This article has been sponsored by BMO Canada. All opinions are my own.

Fixed income doesn’t get enough attention on this blog, mostly because I’m still in my accumulation years and invest in 100% equities across all my accounts. But most investors should hold bonds in their portfolio to reduce volatility and so they can rebalance (selling bonds to buy more stocks) whenever stocks fall.

In this post we’re going to take a deep dive into BMO’s line-up of fixed income ETFs. We’ll see that there isn’t a one-size-fits-all approach to investing in fixed income, and that investors can capture yield using a wide array of products and strategies.

DIY investors should be familiar with BMO’s suite of fixed income ETFs. It’s the largest in Canada with more than $23 billion in assets. At the top of the list is BMO’s Aggregate Bond Index ETF (ZAG) with total assets of $5.86 billion.

Robo-advised clients also have BMO fixed income ETFs in their model portfolios:

- Nest Wealth clients hold BMO Aggregate Bond Index ETF – (ZAG)

- Wealthsimple clients hold BMO Long Federal Bond Index ETF – (ZFL)

- Questwealth clients hold BMO High Yield US Corp Bond Hedged to CAD Index ETF – (ZHY)

- ModernAdvisor clients hold BMO Emerging Markets Bond Hedged to CAD Index ETF – (ZEF)

BMO Fixed Income ETFs

Investors are nervous about holding bonds today. Interest rates are at historic lows, and when rates eventually rise, we’ll see bond prices fall – especially longer duration bonds. We’re also seeing higher inflation, which causes interest rates to go up (and bond values to go down).

Q: Erika, investors are concerned about low bond returns, particularly from long-term government bonds. How should they think about the fixed income side of their portfolio?

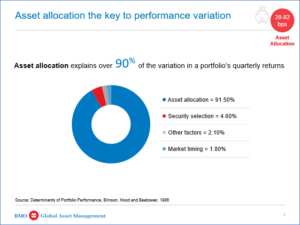

A: Investors should think of fixed income as a ballast in their portfolio. It helps reduce overall volatility (chart below). Correlations between US Treasuries and stocks (represented by the MSCI USA index) have been negative over the last two decades. All that to say, when stocks fall, bonds tend to do well.

From an investor perspective, there are two things at play – FOMO, and fear of volatility. Fixed income still has its traditional value in a portfolio; to offset equity risk.

What we are seeing from some clients is the willingness to take on more equity risk – shifting from a 60/40 balanced portfolio to 70/30 portfolio, as an example.

But you can see the payoff from fixed income using a simple example of Canadian equities (represented by ZCN) and ZAG. Volatility drops materially without costing investors too much return.

| ETF | 10-year annualized return | Standard deviation |

|---|---|---|

| ZCN | 6.21% | 11.8% |

| ZAG | 3.69% | 4.0% |

| 60/40 (ZCN/ZAG) | 5.38% | 7.4% |

| 70/30 (ZCN/ZAG) | 5.61% | 8.5% |

The bottom line: Fixed income keeps investors in the markets during times of distress.

Q: What about a retired investor who typically holds a 60/40 or 50/50 portfolio but is concerned about generating income in a low-yield environment?

A: Such an investor may wish to include ETFs that harness option-writing strategies such as covered call writing, put writing, or a combination of the two, to generate a high level of tax efficient monthly cash flow (option premiums are taxed as capital gains and/or return of capital).

With fixed income generating lower yield today, the equity portion of a portfolio needs to make up for the yield shortfall. Covered call strategies are an efficient way to do so and ETFs are a convenient way that allow investors to attain access.

Here are a few examples of these types of strategies. I would include these on the equity side of the portfolio to increase overall level of yield:

- ZWC BMO Canadian High Dividend Covered Call ETF, yields 7.3%

- ZWB BMO Covered Call Canadian Banks ETF, yields 5.84%

- ZWS BMO US High Dividend Covered Call Hedged to CAD ETF, yields 5.94%

Q: I’m a big fan of asset allocation ETFs to make DIY investing as simple as possible. But is it wise to unbundle ZGRO or ZBAL and hold multiple ETFs with the intention of avoiding long-term bonds in favour of shorter duration government bonds or corporate bonds?

A: Part of the appeal of the all-in-one asset allocation ETFs is their simplicity; and they tend to appeal to investors who do not want to get granular in their investment process. The other benefit of a one-line holding is that you are less likely to overthink the underlying components and make reactive decisions when you see something go into the red.

The 0.18 % management fee (0.20% MER) for ZGRO and ZBAL are all-in, there’s no double-dipping on fees. That is basically the cost of underlying ETFs with almost nothing more for the rebalancing. Keep in mind that there is often a trading cost for rebalancing multiple ETFs on your own. For investors with small portfolios, the cost of selling and buying stocks and bonds every year can become proportionally expensive.

Portfolio rebalancing is the maintenance involved in sticking with your asset allocation plan. Your asset allocation plan is what is going to help you meet your goals. One of the biggest pros to portfolio rebalancing is that it keeps risk under control, and sometimes just maintaining a level of risk takes some action.

