By Aaron Hector, Doherty & Bryant Financial Strategists Inc.

By Aaron Hector, Doherty & Bryant Financial Strategists Inc.

Special to the Financial Independence Hub

The purpose of this article is to show you how to think outside the box and use an RESP [Registered Education Savings Plan) in ways that you may not have previously considered. But before we get to that, let’s look at the basics.

How does an RESP work?

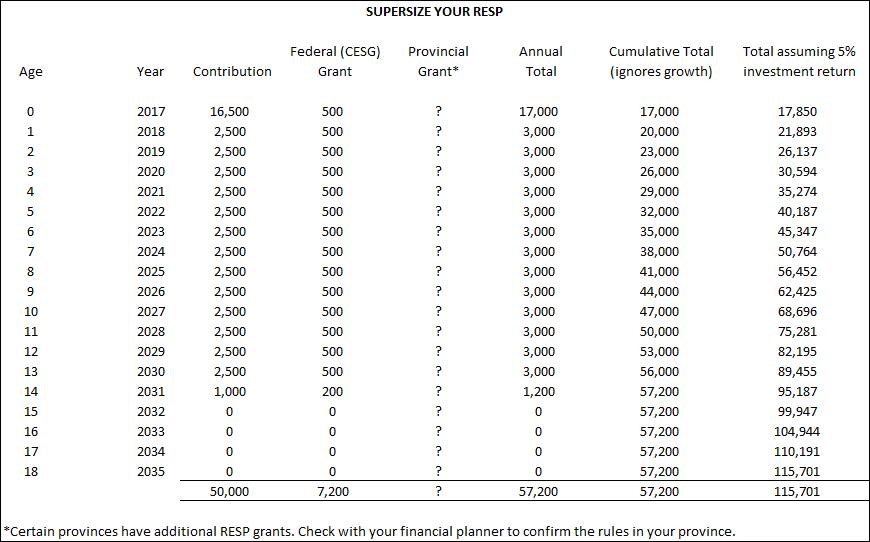

To help you save for your child’s post secondary education, the government provides a 20% match by way of the Canada Education Savings Grant (CESG). The CESG matching is subject to both annual and lifetime maximums. Specifically, on your first $2,500 of contributions each year, you’ll receive $500 in grant money, to a maximum of $7,200 in lifetime grants per child. To illustrate over time, if you contribute $2,500 per year, you will max out the grants available to you in 15 years (14 years at $2,500 + 1 year at $1,000, with a 20% match = $7,200).

If you don’t start making contributions when your child is born, or if there’s a lapse in contribution installments, you are able to ‘reach back’ and receive grants for previous years. You can reach back one year at a time. Therefore, you could consider a contribution of up to $5,000 this year if you missed making a contribution last year, or any year prior, and that would net you a CESG of $1,000 in total- $500 for the current year grant, and $500 for a prior year grant. The carryforward of unused CESG accumulates for every year including the year of birth, regardless of whether you have actually opened an RESP account.

The lifetime contribution limit per beneficiary (child) is $50,000. There is no annual maximum so, in theory, you could do this all in year one. The downside is that you would only receive one year of CESG from the government.

All the typical investment options are allowable within RESP accounts (stocks, bonds, mutual funds, ETFs, etc.), and the income inside the RESP grows on a tax-deferred basis. In other words, you do not need to report the interest, dividends, or capital gains you earn within the RESP on your tax return each year as you go. Rather, this income, when eventually withdrawn from the RESP, can be taxed in the name of your child.

Conventional financial thinking is that most students will have little to no other income in the years that they need to withdraw from an RESP. When the student’s low income is combined with both their basic tax credits and their tuition tax credits, it’s expected that the RESP’s income can be withdrawn by them without paying tax. Of course, some working students will have enough employment income that the RESP earnings (but never the contributed capital) would be taxable at their marginal tax rate when withdrawn.

When I review these rules, I see opportunity …

Opportunity number one can’t be missed: the CESG is simply free money for the taking. I liken this to an employee stock savings plan with a matching component. Unless you believe your company is in a dire situation that would impact your company’s stock price dramatically, you really should do everything you can to participate in the matching program to the maximum allowable limits.

My advice is to open your RESP as soon as you can in the year of your child’s birth, and make the $2,500 contribution immediately. Then, make additional $2,500 contributions in early January of each year thereafter to get the grant as soon as possible and get that money working for you (it typically takes 6-8 weeks for the $500 grant to ‘arrive’ into the RESP account).

