By Alyssa Furtado, RateHub.ca

By Alyssa Furtado, RateHub.ca

Special to the Financial Independence Hub

Shopping for a mortgage can be a challenging task. Much like when you buy a car, it can be hard to get clear information. Mortgage rate comparison websites like RateHub.ca can help you learn about your options in general terms. But when it actually comes time to apply, a mortgage agent can give you objective advice and get you the best mortgage rate.

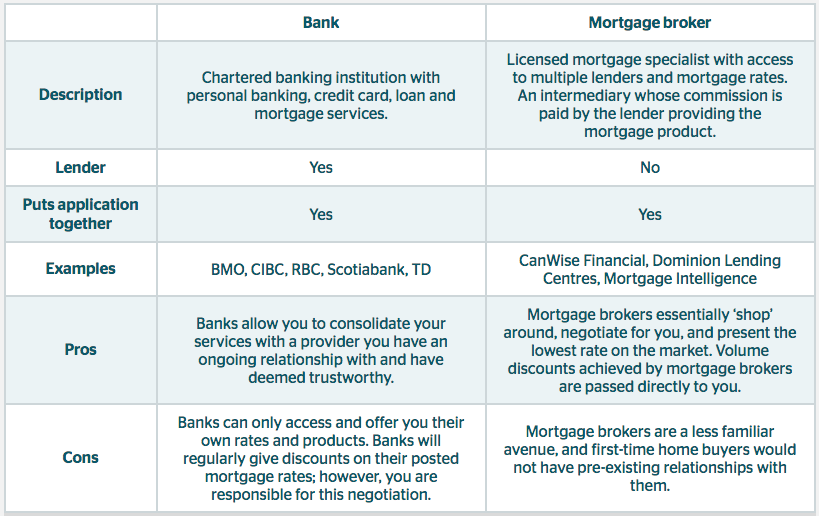

Canadians have two main options when looking for a mortgage: banks and mortgage brokers. When you talk to a mortgage advisor at a bank, you have the ability to negotiate directly with someone at that financial institution. When you work with a mortgage broker, he or she will work with a number of different lenders and negotiate on your behalf.

These are two different approaches to the same thing. But which option is better?

Each has benefits and drawbacks

To answer this question, we need to dive in to the benefits and drawbacks of each. Let’s start at the bank.

When looking for a mortgage, you can expect the mortgage advisor to be quick and responsive. You’ll have the option of convenient face-to-face meetings, and many banks even have mobile salespeople who will come to your home to discuss your mortgage needs.

The best part about working directly with a bank is that you’re in charge of your negotiation. You can inquire at a number of banks, compare offers yourself, and try to get the best deal. And you can sometimes negotiate other banking perks, like discounts on everyday banking, along with your mortgage.

However, there are downsides to going directly to the bank.

The biggest of these drawbacks is each bank only has access to its own mortgage products. So you need to do the comparison shopping yourself. And the person you deal with is a commissioned salesperson, so it’s in their best interest to sell you a mortgage even if it’s not the best product for you.

The Big Five banks also have the strictest underwriting rules out of all the mortgage lenders in Canada. That means if you aren’t an ideal applicant — with regular income from full-time employment, a good credit score, and ample down payment — you might have a difficult time. If you’re self-employed, or don’t have good credit, you could find yourself out of luck at the bank.

If you decide to work with the banks directly, try to get at least three quotes. You might be surprised to learn your usual bank doesn’t offer you the best rate.

Mortgage brokers handle negotiations for you

What about the pros and cons of using a mortgage broker?

The greatest benefit of using a mortgage broker is they handle the negotiations for you. Mortgage brokers have access to mortgage rates from all sorts of lenders, including the big banks. They also have access to mortgage rates from companies you might not have heard of, such as First National and MCAP. The lowest mortgage rate might come from a lender you wouldn’t have thought to approach on your own. If you’re in a hot real estate market like Toronto or Vancouver, you’ll find every point off your mortgage rate will help your mortgage affordability calculator results.

What’s more, mortgage brokers who do a high volume of business are often able to negotiate deeper discounts than you can negotiate on your own, even at your own bank.

And if you’re one of the aforementioned people who don’t fit the bank’s idea of a good borrower, a mortgage broker can help you find a solution. Some mortgage brokers even specialize in helping people with irregular income or bad credit get a mortgage. New Canadians will find more options with a broker as well.

Options can be limited in smaller towns

That said, you might find your options limited if you want to meet with your mortgage broker in person. Unlike banks, which have lots of branches even in small towns, mortgage brokers in Canada are usually based in major cities. That means you’re less likely to get a convenient in-person appointment. Most brokers will prefer to work with you online or over the phone, and you might not ever meet your mortgage broker in person.

And like the salesperson at the bank, your mortgage broker earns a commission from selling you a mortgage. The difference is the broker gets paid no matter what lender you go with. So the pressure isn’t there to sell a specific product, but rather to find you a mortgage that meets your needs.

Despite these minor shortcomings, a mortgage broker should still be your first choice. Not only do you get someone on your side to negotiate for you, you get access to a wider variety of lenders and rates.

Mortgage brokers don’t charge for their services and can help answer your questions even if you’re not ready to start your mortgage search yet. Even if you want to work with your bank, consider reaching out to a mortgage broker as well, just to compare your options.

With better negotiating power and more options for all kinds of borrowers, mortgage brokers are almost always the better option.

Alyssa Furtado is a passionate entrepreneur, financial expert, digital marketer and educator, and founder of RateHub.ca, a website that compares mortgage rates, credit cards, high-interest savings accounts, chequing accounts, and insurance with the goal to empower Canadians to search smarter and save money.

Alyssa Furtado is a passionate entrepreneur, financial expert, digital marketer and educator, and founder of RateHub.ca, a website that compares mortgage rates, credit cards, high-interest savings accounts, chequing accounts, and insurance with the goal to empower Canadians to search smarter and save money.

That’s great that mortgage brokers will have rates from all lenders including big banks. My husband and I want to buy our first home together now that we have two kids. Using a mortgage broker seems like it could help us get a great deal.

It’s actually really handy that mortgage brokers have a bunch of lenders to work with. It makes sense that they can help a person out the most because they’re not biased and all they want is the best outcome for their client. I think using a mortage broker most of the time will help many people.

That is so sweet! You give me the motivation to keep blogging!The post Contains Really Lot of valuable Information I really Gathered lot of information Form your Post.Thank you so much for sharing valuable information.

Hey! it’s a good thing the lowest mortgage rate might come from a lender you wouldn’t have thought to approach on your own.