By Fritz Gilbert, TheRetirementManifesto.com

Special to the Financial Independence Hub

Managing a personal portfolio is always a challenge. It’s something we typically do alone (or with an advisor) and we seldom get insight into how others manage their money in retirement.

Are we doing it right? What are other people doing? What can I learn from them?

While reading various blogs is helpful (and appreciated by this writer), what if we could gain real insight into how other “real” people manage their money in retirement?

Today, we’re in luck. I recently found a fascinating study that provides some rare insight.

Real people. Real money. Real answers.

Today, a look into how people manage their money in retirement.

Managing our money in retirement is something that we typically keep to ourselves. Seldom do we get an opportunity to see what others are doing. Fortunately, JP Morgan studied 31,000 people as they prepared for and entered retirement. They compiled their findings for us in their report, “Mystery no more: Portfolio allocation, income, and spending in retirement.”

It’s a rare opportunity to compare ourselves to others, and I hope you’ll find it as interesting as I did. Below is a summary of the report, organized by major topic.

Voyeurs rejoice, it’s time to see how others are managing their money in retirement.

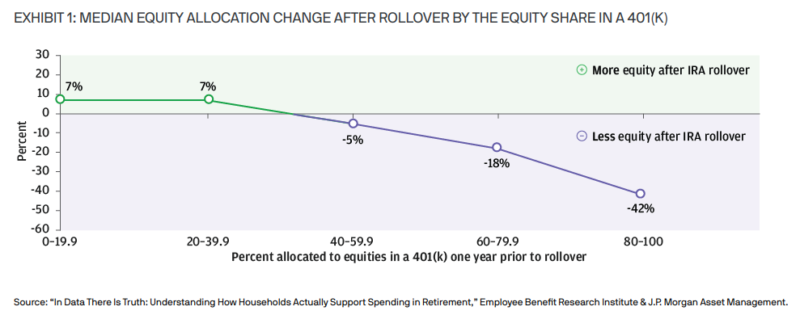

Asset Allocation: Dialing Down The Risk

When retirees roll over their 401(k) balances, an astounding 75% reduce their exposure to equities. The median reduction is 17%, and those with a higher equity exposure tend to reduce it the most. Note in the chart below that those with an 80-100% equity exposure reduced it by 42%!

Are You Doing It Right? Reducing your risk as you approach/enter retirement is an important strategy to reduce your Sequence of Return Risk. If you have too large an exposure to stocks, you’ve likely suffered some anxiety in this year’s bear market. Moving some of that equity into lower-risk asset classes allows you to fund your retirement spending without having to sell equities after a downturn. As I’ve outlined in my posts on The Bucket Strategy, we keep 3 years of cash, and I’m sleeping just fine these days.

Using RMDs As Withdrawal Guidance

Required Minimum Withdrawals (RMDs) are established guidelines from the IRS for mandatory withdrawals from pre-tax retirement accounts starting at age 72 (Uncle Sam wants his tax revenue, after all!).

I was surprised to find that 80% of those surveyed who are younger than RMD age took no withdrawals from their retirement accounts. Meanwhile, a full 84% of those subject to RMD’s took only the minimum required withdrawal.

A better approach is to do annual withdrawals or Roth conversions prior to reaching your RMD age, using your marginal tax bracket and your safe spending rate as guidelines for how much to withdraw. It’s also important to recognize your spending will likely be higher in your earlier vs. later retirement years. You’ve saved that money to enjoy retirement, so don’t let an IRS guideline dictate how much you can safely withdraw or spend. Quoting from the study:

“The RMD approach is inefficient. It does not generate income that supports retirees’ & declining spending behavior and may leave a sizable account balance at age 100.”

Are You Doing It Right? If you’re not strategically withdrawing from your retirement accounts before age 72, chances are you’re doing it wrong. The tax savings over your lifespan can be significant, and I encourage everyone who retires before the age of 72 to develop a plan for Roth conversions in your “pre-RMD” years. I’ve outlined the strategy I use in How To Execute A Before-Tax Rollover Into A Roth. I’ve done a Roth conversion every year since I retired at age 55.

Given this year’s bear market and the potential 2026 expiration of current advantageous tax rates (see The New Tax Law Loophole That Benefits Retirees), it’s critical to determine if a Roth conversion is right for you NOW. Also, if you’re spending less than your Safe Withdrawal Rate (read my SWR opinion in Rethinking The Safe Withdrawal Rate) I encourage you to consider retirement account withdrawals to support your safe spending limits.

