By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

Depending on where you live in Canada, purchasing real estate in recent years hasn’t exactly been a cakewalk. Tight supply and rampant buyer demand (and alleged speculative investing) have pushed home prices to what some experts argue are unsustainable levels in the nation’s hottest markets.

However, following a slew of new policy changes introduced over the last year — such as Metro Vancouver’s foreign buyer tax and the Ontario Fair Housing Plan — those red-hot conditions have changed, with real estate boards from both markets reporting slower sales in the months following.

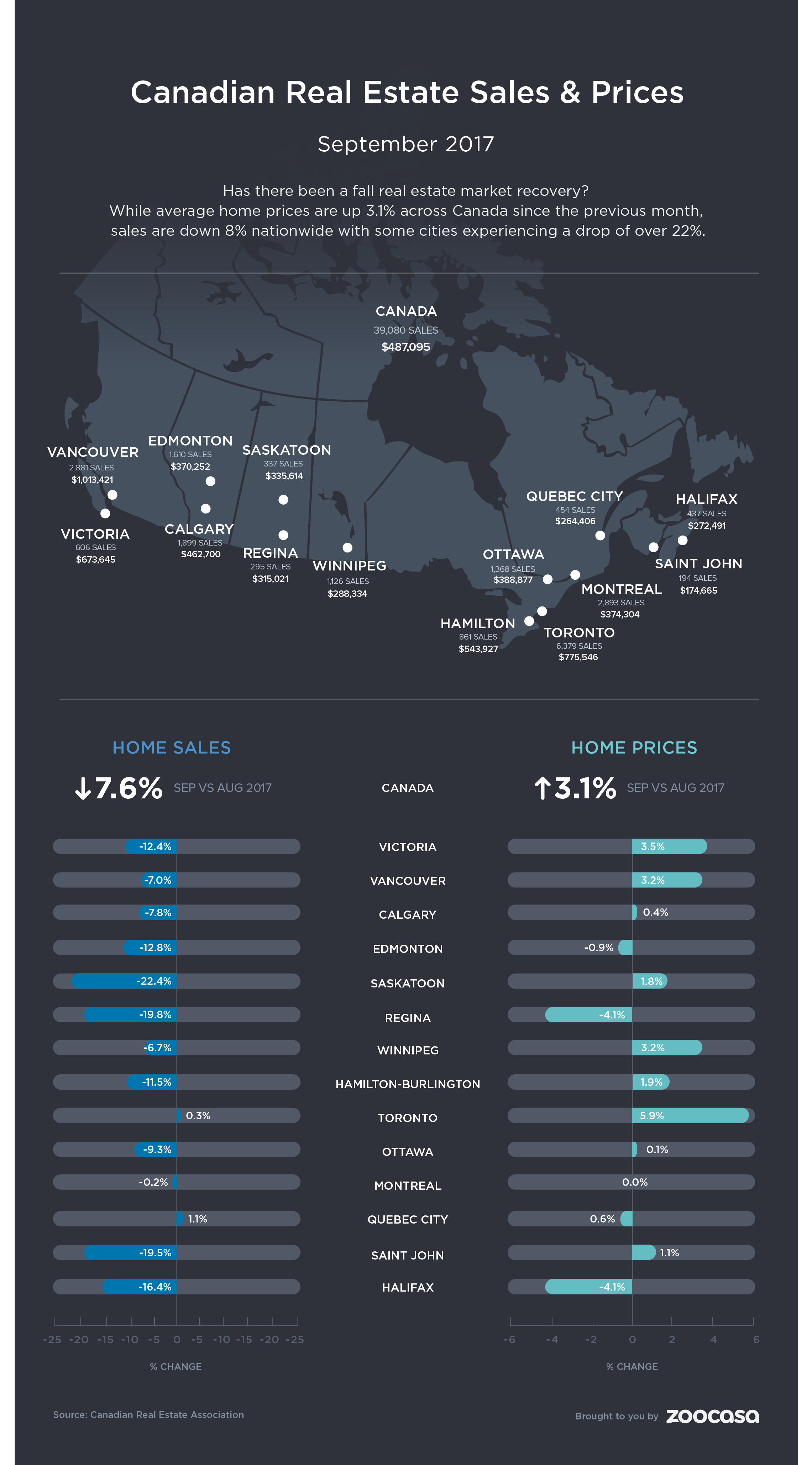

That’s made a dent in the national numbers, reveals the latest analysis from the Canadian Real Estate Association: with a 11 per cent drop in sales from last September. This is despite the typically busier autumn market, which is often the last chance for buyers to make a serious go of it before the snow — and holiday season — sets in. Seasonally adjusted activity was up slightly month over month at 2.1 per cent.

Too soon to call for market stability: CREA

While this could indicate market conditions are starting to settle after what has been a turbulent spring and summer market, it’s too soon to call it a trend, say CREA’s analysts.

“National sales appear to be stabilizing. While encouraging, it’s too early to tell if this is the beginning of a longer-term trend,” stated CREA President Andrew Peck.

Calmer sales activity hasn’t translated to greater affordability, though: home prices continued their ascent, with benchmark prices rising in 13 of MLS’s tracked markets. It’s the first time in seven years that all markets have seen simultaneous growth, with the national average price coming to $487,000.

However, prices are increasing at a slower pace than at the market’s peak, and that’s mainly due to the lost steam in the detached house segment since March. One- and two-storey single family homes appreciated by 7.9 and 7.2 per cent respectively, compared to the sizzling condo market, which saw 19.8 per cent appreciation, and townhouses at 13.5 per cent.

Slower home appreciation could be an economic risk, says CREA Chief Economist Gregory Klump, who says recently announced mortgage rules will make their mark. “Further tightening of federal regulations aimed at cooling housing markets in Toronto and Vancouver risks creating collateral damage in markets elsewhere in Canada,” he says. “It also jeopardizes Canadian economic growth, which is already showing signs of fading.”

Look to specific Buyers’ and Sellers’ conditions

Those considering whether they should make their move in the slower autumn market may be surprised to learn that more of Canada’s most sought-after markets have become more buyer-friendly. A region’s sales-to-new-listings ratio — which is calculated by dividing the total number of sales by the number of new homes listed for sale within a specific time frame — can gauge the level of buyer competition and available choice in a desired city or neighbourhood.

Nationally, the ratio fell to 55.7 per cent from 57.7, as 5 per cent more homes were brought to market following a three-month decline. This new supply effectively outpaced slower sales activity, causing the market, while balanced, to lean slightly toward buyer’s territory. This occurred in two thirds of all markets, including Greater Toronto real estate, which now has a ratio of 56.1 per cent. CREA considers a ratio between 40 – 60 per cent to be considered balanced, with below and above as buyer’s and seller’s markets, respectively.

The amount of time to completely deplete the supply of homes for sale remained fairly flat across Canada, with a time frame of five months. However, this changes drastically depending on the region — for example, there were fewer Hamilton real estate listings, with only 2.4 months available in the Golden Horseshoe — though still a drastic change from the region’s all-time low of 0.8 months.

Check out the infographic below to see how prices and sales have changed annually in Canada’s largest markets.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.