There is tremendous value to having the rebalancing done systematically. Conservatively, experts say it can add between 0.30% to 0.40% annually over the long term.

For an investor who does not mind doing a handful of trades and rebalancing once or twice a year, the “unbundling” strategy could work. However, if the concern is rising rates, corporate bonds would tend to do better than government bonds.

I would opt for something like ZCS (1-5 year laddered Canadian corporate bonds, all investment grade) over ZSB (which is 2/3 government bond and 1/3 corporates). The MER’s are almost identical at 0.11% and 0.10% respectively.

The downside to switching to a short duration bond ETF is that you would not participate in gains should we revert to another period of falling rates in the future.

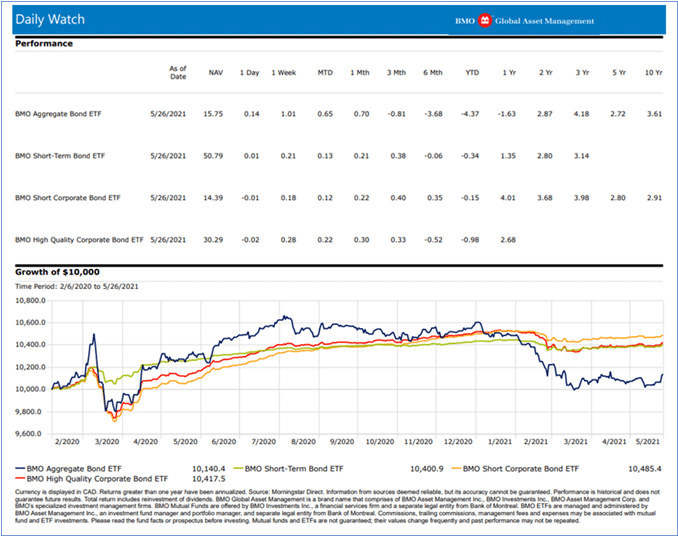

Below are the total returns over the last 15 months for ZAG, ZCS, and ZSB. I have also included ZQB (which is only ‘A’ and above rated corporate bonds) for investors who want corporates but only of the best quality (no BBB’s).

Ultimately, the decision to unbundle an asset allocation ETF or not would depend on the investor’s preferences, portfolio size, time limitations, and investment expertise.

In our model portfolios, and in our managed ETF portfolios, we maintain ZAG as a core portion of our fixed income exposure (though we have complemented it with rate reset preferred shares, short-term US TIPS, and corporate bond ETFs to mitigate the impact of rising rates & inflation).

We want to have some duration exposure to provide a hedge in times of equity market corrections. Longer duration bonds provide an offset to equity market risk in a well-balanced portfolio.

Q: BMO has a broad line-up of fixed income ETFs. What’s an under-the-radar option for someone who’s concerned about inflation and falling bond prices?

A: Here are some links to a few recent fixed income resources:

- 3 tools to optimize your fixed income portfolio – discusses ZEF (BMO Emerging Markets Bond Hedged to CAD Index ETF), ZPR (BMO Laddered Preferred Share Index ETF) and ZTIP.F (BMO Short-Term US TIPS Index ETF (Hedged Units)

- Rising rates & ZAG – In this piece, Alfred Lee discusses how allocating 15% of your core fixed income towards ZPR and ZTIP.F can help mitigate the impact of rising interest rates.

- Fixing your bond portfolio – a useful guide on the fixed income portfolio construction process.

Fun fact: BMO has more bond ETFs over $1 billion and over $500 million than any other provider and offers the widest choice of fixed income exposures.

Final Thoughts

Thank you to Erika Toth from BMO ETFs for taking us through BMO’s fixed income line-up and sharing her ideas on how investors should think about bonds in the current environment.

With interest rates at historic lows, we certainly can’t expect the same future returns from bonds as we’ve enjoyed over the last 25-30 years.

Here are my two takeaways from this interview:

One: Investing in a low cost, risk appropriate, broadly diversified, and automatically rebalancing portfolio is a smart choice for the vast majority of investors, regardless of the current market conditions or interest rate environment. You can do this by holding a single asset allocation ETF in your discount brokerage account, or by investing through a robo-advisor.

The longer-duration bonds held in these portfolios may not be ideal for this environment, but they can be beneficial if stocks fall sharply (as they did in March 2020).

Two: For investors who prefer to take a more hands-on approach to their investments, particularly on the fixed income side, they’ll find a wide range of options including TIPS, high grade corporate bonds, and emerging market bonds.

Yield hungry investors can also delve into the world of covered call strategies to potentially juice the income on the equity side of their portfolio. This includes products like BMO Covered Call Canadian Banks ETF (ZWB).

Readers, have you changed the way you look at the fixed income side of your portfolio? Let me know in the comments.

n addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on June 2, 2021 and is republished here with his permission.

n addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on June 2, 2021 and is republished here with his permission.

Great post. Folks can certainly do core and then fix some portfolio holes – aka inflation risk. Stocks did not work during stagflation. Not U.S. not Canadian, not International.

Folks might layer in some commodities as well.

Dale @ Cut The Crap Investing