I often recommend deferring CPP until age 70 to secure more lifetime income in retirement. It’s also possible to defer OAS to age 70 for a smaller, but still meaningful, increase in guaranteed income.

I often recommend deferring CPP until age 70 to secure more lifetime income in retirement. It’s also possible to defer OAS to age 70 for a smaller, but still meaningful, increase in guaranteed income.

While the goal is to design a more secure retirement, there can be a psychological hurdle for retirees to overcome. That hurdle has to do with withdrawing (often significant) dollars from existing savings to fill the income gap while you wait for your government benefits to kick in.

Indeed, the idea is still to meet your desired spending needs in retirement – a key objective, especially to new retirees.

This leads to what I call the retirement risk zone: The period of time between retirement and the uptake of delayed government benefits. Sometimes there’s even a delay between retirement and the uptake of a defined benefit pension.

Retirement Risk Zone

The challenge for retirees is that even though a retirement plan that has them drawing heavily from existing RRSPs, non-registered savings, and potentially even their TFSAs, works out nicely on paper, it can be extremely difficult to start spending down their assets.

That makes sense, because one of the biggest fears that retirees face is the prospect of outliving their savings. And, even though delaying CPP and OAS helps mitigate that concern, spending down actual dollars in the bank still seems counterintuitive.

Consider an example of a recently divorced woman I’ll call Leslie, who earns a good salary of $120,000 per year and spends modestly at about $62,000 per year after taxes (including her mortgage payments). She wants to retire in nine years, at age 55.

Leslie left a 20-year career in the public sector to work for a financial services company. She chose to stay in her defined benefit pension plan, which will pay her $24,000 per year starting at age 65. The new job has a defined contribution plan to which she contributes 2.5% of her salary and her employer matches that amount.

Leslie then maxes out her personal RRSP and her TFSA. She owns her home and pays an extra $5,000 per month towards her mortgage with the goal of paying it off three years after she retires.

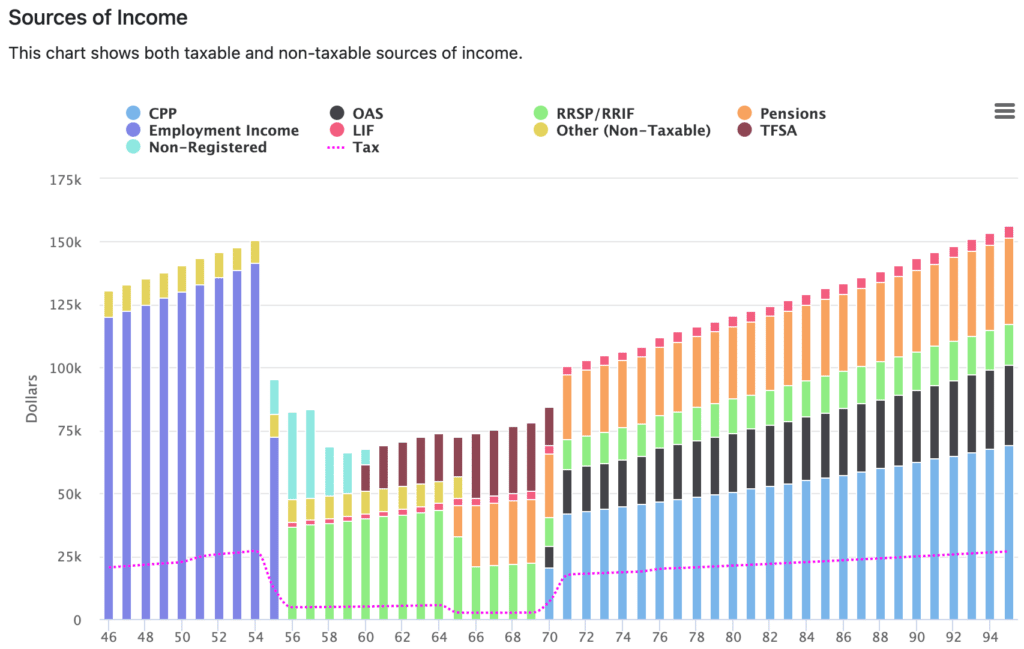

Because of her impressive ability to save, Leslie will be able to reach her goal of retiring at 55. But she’ll then enter the “retirement risk zone” from age 55 to 65, while she waits for her defined benefit pension to kick in, and still be in that zone from 65 to 70 while she waits to apply for her CPP and OAS benefits.