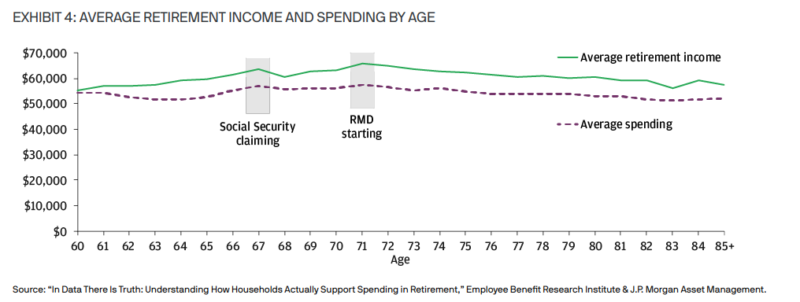

Spending Increases as Social Security & RMDs Begin

An interesting pattern appeared in the survey data. As income increases with the commencement of Social Security payments, spending also tends to increase. The same pattern occurs when RMDs begin, as outlined in the following chart:

In reality, part of the increased spending when RMDs start could be driven by the increased taxes associated with those RMD’s. On the Social Security front, however, it appears that the increase in income directly impacts the amount retirees spend.

Are You Doing It Right? The concern I have with the above data is that it appears people are holding back their spending in their “active years” (60 – 67), then increasing it as they near their 70s. Clearly, there are many people who simply need their SS to cover basic living expenses. I wonder, however, if some folks are potentially suffering some opportunity cost of living a bit too conservatively in their pre-SS years when they could most enjoy the spending. I would encourage people to seriously consider running the New Retirement calculator (affiliate link) which effectively models both the Social Security and RMD tax impact by year. For more details, read my complete review on the New Retirement calculator here. Perhaps you can maintain a higher spending level in your pre-SS years by increasing your investment withdrawals, knowing they’ll be reduced once SS starts (assuming level spending). The New Retirement calculator can answer that question for your situation.

Households With Annuity or Pension Income Spend More

Managing your money in retirement is all about converting your assets into an income stream to support your retirement lifestyle. If that process is automated through either an annuity or pension, folks tend to spend more than if they fund their lifestyles exclusively through investment withdrawals. As I outlined in 5 Steps To Learn To Spend In Retirement, many folks under-spend in retirement (a phenomenon that actually has a name, “Chrometophobia”). I suspect this tendency is more frequent among those who don’t have the “safety net” provided by either an annuity or a pension. The study concludes with the recommendation that more 401k providers develop means of offering an “in-plan spending offering”. A full 85% of survey respondents stated they would be more likely to keep their balances in their 401k post-retirement if such an option were available. I predict this will be a likely development in the coming years.

Are You Doing It Right? If you’re under-spending your safe withdrawal rate, consider reading the “Learn To Spend” post cited above. In addition, if you have no guaranteed income, there’s nothing wrong with evaluating the potential of converting some of your assets into a guaranteed annuity. It’s a controversial subject, but my opinion is that they have merit in a situation where a retiree has no guaranteed income for life, especially if they’re spending less than they safely can as a result.

To read more, you can start with my post titled What Role Should An Annuities Play In Retirement. Another one worth your time is FIPhysician’s How To Use an Annuity in Retirement.

Conclusion

The study was a rare look into how 31,000 people manage their money in retirement. Not surprisingly, a lot of people seem to be making some mistakes (no Roth conversions come to mind). It’s understandable, given the complexity of the topic and the reality that learning to manage your money in the “decumulation phase” is an entirely different skill set than those used in the “accumulation phase.”

Hopefully, by reading how others are managing their money, you’re able to better evaluate your situation to help identify any “blind spots” you may be unaware of. If you’re concerned, this is one area where “DIY” is not always the best approach. Spend some time with a professional if necessary to develop your strategy and bring some peace of mind into your life.

Then, get on with enjoying your life in retirement. You worked too hard to get here.

Make the most of it.

Your Turn: Any surprises as you read how real people manage their money in retirement? Are you doing Roth conversions? What are your thoughts on annuities? Let’s chat in the comments…

Fritz Gilbert is the Founder of The Retirement Manifesto, a Plutus Award winning blog dedicated to helping people Achieve A Great Retirement. After 30+ years in Corporate America, most recently as a Commodity Trader, Fritz retired as planned in June 2018 at Age 55. He and his wife are looking forward to extended travel and “giving back” to their community through charitable work in retirement. This blog was published on his website on July 22, 2022 and is republished here with his permission.

Fritz Gilbert is the Founder of The Retirement Manifesto, a Plutus Award winning blog dedicated to helping people Achieve A Great Retirement. After 30+ years in Corporate America, most recently as a Commodity Trader, Fritz retired as planned in June 2018 at Age 55. He and his wife are looking forward to extended travel and “giving back” to their community through charitable work in retirement. This blog was published on his website on July 22, 2022 and is republished here with his permission.