — The Retirement Game by P.J. Wade — discusses Retirement as compared to a board game fashioned like Monopoly. She talks about how things must change, and that “there is much more to ensuring a secure and fulfilling future than money management.” She then goes on to talk about a few tips that work well for retirement planning as they do in game playing.

Everyone loves a tip in the game, and as it goes, P.J’s are still handy today, like understanding the object of the game, expecting the unexpected and knowing the rules of the game. Reading current articles of the same ilk today, you would note that the dice are still rolling, with a new generation of players who may almost see the same board game but with a few squares in need of some rewrite.

Mark Venning works with non-profit and business leaders, providing presentations, research and advisory services on the Business & Social Aspects of Aging Demographics – and 1:1 with business professionals “leaving the corporate crow’s nest” to explore Entrepreneurship in Later Life. www.changerangers.com

Mark Venning works with non-profit and business leaders, providing presentations, research and advisory services on the Business & Social Aspects of Aging Demographics – and 1:1 with business professionals “leaving the corporate crow’s nest” to explore Entrepreneurship in Later Life. www.changerangers.com