By Ian Riach, Franklin Templeton Canada

(Sponsor Content)

Investors may see key improvements in conditions in the capital markets and the wider economy in 2023 and beyond, according to the Capital Market Expectations (CMEs) from Franklin Templeton Canada. We presented our CMEs at Franklin Templeton’s Global Investment Outlook in Toronto on December 6.

We develop a proprietary set of CMEs annually, using top-down fundamental and quantitative research. Using an outlook for the next seven to 10 years, we review the expected returns and risk of investable asset classes: equities, fixed income, alternatives and currencies. Our economic outlook and 10-year asset class forecasts are driven by macro expectations, current valuations and various asset class assumptions. The CMEs are annualized 10-year return expectations, and they are intended to coincide with the average length of a business cycle and are aligned with the strategic planning horizon of many institutional investors.

Our process also considers long-term macroeconomic themes to complement the objectivity of our quantitative analysis. This year, we factored in three major themes:

Growth: We expect to see moderate growth in the next phase of the economic cycle, driven by advances in technology and increasing productivity. Demographics will likely be a slight headwind to growth as populations in developed markets age.

Inflation: Inflation is expected to remain slightly higher than the targets established by central banks over the medium term. Rising wages and energy prices are sticky aspects of inflation.

Fiscal and monetary policy: Central banks, including the Bank of Canada, will keep up their aggressive fight against high inflation. Not surprisingly, this will hamper economic growth. On the other hand, we expect fiscal policy by governments to remain accommodative. Fiscal policy can result in higher government debt, which can be inflationary. But if government stimulus targets, say, capital projects such as infrastructure, then it can be beneficial to long-term growth. Policymakers are walking a tightrope now.

Capital Market Expectations

With that background, here is a concise summary of our expectations over the next several years:

- The expected returns for fixed income assets, like bonds, have become more attractive. We also expect the recent volatility in fixed income markets to subside.

- The returns of global equities are expected to revert to their longer-term averages and outperform bonds.

- Stocks in Emerging Markets are expected to outperform developed market equities over the next seven to 10 years.

- A diversified and dynamic approach to investing is the most likely path to achieving stable returns over the long run.

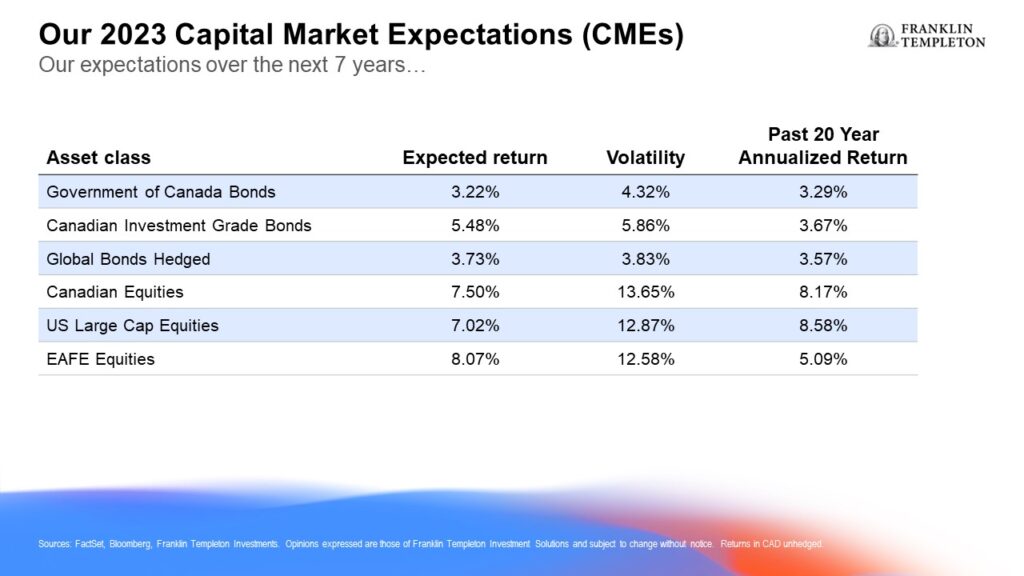

The chart below sets out our range of expectations for key assets compared to historical averages:

Note that these return projections are higher than our 2022 outlook and are closer to their long-term averages.

