I spent a total of four minutes working on my RRSP portfolio last year.

It wasn’t benign neglect: my two-ETF all-equity portfolio really is that simple! I made four trades, which took about a minute each after determining how much money to invest, in which of the two ETFs to allocate the investment, and how many shares that would buy (plus a few seconds to enter my trading password).

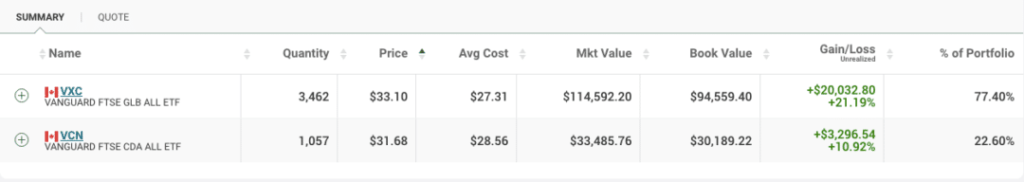

The buying process is easy since I don’t have any bonds in my portfolio. I simply add money to the fund that brings my portfolio closest to its original allocation – 25 per cent VCN and 75 per cent VXC.

Back when I was picking stocks I’ll bet I spent a good three hours a week reading about individual stocks and market trends, plus another hour a week staring at my portfolio and playing around with stock screeners. That adds up to over 200 hours a year spent obsessing over my portfolio and trying to find an edge with my investments.

Has investment performance suffered? Hardly. This four-minute a year portfolio was up 18.08 per cent in 2015, up 8.76 per cent in 2016, and is up 5.66 per cent year-to-date. Compare that to the benchmark I used for my dividend stock portfolio, iShares’ CDZ, which was down 11.53 per cent in 2015, up 20.93 per cent in 2016, and is up 1.3 per cent year-to-date.

When it comes to return on time invested, my four-minute portfolio is pretty tough to beat.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on March 5th and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on March 5th and is republished here with his permission.

Thanks for the informative article. Unogeeks is the top SAP FICO Training Institute, which provides the best SAP FICO Training