By Sa’ad Rana, Senior Associate – ETF Online Distribution, BMO ETFs

(Sponsor Content)

Indexed investing, when done properly can be an efficient and low-cost way of gaining exposure to various markets. Investment vehicles such as exchange-traded funds (ETFs), make it possible for individuals to invest in these indexes, i.e., the Nasdaq-100 index.

Nasdaq-100 & Exposures

Launched in 1985, the Nasdaq-100 is one of the world’s most well-known large-cap growth indexes. The companies in the Nasdaq-100 include over 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. It is mainly comprised of technology, consumer, and health companies – with a slight exposure to industrials and telecom.

When looking at what is powering economic growth in the 21st century, we look to those new economy sectors that are highly digital. These are disproportionately tech or consumer companies like Amazon, Microsoft, and Google. This index gives you exposure to the biggest Nasdaq-listed names, along with others that follow closely behind these leaders in technology.

Nasdaq-100 vs S&P 500 Volatility & Performance

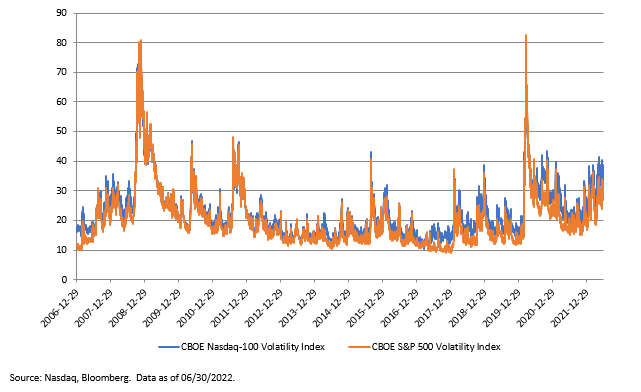

When looking at volatility, one may think of the Nasdaq as being a more growth-oriented index, and if looking at returns alone, these have certainly shown to be significant over the years. Investors may assume that the indexes’ higher performance leads to higher volatility compared to other leading indexes. However, if we take a look at the chart below, which is more of a longer-term picture, you are getting a pretty significant consistent volatility range. Of course, if you look at this year in comparison inflation has been at the forefront of headlines, growth-oriented companies have been taking a harder hit than more cash-up-front companies: you see more volatility in the Nasdaq this year vs the S&P 500.

Both the Nasdaq-100 and the S&P 500 have had very similar volatility over last 15+ years

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

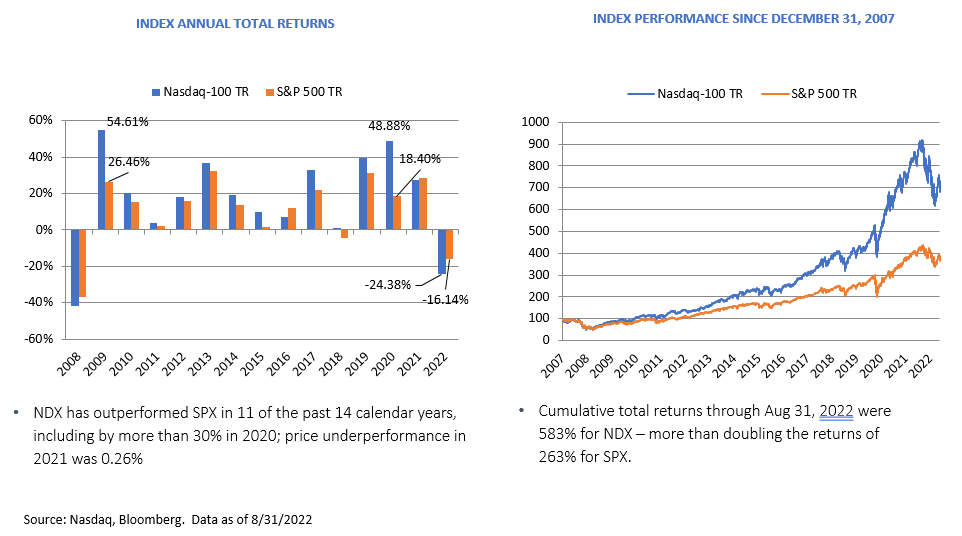

The big story for everyone is the performance of the Nasdaq-100 vs. the S&P 500. The long-term performance of the Nasdaq-100 shows an upward trend. If we look at post-2008, generally monetary policy had been very supportive of market growth, and companies had been able to invest in research, helping them grow over time. You see this reflected in the Nasdaq-100, where thanks to the underlying companies in this index, there is outperformance. The chart below showcases this quite well. It tells us that the Nasdaq-100 is a valuable holding in a portfolio based on performance.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