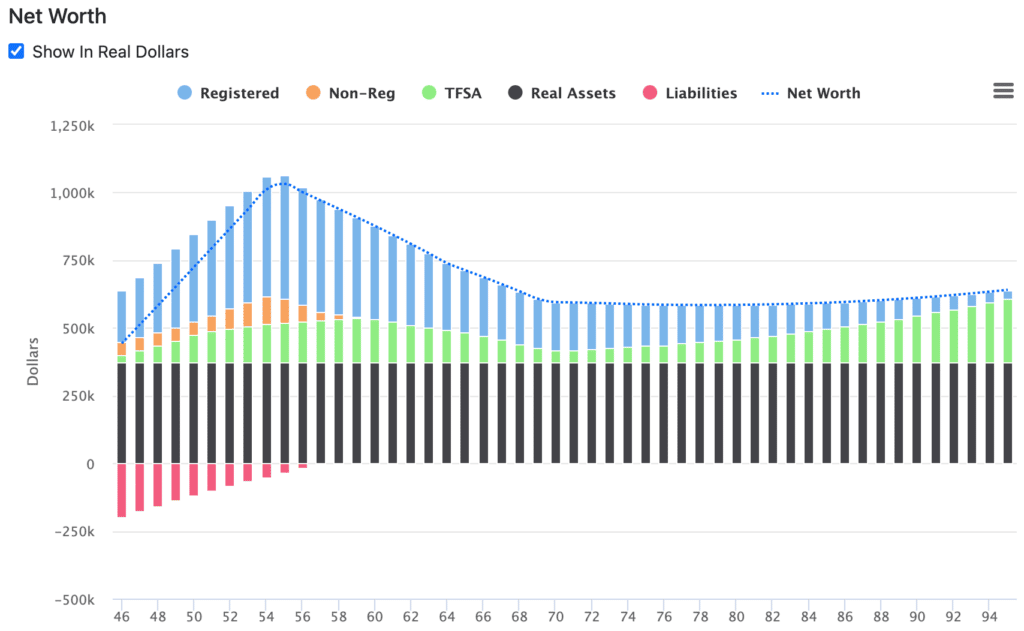

The result is a rapid reduction in her assets and net worth from age 55 to 70:

Leslie starts drawing immediately from her RRSP at age 56, at a rate of about 7.5% of the balance. She turns the defined contribution plan into a LIRA and then a LIF, and starts drawing the required minimum amount. Finally, she tops up her spending from the non-registered savings that she built up in her final working years.

When the non-registered savings have been exhausted at age 60, Leslie turns to her TFSA to replace that income. She’ll take that balance down from $216,000 to about $70,000 by age 70.

Now, we know that withdrawing 7.5% of a portfolio is not sustainable over the long term. But Leslie has a magic trick up her sleeve. She can cut her RRSP withdrawals in half at age 65 when her defined benefit pension kicks in. By age 70, when CPP and OAS benefits begin, Leslie can start drawing the minimum amount required from a RRIF (5%).

Even with the reduction in RRSP/RRIF withdrawals, Leslie’s income from her pension and government benefits is now high enough to stop making withdrawals from her TFSA, and in fact start contributing to the tax-free account again.

This makes for a nice tax-free estate for Leslie’s only child, but also gives her a pot of money for any planned or unplanned expenses or spending shocks that may occur throughout retirement.

Finally, of note, once Leslie’s mortgage is paid off at age 58 she increases her after-tax spending by $5,000 to enhance her retirement spending. Her after-tax spending budget increases by 2.1% per year to keep pace with inflation over the long term.

Final Thoughts

While this is one unique example of the retirement risk zone, I see similar scenarios play out all the time for clients who retire between 55 and 65 and have a delay in taking their pension and/or government benefits.

It’s not even unique to those deferring CPP and/or OAS to 70. The retirement risk zone can happen anytime between retirement and the traditional uptake of government benefits.

Early retirees want to maximize their ability to spend and may also have one-time expenses like a new vehicle, home renovations, a bucket list trip, or financial support to their young adult children.

Related: Your Retirement Readiness Checklist

For these reasons it can be difficult, psychologically, to defer taking your pension and/or government benefits (even though it makes the most mathematical sense) while spending down existing savings.

That’s why it’s helpful to see the big picture with a retirement plan that shows how all of these different income puzzle pieces fit together over the long term.

The retirement risk zone can seem extremely risky until you see the pension and/or government benefit dollars kick in and raise your income floor by a substantial amount.

So, while it’s tempting to take your pension and benefits early to ease the anxiety you face during this retirement risk zone period, know that by doing this you’ll actually be losing income in your later retirement years.

Instead, consider taking on some part-time work, or delaying your retirement by 6-12 months, or spacing out some of your planned one-time expenses (or easing asset depletion concerns by financing a large purchase over a few years), to help bridge the gap.

Better yet, as I say to my clients, it’s helpful to wrap your head around the idea of transferring risk from the market to the government and/or your company pension plan – trading your own riskier investments for a guaranteed, paid-for-life, indexed-to-inflation source of income.

The goal all along, even during the retirement risk zone period, is to generate enough income to meet your spending needs in retirement.

Take comfort knowing that by the time your CPP and OAS kicks in at age 70, you’ll often end up with more income than you need to meet your desired spending in retirement. Tuck that extra income away in your TFSA to create a tax-free estate, a source of funds for large planned one-time expenses, or as a safeguard against unplanned spending shocks.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on Aug. 6, 2022 and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on Aug. 6, 2022 and is republished here with his permission.

What this article doesnt recognize is that by taking the CPP and OAS at 65 as my wife and I both did, we invest the proceeds after tax in a Non Reg Account in a dividend etf such as ZDV. We get the dividend tax credit and pay almost no taxes or very little taxes. This preserves our RRSPs and TFSA for later use. The article doesnt note as well that if you defer CPP and OAS and die before the breakeven age of 82, you have received less overall than the people who took CPP and OAS at age 65 like we did and die at the same year up to 82. I dont want the government coming ahead by hoping I die before age 82 and ‘trick’ me into deferring. Remember, 30% of us die by age 80. 10% of people who reach age 60 die by age 70. For my wife and I,we are ahead of the deferrers until age 82 and our estate is going to be ahead too. We plan to save most of what we took early and its going to be paying us nice dividends too. I have done all the numbers and it makes complete sense to us to not defer CPP and OAS.