The second opportunity, which is often overlooked and almost always underutilized, is the tax-deferred (and commonly tax free) growth of the investments within the RESP. As reviewed above, the maximum lifetime CESG of $7,200 can be attained within 14 years of contributing $2,500 annually, followed by a single $1,000 contribution in the 15th year. That totals $36,000 in contributions, yet the lifetime limit is $50,000. This tells us that an additional $14,000 worth of contributions can be made in any year. If you have already maxed out your RRSP and TFSA plans, you may be better off investing an extra $14,000 in your RESP rather than putting it inside a taxable investment account. If you do this in year one, you can take maximum advantage of the tax-deferred compound growth. I call this ‘supersizing your RESP.’

What if your child doesn’t go to school?

If your children do not attend a post-secondary education program, the CESG received must be repaid to the government in full, and the amount that you contributed will be returned to you without penalty. The growth on the investments, however, will be taxed to you on their withdrawal and a penalty equal to 20% of the plan’s growth will be levied against you.

Luckily, you have time on your side. An RESP can remain open for 35 years and you’ll likely know after 18 years if your child is on a post-secondary path. Even if your child is uncertain until they’re 28 years old, that still leaves seven years to plan how best to wind down the RESP.

Here are a few options:

- If you have contribution room available in your RRSP, the balance in the RESP that would normally be subject to tax and penalties can be transferred to the RRSP to a maximum of $50,000.* The money will remain invested on a tax-deferred basis and avoid the 20% penalty. If you don’t have room in your RRSP today, remember: we have time on our side. Stop making RRSP contributions for a few years and slowly transfer balances from your RESP into your RRSP. This rollover option is also true for transfers to RDSP plans, as long as the beneficiary of the RESP and RDSP are the same.

*Pro tip: If you and your spouse set up the RESP as joint subscribers, you can double the RRSP rollover allowance from $50,000 to $100,000!

- If you have a year where your income is lower than normal (perhaps you were ill or in between jobs), you could consider drawing income out of the RESP. The 20% penalty would still apply, but at least your tax bracket would be much lower. Or, if transitioning to retirement, you could use the money coming out of your RESP as an income bridge for a year or two before tapping into other income sources like RRSPs, LIRAs, CPP, or even OAS.

- Do your homework to make certain there isn’t some kind of educational program that might fit for your child. You may be pleasantly surprised to know that not only college and university-level courses qualify for funding, but many trade schools and correspondence courses do as well. If your child has had challenges with education in the past, you may be comforted to know that educational withdrawals from RESP accounts qualify based on enrollment only, in other words, there is no bearing on whether a course is passed successfully. You may even find that the course enrollment fee is more than offset by avoiding the income inclusion and penalties that could occur otherwise. Once enrollment is confirmed and sustained, withdraw the plan funds to the maximum extent permitted by your RESP provider.

RESPs for Adults

I’ll close with opportunities for adults, which are a bit more obscure. An adult can be a subscriber or beneficiary or both on the same plan. They won’t qualify for the CESG grants due to age restrictions, but can still take advantage of the 35-year tax deferral. Maybe you have a thirst for knowledge and know you’ll want to take classes in retirement. Maybe you’ll want to take classes in sunny California or Florida? Educational RESP withdrawals are not restricted to Canadian educational institutions.

In addition, you could conceivably use the RESP as an income-splitting vehicle between you and your lower-income spouse. If you name your lower-income spouse as a joint subscriber to the plan and you personally fund the contributions, your contributions would grow tax free for 35 years. Then, you could transfer $50,000 to your spouse’s RRSP (because they are a joint subscriber). When the funds are withdrawn from your spouse’s RRSP, they would be taxed at their lower tax bracket.

Closing thoughts

These planning arrangements and are a bit more sophisticated than the standard way of dealing with RESP accounts. Before implementing any of these strategies, make sure you have a discussion with your financial planner to discover which solutions fit best with your overall plan.

For more on RESPs, I invite you to read The abc’s of RESPs written by my colleague, Terry Willis.

Aaron Hector has been a consultant at Doherty & Bryant Financial Strategists, a subsidiary of T.E. Wealth, for nearly 10 years. He provides comprehensive financial planning to high-net-worth individuals and families in Western Canada, and has extensive experience in executive compensation plans, retirement planning, and income tax reduction strategies. As a dual citizen of Canada and the USA, he also has a passion for cross-border financial planning.

Aaron Hector has been a consultant at Doherty & Bryant Financial Strategists, a subsidiary of T.E. Wealth, for nearly 10 years. He provides comprehensive financial planning to high-net-worth individuals and families in Western Canada, and has extensive experience in executive compensation plans, retirement planning, and income tax reduction strategies. As a dual citizen of Canada and the USA, he also has a passion for cross-border financial planning.