by Patricia Campbell, Cascades Financial Solutions

(Sponsor Content)

Ages: 60 & 55

Province: Ontario

Professions: Capital and Facilities Planning Director & Senior Data Analysist

Primary Goal: Determine annual retirement income, save taxes, and plan for travel.

Marcus and Lee were on track for retirement in 5 years, but an early retirement offer from Marcus’ company prompted them to consider retirement earlier than originally planned. We investigate their concerns in this retirement planning case study using Cascades Financial Solutions.

The Issues

Unexpectedly, Marcus was forced into retirement by his company due to a severe downturn in business. The couple thought they had at least five more years before they would need to make a decision regarding retirement.

Over their careers, Marcus and Lee prioritized saving money each year in their Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA). In addition, they both had a joint savings account, and Marcus had a defined benefit pan but, was it enough?

Their Concerns

How much retirement income will they have? Did they have enough money for Marcus to retire early? Lee will continue working until she is 60 but was depending on Marcus to have 5 more years of income and savings.

How could they minimize the taxes on their retirement? The couple would like to explore tax efficient strategies and are unsure how to approach this.

Will they be able to travel? By retiring early Marcus is concerned about their future travel plans.

The Plan

Marcus and Lee realized that this was a critical time and needed help from someone with extensive experience in retirement income planning.

Marcus and Nicole decided to seek financial planning advice. The financial planner they found uses Cascades Financial Solutions.

The Cascades financial planning process included the below steps:

Gather fact find data. This included the details of each RRSP, TFSAs, defined benefit plan and any joint savings, their investments large purchases they plan on making in the future.

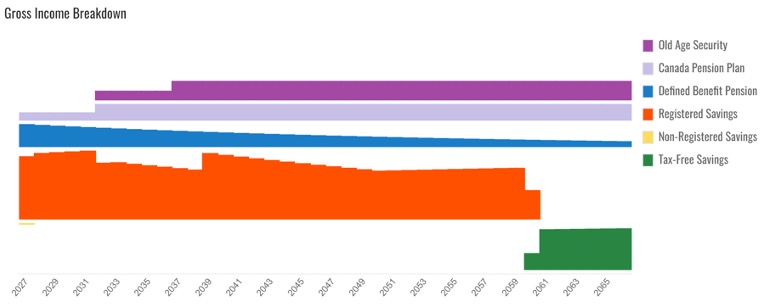

Consider ages for CPP and OAS options. The next step was to run a few retirement income scenarios which included adjusting the start age to receive CPP and OAS.

Choose a winning strategy. After running a few scenarios which included receiving CPP at 60 vs. receiving at 70 they were able to determine a sustainable withdrawal plan and maximize taxes savings over the course of their retirement.

Execute the plan. Finally, it was time to start putting the new retirement income strategy in place. Seeing the plan on paper, gave the couple the confidence and financial security they needed to be at ease.

The Results

Marcus was delighted retiring early knowing their hard work and saving for a rainy day paid off. While Lee wasn’t quite ready to retire, she was happy Marcus can enjoy a few years of retirement before she did. When they are both retired, they plan to take two international trips each year and spend plenty of time with family.

The financial planning process helped Marcus and Lee in several ways:

Marcus was able to accept his early retirement offer without any pressure.

Lee was able to continue working, knowing she could retire at the time she planned to.

They saved tens of thousands in taxes by creating a Cascades Financial Solutions retirement income plan.

Marcus and Lee have confidence in knowing that their retirement plan is sustainable. They can relax and appreciate the retirement they worked so hard to earn.

Patricia Campbell directs Operations & Marketing at Cascades Financial Solutions.

Patricia Campbell directs Operations & Marketing at Cascades Financial Solutions.

Thank you for the case study.

I always tend to forget about CPP and OAS options for my own planning.