Franklin Templeton Canada uses its CMEs to shape strategic asset allocation for our portfolios. However, we do not just “set it and forget it”. We employ a dynamic asset allocation process over the shorter-term, taking into account market conditions. While we are optimistic over the next decade that returns will favour risk assets, our short-term preference (next 12 months) is to be cautious as recession risks rise.

We are generally underweight equities in our allocations, but favour Canada and the United States over international regions. We feel that short-term challenges for growth are a headwind for international equities. On bonds, we’ve become more neutral in our positioning and are holding higher cash balances, given the recent rise in interest rates. After a rough year for fixed income markets, we expect rates should stabilize in 2023 and the yield curve to normalize, likely as a result of short-term rates decreasing and long-term rates moving higher.

A looming recession?

The possibility of a recession is a big concern for investors, policymakers and portfolio managers. After the rapid increase in short-term bond yields this year, the yield curve is inverted, and this is a traditional predictor of an economic recession.

Our Global Investment Outlook conference heard an excellent analysis of the elevated risk of a recession in the United States from Jeff Schulze, Director and Investment Strategist at ClearBridge Investments (a Franklin Templeton company) in New York. This risk is an important consideration for Canadians.

ClearBridge Investments uses a proprietary recession risk and recovery dashboard to provide a statistical foundation for its quarterly analysis of the state of the U.S economy and the implications for global markets. The dashboard includes 12 economic indicators to assess recession risk.

“We have a 75% probability of a U.S. recession next year,” Jeff told the Outlook audience.

However, Jeff also said the downturn could be shallow and he cited three reasons why the U.S. economy could make a soft landing:

- U.S. consumers are less sensitive to interest rates because household balance sheets are healthy, generally.

- The tight labour market is in a position to loosen without substantial job losses.

- Corporate profit margins are near record levels so businesses may opt to keep more workers on the payroll in a recession.

Jeff added that he believes the U.S. is in the early stage of a new secular bull market, which could result in healthy returns for stocks.

CMEs as guidance

Our CMEs are meant to provide guidance over the next market cycle. They help us set the strategic asset mix for Franklin Templeton portfolios but they are flexible enough to allow for adjustments, depending on market conditions. Also, investors, advisors, consultants and other gatekeepers may want to use our CMEs as a guide and to help with their conversations about portfolio positioning.

After coming through all the big challenges for investors in 2022, we believe that a dynamic, actively-managed approach to investing in diversified portfolios of stocks and bonds will result in stable long-term returns.

Ian Riach, CFA, is Senior Vice President and Portfolio Manager with Franklin Templeton Investment Solutions (FTIS) in Toronto. Ian joined Franklin Templeton in 1999 and is a member of the FTIS Investment Strategy & Research Committee. He has portfolio management responsibilities for all Canadian-based multi-asset products including the Franklin Quotential Portfolios, Private Wealth Pools, and Franklin LifeSmart Portfolios. He is also responsible for Institutional Balanced Portfolio Management. As the Chief Investment Officer of Fiduciary Trust Canada (part of Franklin Templeton Investments), Mr. Riach also oversees the investment management of Franklin Templeton’s private wealth business. With over 30 years in the investment industry, Mr. Riach holds a Bachelor of Commerce degree from the University of Calgary and is a Chartered Financial Analyst (CFA) Charterholder.

Ian Riach, CFA, is Senior Vice President and Portfolio Manager with Franklin Templeton Investment Solutions (FTIS) in Toronto. Ian joined Franklin Templeton in 1999 and is a member of the FTIS Investment Strategy & Research Committee. He has portfolio management responsibilities for all Canadian-based multi-asset products including the Franklin Quotential Portfolios, Private Wealth Pools, and Franklin LifeSmart Portfolios. He is also responsible for Institutional Balanced Portfolio Management. As the Chief Investment Officer of Fiduciary Trust Canada (part of Franklin Templeton Investments), Mr. Riach also oversees the investment management of Franklin Templeton’s private wealth business. With over 30 years in the investment industry, Mr. Riach holds a Bachelor of Commerce degree from the University of Calgary and is a Chartered Financial Analyst (CFA) Charterholder.

Important Legal Information This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user. All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Equity and Fixed Income prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Franklin Templeton Investment Solutions, part of Franklin Templeton Canada. Franklin Templeton Canada is a business name used by Franklin Templeton Corp.