Market Considerations: Performance vs Interest Rates

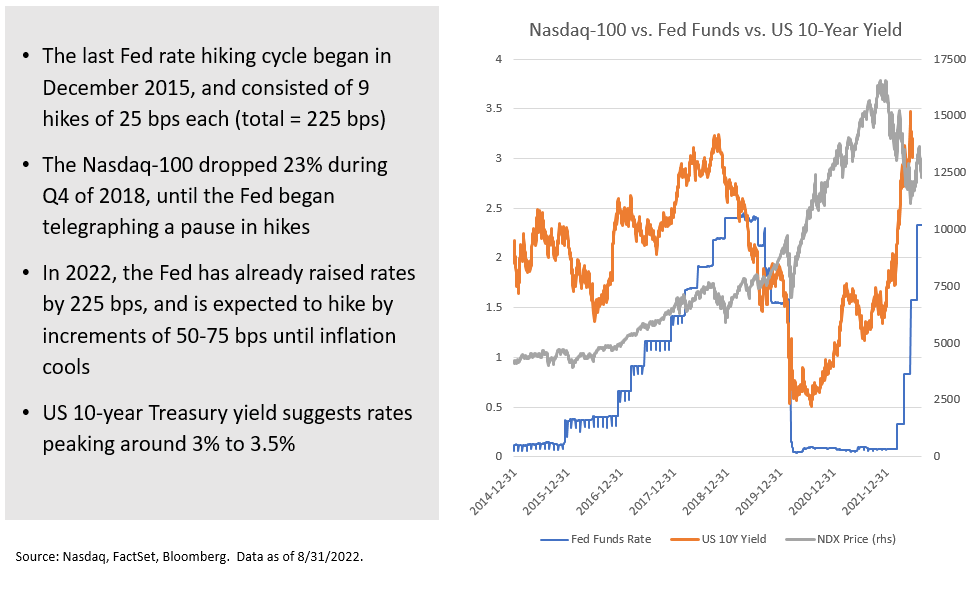

The chart below shows what happened the last time rates went up by a similar amount. You can see a gradual stairway up from almost 0% to about 2.5%. You can see the dip in the NDX price (grey line), which looks like a blip, almost not noticeable (but it was 23%). This isn’t very far from the drawdown this year to date. Albeit the Fed is raising rates much faster.

Based on experience, the Fed may keep rates high until inflation gets under control into that sort of two to three per cent range. The question for investors is, what happens to stocks if rates get to 3%, 4% or maybe 5% and perhaps stay at that level for a few years? This is where it is imperative to look at the amount of debt these companies have on their balance sheet, how much the interest costs will go up and what their earnings power looks like. Will they be able to remain competitive with the price of everything rising? Will consumers continue to pay for these products vs. downsizing or even substituting for cheaper alternatives?

When we look at the price-setting ability of many of the Nasdaq-100 companies for these products and services (the ones you simply cannot live without these days), it looks to be an optimistic viewpoint even if rates were to get up higher and stay there for a few years.

Getting Exposure:

There are a variety of Canadian listed ETFs one could use to gain exposure to the Nasdaq-100. BMO ETFs offers two such ETFs:

ZNQ – BMO NASDAQ 100 Equity Index ETF: has been designed to replicate, to the extent possible, the performance of a NASDAQ listed companies index, net of expenses. The Fund invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index.

ZQQ – BMO Nasdaq 100 Equity Hedged to CAD Index ETF: has the same strategy as ZNQ with the addition of U.S. dollar currency exposure that is hedged back to the Canadian dollar.

For more information on the Nasdaq-100 please click HERE to watch our session on this topic.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.

Disclaimer Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently and past performance may not be repeated. NASDAQ®, and NASDAQ-100 Index® or NASDAQ-100 Index® Hedged to CAD, are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by the Manager. The ETF(s) have not been passed on by the Corporations as to their legality or suitability. The ETF(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the ETF(s). Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.